Rubrik (RBRK): Evaluating Valuation After a Recent 28% Weekly Share Price Jump

Rubrik (RBRK) has been on a quiet but steady climb, with the stock up about 28% over the past week and roughly 20% over the past month, catching more investors’ attention.

See our latest analysis for Rubrik.

Zooming out, Rubrik’s recent surge sits on top of a solid backdrop, with the year to date share price return of 37.62% and a 12 month total shareholder return of 29.66% signaling that momentum is building rather than fading around its $91.31 share price.

If Rubrik’s run has you rethinking your exposure to high growth tech names, this could be a good moment to explore other high growth tech and AI stocks that are starting to gain traction.

Still, with Rubrik trading below consensus targets but already rewarded for rapid growth, the key question is whether today’s valuation leaves room for meaningful upside or if the market has largely priced in its future expansion.

Most Popular Narrative: 19.9% Undervalued

With the narrative fair value near $114 versus Rubrik’s $91.31 close, the story leans toward upside as analysts map out an aggressive growth runway.

The company's pivotal role at the intersection of data security and AI, especially through products like Annapurna, can expand their total addressable market (TAM), potentially driving future revenue growth and enhancing their market position in this expanding field.

Want to see how ambitious growth, richer margins, and a punchy future earnings multiple all connect into that fair value call? The full narrative lays out the entire playbook.

Result: Fair Value of $114.05 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heightened competition and slower than expected AI or cloud adoption could challenge Rubrik’s growth assumptions and put pressure on both margins and valuation.

Find out about the key risks to this Rubrik narrative.

Another Angle on Valuation

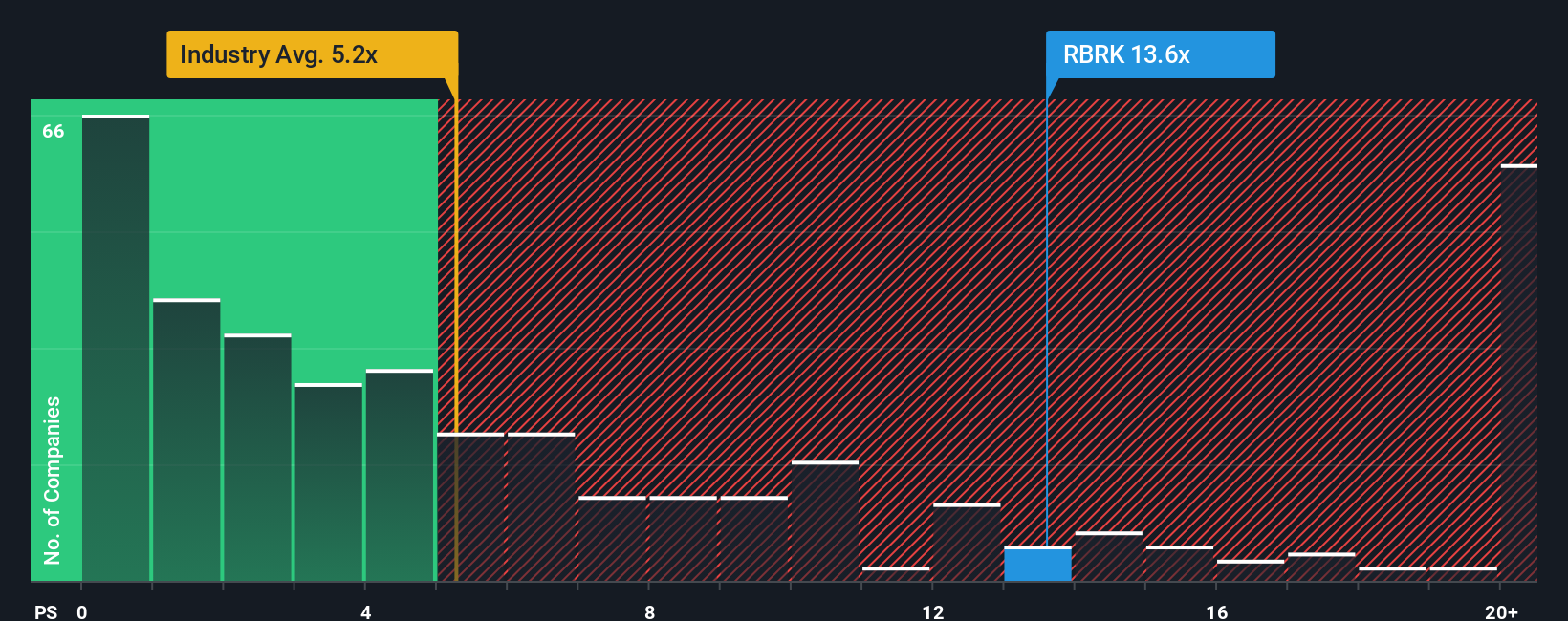

While the narrative suggests Rubrik is almost 20% undervalued, its price to sales ratio of 15.3 times looks stretched versus US software peers at 4.9 times and a fair ratio of 10.5 times. If sentiment cools, could that gap close from the top down?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Rubrik Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in just a few minutes: Do it your way.

A great starting point for your Rubrik research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before the market moves on without you, use the Simply Wall St Screener to uncover fresh opportunities that match your strategy and keep your portfolio progressing.

- Capture potential under-the-radar bargains by targeting companies trading below intrinsic value with these 900 undervalued stocks based on cash flows that still show solid fundamentals.

- Ride the momentum of innovation by pinpointing cutting edge businesses shaping tomorrow’s breakthroughs through these 27 AI penny stocks that are already building real-world solutions.

- Strengthen your income stream by focusing on reliable payers using these 15 dividend stocks with yields > 3% that combine attractive yields with sustainable payout profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal