A Look at IRADIMED’s Valuation After Special Dividend Signals Confidence in Future Cash Generation

IRADIMED (IRMD) just handed investors a year end gift by approving a special 0.50 dollar per share cash dividend that sits on top of its regular payouts and signals confidence in future cash generation.

See our latest analysis for IRADIMED.

The move comes after IRADIMED highlighted its growth story at recent investor conferences, and the strong backdrop shows in the numbers, with the share price up sharply this year and multi year total shareholder returns suggesting that momentum is still building.

If this kind of steady execution appeals to you, it could be a good moment to explore other specialized medical names using our healthcare stocks for fresh ideas.

With shares up more than 75 percent year to date and trading only slightly below analyst targets, the key question now is whether IRADIMED still trades at a discount or if the market is already pricing in its next leg of growth.

Most Popular Narrative Narrative: 2.3% Undervalued

With IRADIMED last closing at $96.76 versus a narrative fair value of $99, the current setup hinges on whether its growth durability matches lofty expectations.

The introduction and FDA approval of the new 3870 MRI compatible IV pump, with significantly enhanced usability and technology over the legacy product, is expected to catalyze a major replacement cycle among hospitals and imaging centers, unlocking large scale, recurring device and consumable revenues. This supports a step change in revenue growth as existing customers upgrade and potential new customers previously deterred by usability issues are attracted.

Want to see how steady double digit growth, rising margins, and a rich future earnings multiple can still argue for upside at these levels? The full narrative spells out the projections, the timing, and the premium multiple that underpin this fair value view.

Result: Fair Value of $99 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the story could change if execution stumbles on the 3870 pump rollout or if healthcare budget pressures slow hospital purchasing decisions.

Find out about the key risks to this IRADIMED narrative.

Another Angle on Valuation

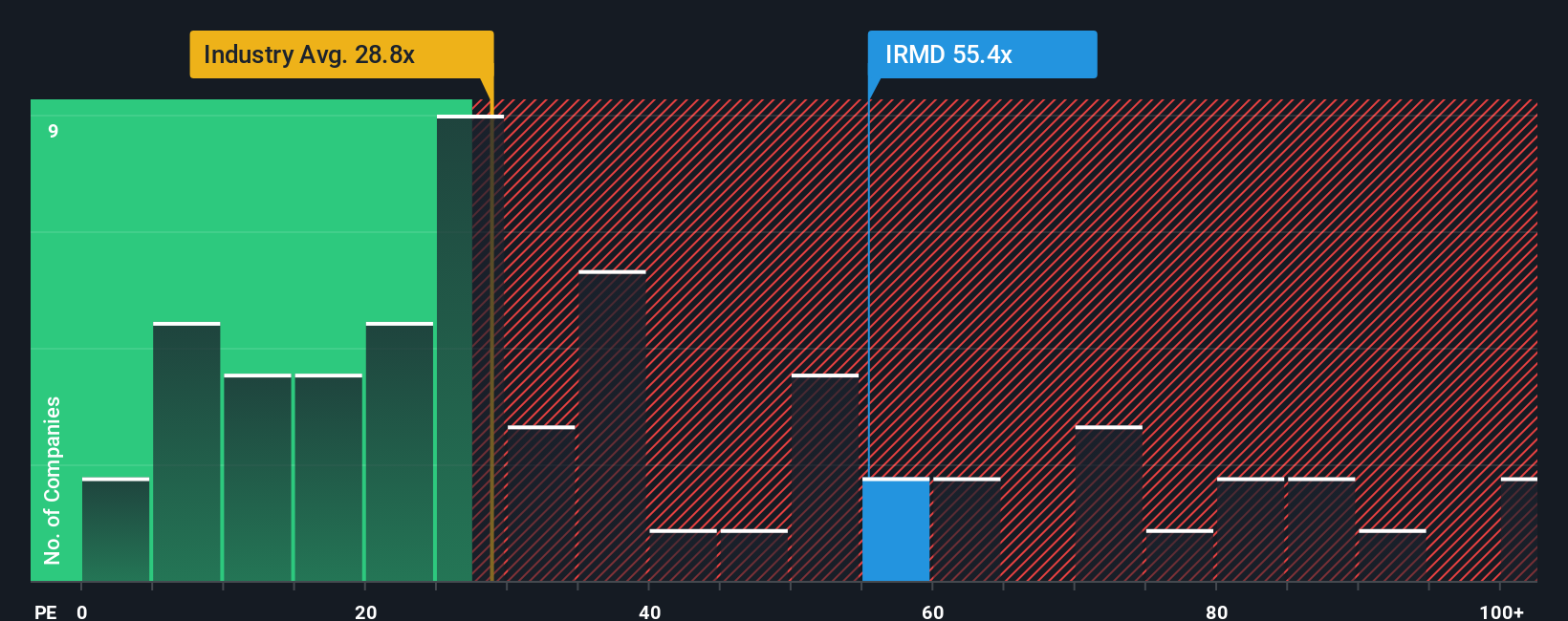

While the narrative fair value paints IRADIMED as modestly undervalued, a simple earnings multiple view tells a different story. At roughly 57 times earnings versus 30 times for the US medical equipment industry, 22 times for peers, and a 20 times fair ratio, the stock embeds a lot of optimism that could unwind if growth disappoints.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own IRADIMED Narrative

If you see the story differently or want to dig into the numbers yourself, you can craft a personalized view in minutes: Do it your way.

A great starting point for your IRADIMED research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop at IRADIMED. The next standout opportunity could be waiting in plain sight if you use the right tools to scan the market intelligently.

- Capture overlooked upside by running through these 903 undervalued stocks based on cash flows that flag financially strong companies trading below what their cash flows suggest they are worth.

- Ride structural growth by checking these 27 AI penny stocks that are building real businesses around artificial intelligence, not just chasing buzzwords.

- Strengthen your portfolio’s income engine with these 15 dividend stocks with yields > 3% that can help you pinpoint reliable cash payouts above 3 percent.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal