Assessing BAE Systems After Its 50% Surge Amid Strong Defense Backdrop

- If you are wondering whether BAE Systems is still attractive after its huge run, or if you are arriving just as the value story is fading, you are in the right place.

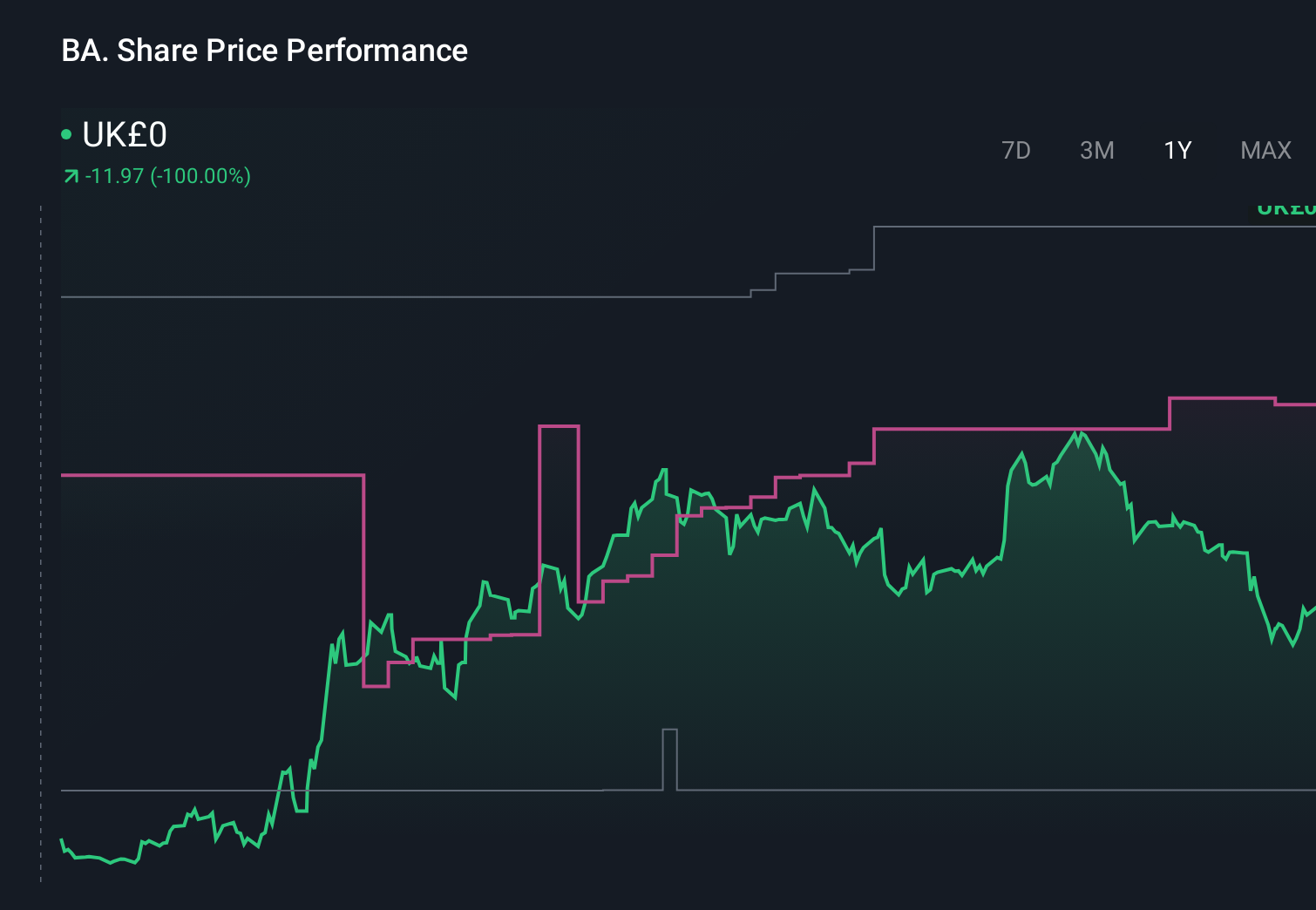

- The stock is up 49.7% year to date and 49.3% over the last year, even after a recent 4.5% pullback over the past month and a 6.3% bounce in the last week. This suggests sentiment is strong but becoming more volatile.

- Those moves are happening against a backdrop of robust defense spending commitments across NATO countries and renewed focus on long term security partnerships that directly benefit BAE Systems. Investors are also reacting to contract wins and growing order backlogs, which together are reinforcing the idea that future cash flows could be higher and more resilient than previously assumed.

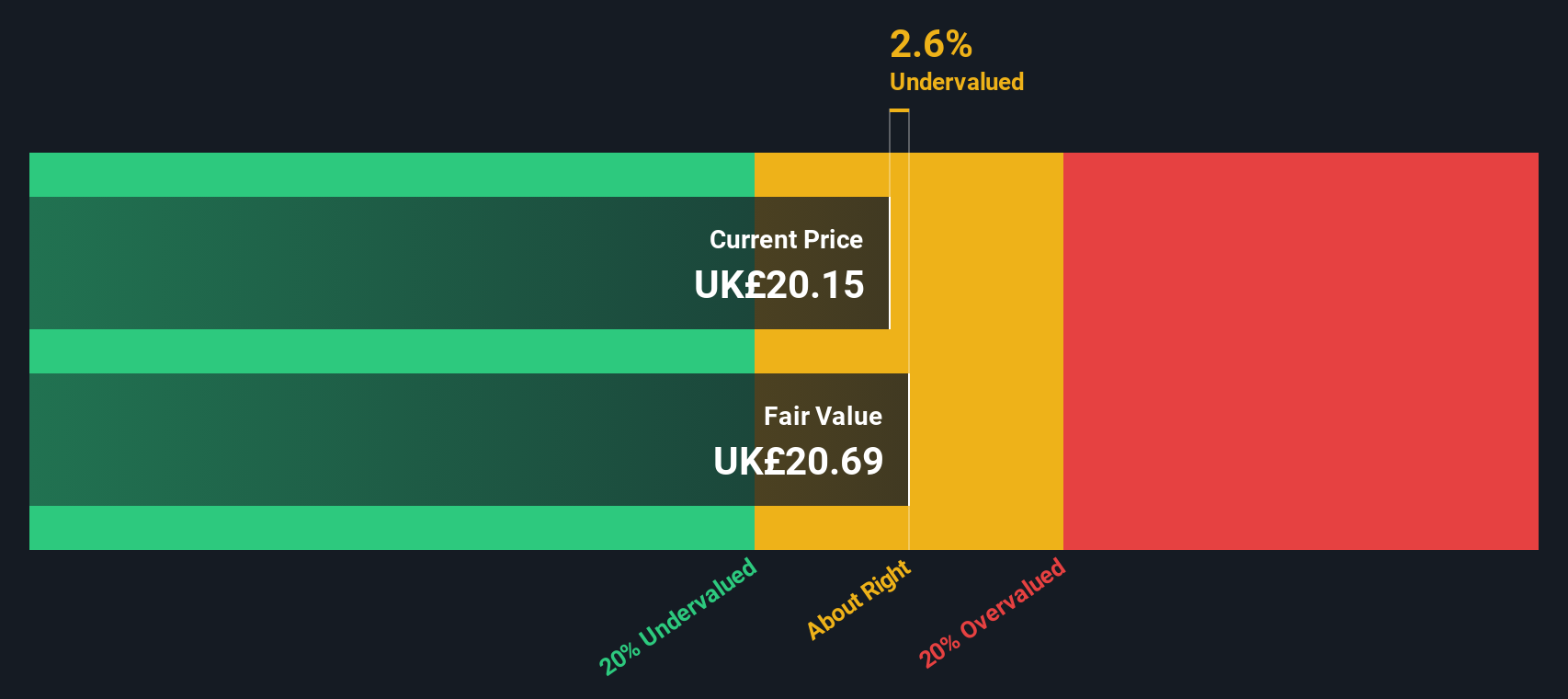

- Our valuation work gives BAE Systems a 5/6 valuation score, suggesting it appears undervalued on most of the metrics we track. Next we will walk through those methods, before finishing with a more comprehensive way to think about fair value than any single model alone.

Find out why BAE Systems's 49.3% return over the last year is lagging behind its peers.

Approach 1: BAE Systems Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth today by projecting the cash it can generate in the future and then discounting those amounts back into today’s money.

For BAE Systems, the model starts from last twelve month free cash flow of about £2.1 billion and projects this to grow steadily over the coming decade, using analyst estimates for the next few years and then extrapolating further growth beyond that. By 2029, free cash flow is forecast to reach roughly £3.3 billion, with projections continuing to rise modestly through 2035 as the business scales its order book and margins.

Using a 2 Stage Free Cash Flow to Equity framework, Simply Wall St estimates an intrinsic value of about £21.95 per share. Compared with the current share price, this implies the stock trades at roughly a 21.4% discount to the DCF fair value. This suggests the market is not fully pricing in the strength and durability of BAE’s future cash flows.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests BAE Systems is undervalued by 21.4%. Track this in your watchlist or portfolio, or discover 900 more undervalued stocks based on cash flows.

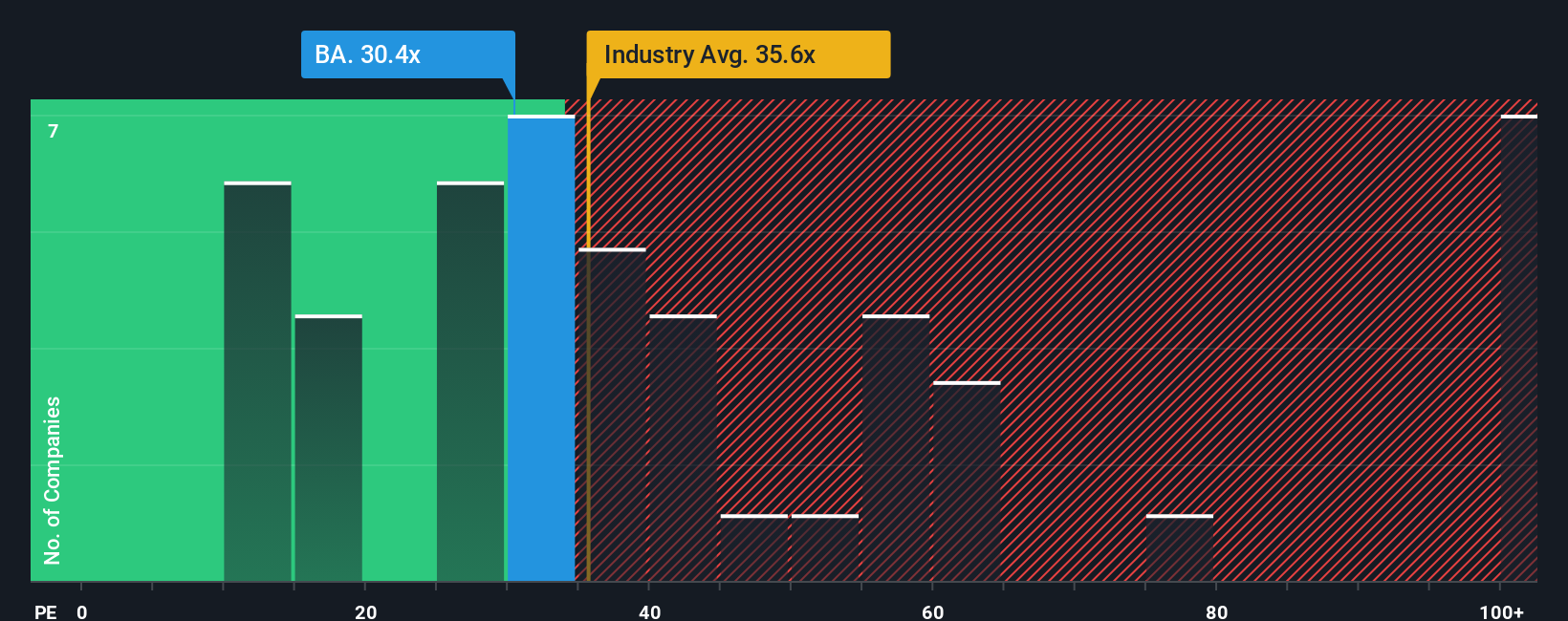

Approach 2: BAE Systems Price vs Earnings

For profitable, relatively mature companies like BAE Systems, the price to earnings ratio is a practical way to judge valuation because it links what investors pay today to the profits the business is already generating. A higher or lower PE can be justified depending on how quickly earnings are expected to grow and how risky or cyclical those earnings are, which together shape what a normal or fair PE should be over time.

BAE currently trades on a PE of about 26.0x. That is below the Aerospace and Defense industry average of roughly 46.0x, but above the peer group average of around 21.3x, suggesting investors are paying a premium to similar companies but a discount to the broader sector. Simply Wall St’s Fair Ratio framework estimates a fair PE of about 30.2x for BAE, based on its earnings growth outlook, margins, risk profile, industry and market capitalization.

This Fair Ratio is more informative than simple peer or industry comparisons because it adjusts for BAE’s specific strengths and risks rather than assuming every defense contractor deserves the same multiple. With the current PE of 26.0x sitting below the 30.2x Fair Ratio, the shares appear modestly undervalued on this basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1450 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your BAE Systems Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of BAE Systems with a concrete forecast and Fair Value by telling the story behind the numbers, from your assumptions about future revenue, earnings and margins through to what you think the shares are worth, all within an easy tool on Simply Wall St’s Community page that millions of investors already use. A Narrative ties three things together in one place: the company’s story, the financial forecast that follows from that story, and the Fair Value that drops out of those forecasts. You can then compare this to the current share price to decide whether BAE looks like a buy, hold or sell. Because Narratives are updated as soon as new information such as earnings reports, major contracts or news hits the platform, they stay relevant and can change as the facts change. For example, one BAE Systems Narrative might lean bullish, stressing record backlogs and global defense demand to justify a Fair Value near the top of the analyst range around £25, while a more cautious Narrative could focus on ESG, contract and capacity risks to anchor Fair Value closer to the bottom of the range, near £13.

Do you think there's more to the story for BAE Systems? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal