Why Salesforce (CRM) Is Up 11.2% After Strong Q3, AI Wins and Insider Buying – And What's Next

- In early December 2025, Salesforce reported Q3 FY26 results showing higher revenue and earnings year over year, raised its full-year guidance, affirmed a quarterly cash dividend of US$0.416 per share, completed a multibillion‑dollar buyback tranche, and announced that Lumen Technologies’ David Ward will join as President and Chief Architect.

- The quarter also highlighted rapid AI adoption through the Agentforce platform, a global Agentforce Life Sciences win with AstraZeneca, and a US$25 million insider share purchase by director Mason Morfit, all reinforcing management’s commitment to AI-driven growth and shareholder returns.

- We’ll now examine how Agentforce’s rapid adoption and AstraZeneca’s selection of Salesforce’s AI tools refine the company’s longer-term investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Salesforce Investment Narrative Recap

To own Salesforce today, you generally need to believe its AI driven Customer 360, anchored by Agentforce and Data Cloud, can offset slower core CRM growth and rising competition from hyperscalers. The latest quarter’s revenue and earnings growth, higher full year guidance, dividend affirmation, and buyback completion all support that thesis, while the biggest near term risk remains that bundled AI and CRM suites from larger platforms could pressure Salesforce’s growth and pricing. The recent news does not materially change that risk balance.

The most relevant update here is Salesforce’s expanded relationship with AstraZeneca around Agentforce Life Sciences and Agentforce 360 as a global engagement solution. This win ties directly into the core catalyst of deeper AI and data integration across industries, reinforcing how Salesforce aims to increase contract sizes, embed itself in complex workflows, and raise switching costs at large customers, even as competition for AI budgets from hyperscalers and other software providers intensifies.

But while Agentforce wins like AstraZeneca support the AI story, investors should also be aware that intensifying competition from larger cloud suites could...

Read the full narrative on Salesforce (it's free!)

Salesforce's narrative projects $51.9 billion revenue and $10.3 billion earnings by 2028. This requires 9.6% yearly revenue growth and about a $3.6 billion earnings increase from $6.7 billion today.

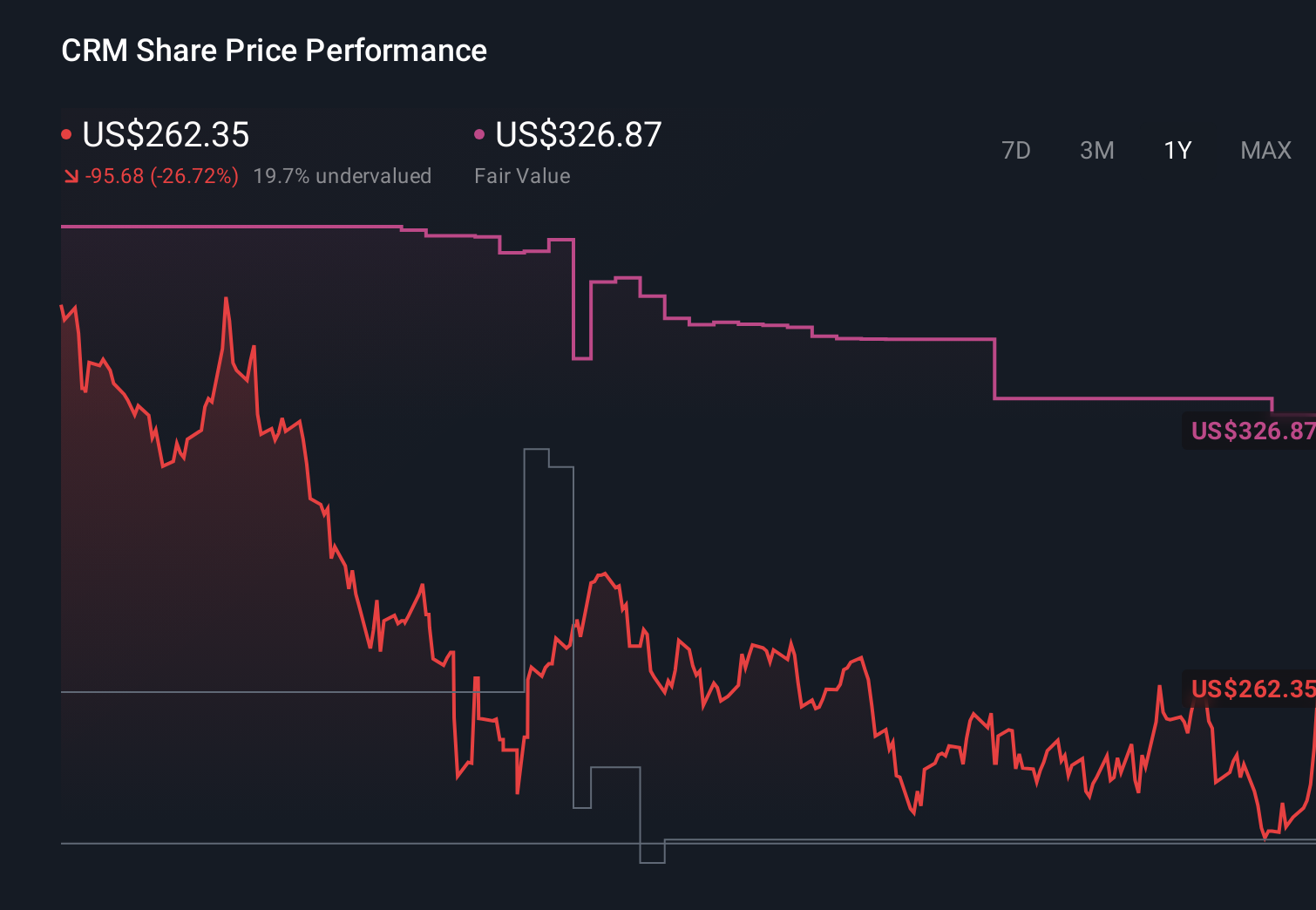

Uncover how Salesforce's forecasts yield a $326.87 fair value, a 25% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members see Salesforce’s fair value anywhere between US$223.99 and US$375.50 across 43 separate estimates, so you are not short of alternative views to compare. Against that spread, the current AI and Agentforce adoption story sits alongside a clear risk that bundled offerings from hyperscalers could still pressure Salesforce’s growth and pricing power over time, so it helps to weigh several perspectives before forming a view.

Explore 43 other fair value estimates on Salesforce - why the stock might be worth 14% less than the current price!

Build Your Own Salesforce Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Salesforce research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Salesforce research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Salesforce's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal