The Bull Case For B2Gold (TSX:BTO) Could Change Following Goose Mine Production Guidance Cut

- In late November 2025, B2Gold cut its 2025 gold production guidance for the Goose Mine to 50,000–80,000 ounces after encountering operational delays, while keeping guidance for its other mines unchanged.

- This shift places greater emphasis on how effectively B2Gold can manage project execution risk at Goose without disrupting its broader production plans.

- We’ll now examine how the Goose Mine’s reduced 2025 output expectations may alter B2Gold’s broader investment narrative and risk profile.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

B2Gold Investment Narrative Recap

To own B2Gold, you need to believe the company can translate its multi mine footprint and new projects into steady cash flow without letting cost or execution issues dominate the story. The Goose Mine guidance cut narrows the near term production catalyst but does not appear to derail the broader growth case, while putting a brighter spotlight on project execution risk and how effectively management can contain costs and schedule slippage.

Against this backdrop, the ongoing dividend at US$0.02 per quarter stands out as a key signal of how management is balancing Goose related spending with direct cash returns to shareholders. For investors, that dividend track record now sits alongside the Goose Mine’s reduced 2025 outlook as a test of whether B2Gold can keep funding growth while preserving financial flexibility and avoiding the kind of cost overruns that would weaken the investment case.

Yet investors should also be aware that operational and climate driven risks around Goose mean the current production setback might not be the last...

Read the full narrative on B2Gold (it's free!)

B2Gold's narrative projects $3.7 billion revenue and $1.8 billion earnings by 2028. This requires 19.2% yearly revenue growth and an earnings increase of about $2.2 billion from -$433.6 million today.

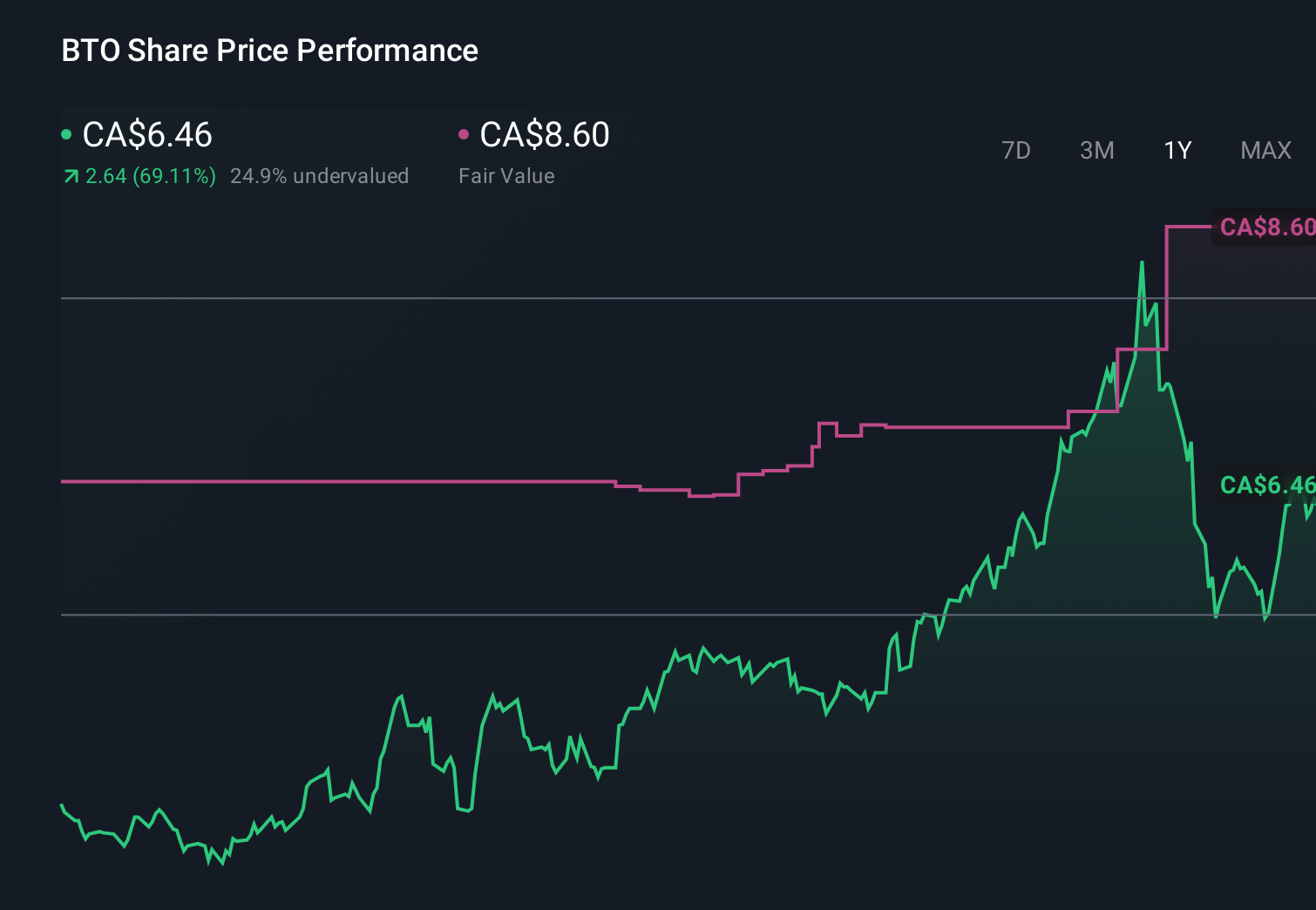

Uncover how B2Gold's forecasts yield a CA$8.60 fair value, a 36% upside to its current price.

Exploring Other Perspectives

Fourteen members of the Simply Wall St Community place B2Gold’s fair value anywhere between CA$4.58 and CA$44.44, showing how far opinions can stretch. When you set those views against the recent Goose Mine guidance cut and its execution risk, it becomes even more important to weigh several perspectives before deciding how B2Gold might fit into your portfolio.

Explore 14 other fair value estimates on B2Gold - why the stock might be worth 28% less than the current price!

Build Your Own B2Gold Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your B2Gold research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free B2Gold research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate B2Gold's overall financial health at a glance.

No Opportunity In B2Gold?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal