WD-40 (WDFC) Valuation Check After Revenue Beat But EBITDA Miss In Latest Earnings

WD-40 (WDFC) just posted Q3 results that pushed revenue up about 5% year on year and roughly 6% above Wall Street expectations, yet a clear EBITDA miss has investors reassessing the story.

See our latest analysis for WD-40.

The mixed quarter seems to have reinforced worries already showing up in the share price, with a year to date share price return of around negative 20 percent and a one year total shareholder return of roughly negative 28 percent. This suggests momentum is still fading despite decent multi year gains.

If this earnings wobble has you reassessing your watchlist, it could be a good moment to compare WD-40 with other household names and explore fast growing stocks with high insider ownership.

With revenue still growing and the share price sharply lower this year, is WD-40 now trading at an unjustified discount to its long term potential, or is the market correctly pricing in slower, margin constrained growth?

Most Popular Narrative: 27.9% Undervalued

With WD-40 closing at $190.76 versus a narrative fair value of $264.50, the storyline leans toward meaningful upside if the forecasts play out.

The company's focus on premiumization of products, with targets for a compound annual growth rate for premium products exceeding 10%, is poised to improve net margins by shifting the product mix towards higher margin offerings.

Curious why steady revenue, softer margins and shrinking share count could still support such a rich future earnings multiple? Unpack the assumptions powering that valuation leap.

Result: Fair Value of $264.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside hinges on successful divestitures and steady EIMEA momentum, with currency swings and Asia Pacific softness still capable of derailing the thesis.

Find out about the key risks to this WD-40 narrative.

Another View: Rich on Traditional Valuation Checks

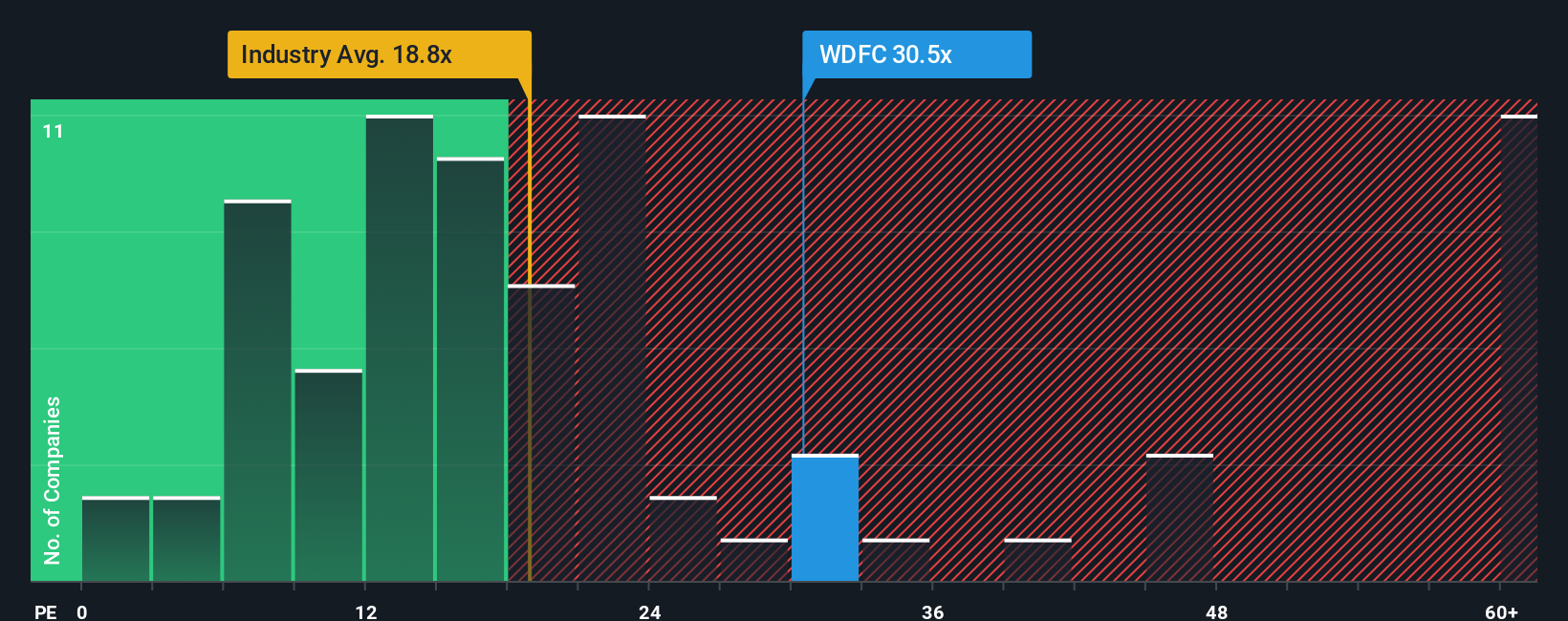

That narrative fair value points to upside, but standard valuation checks tell a very different story. WD-40 trades on a P/E of 28.4 times, versus 17.1 times for the global household products industry, 12 times for peers, and a fair ratio of just 12.5 times. This suggests meaningful downside risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own WD-40 Narrative

If you see the numbers differently or would rather dig into the details yourself, you can build a personalized thesis in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding WD-40.

Ready for your next investing edge?

Before you move on, lock in your next opportunity by scanning fresh ideas across sectors using the Simply Wall Street Screener, built to surface standouts fast.

- Capitalize on mispriced potential by targeting companies that look cheap on future cash flows with these 900 undervalued stocks based on cash flows.

- Ride powerful structural shifts in medicine and diagnostics by focusing on innovators powered by smart algorithms through these 30 healthcare AI stocks.

- Strengthen your income stream by zeroing in on reliable payers via these 15 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal