Should Kinross Gold’s (TSX:K) Accelerated US$500 Million Debt Repayment Require Action From Investors?

- On December 4, 2025, Kinross Gold Corporation repaid in full its outstanding 4.50% Senior Notes with a principal amount of US$500 million, bringing total debt repayments to US$1.50 billion across 2024 and 2025 and leaving US$750 million of Senior Notes outstanding, with the next maturity in 2033.

- This accelerated balance sheet cleanup highlights Kinross’s emphasis on reducing interest costs and financial risk, potentially giving it more room to fund projects and shareholder returns.

- With Kinross accelerating repayment of US$500 million in notes, we’ll examine how this balance sheet shift reshapes its investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

Kinross Gold Investment Narrative Recap

To own Kinross Gold, you have to believe it can convert its current strong profitability and high gold-price leverage into durable free cash flow, despite rising operating costs and long dated growth projects. The early repayment of US$500,000,000 of 4.50% Senior Notes strengthens the balance sheet, but does not materially change the near term production and cost profile, where inflationary pressures and mine specific cost creep remain the key swing factors and near term risk.

The recent update that Kinross plans 2025 production slightly above the midpoint of its 2.0 million ounce guidance ties directly into this debt reduction story, because it frames how much cash flow is available after servicing costs fall. With the next Senior Notes not maturing until 2033, the combination of current earnings strength, ongoing buybacks and dividends, and a lighter debt load puts more focus back on whether Kinross can offset rising costs at sites like Fort Knox, Round Mountain and Tasiast through operating efficiencies and steady output.

Yet even with a cleaner balance sheet, investors should be aware that rising royalties and inflation could still...

Read the full narrative on Kinross Gold (it's free!)

Kinross Gold's narrative projects $6.4 billion revenue and $1.5 billion earnings by 2028. This requires 1.7% yearly revenue growth with earnings remaining flat, implying no change from current earnings of $1.5 billion.

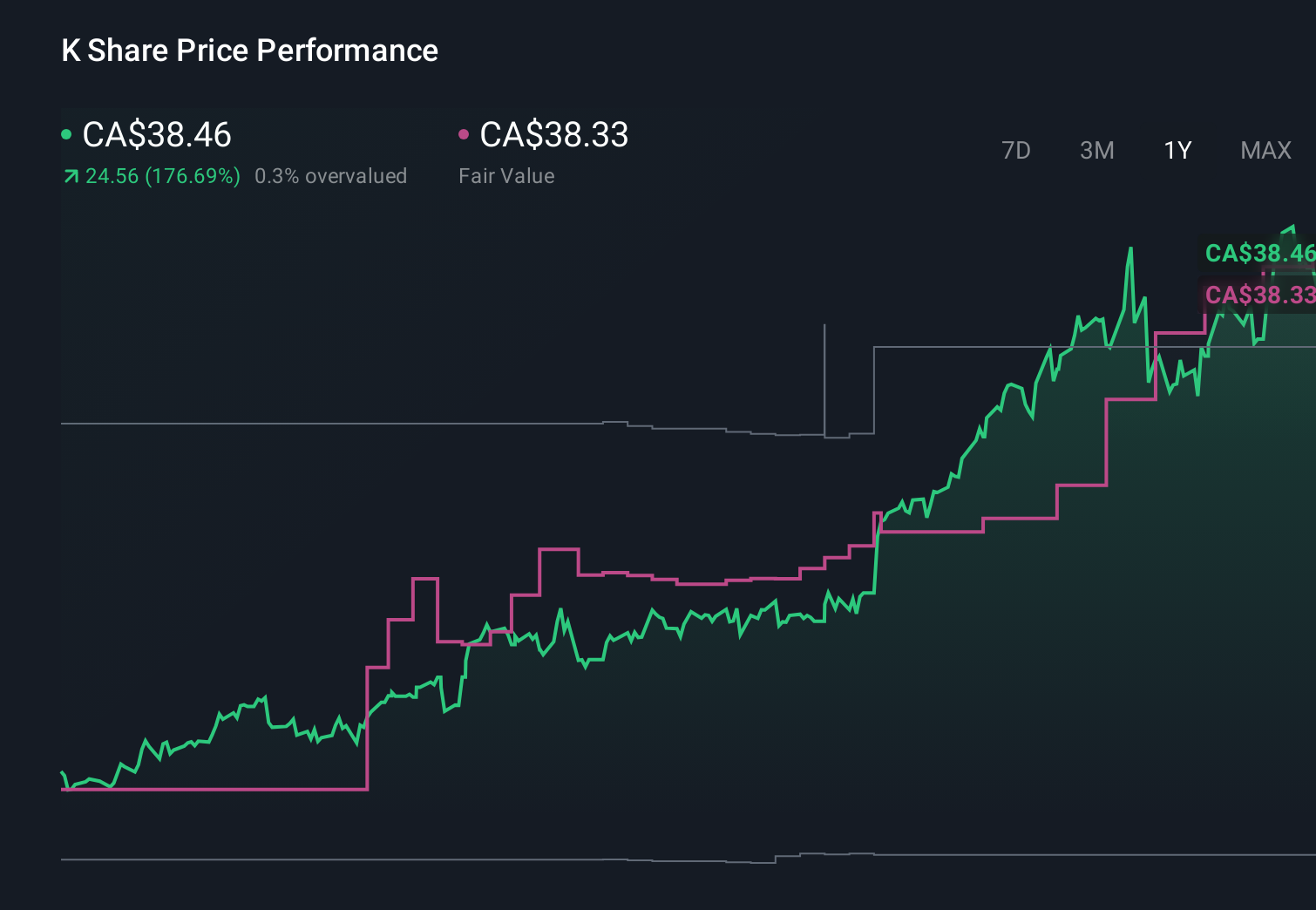

Uncover how Kinross Gold's forecasts yield a CA$38.33 fair value, a 3% upside to its current price.

Exploring Other Perspectives

Five members of the Simply Wall St Community currently see Kinross Gold’s fair value between US$12.50 and US$38.33, reflecting very different expectations. You can weigh those views against the recent acceleration in debt repayment, which reduces financial risk but leaves cost inflation and reserve replacement as key themes for the company’s performance.

Explore 5 other fair value estimates on Kinross Gold - why the stock might be worth as much as CA$38.33!

Build Your Own Kinross Gold Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kinross Gold research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Kinross Gold research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kinross Gold's overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal