Boralex (TSX:BLX) Valuation Check As Jean-Christophe Dall’Ava Takes Over European Leadership

Boralex (TSX:BLX) just reshuffled a key leadership seat in Europe by naming Jean-Christophe Dall’Ava as Executive Vice President and General Manager, Europe. He succeeds long-time leader Nicolas Wolff.

See our latest analysis for Boralex.

The leadership refresh lands at a fragile moment for sentiment, with the 1 month share price return at negative 16.14 percent and the 1 year total shareholder return at negative 16.96 percent, signaling fading momentum despite solid underlying growth in revenue and net income.

If this leadership shift has you rethinking your renewable energy exposure, it could be a good time to scan the broader utilities space and discover fast growing stocks with high insider ownership

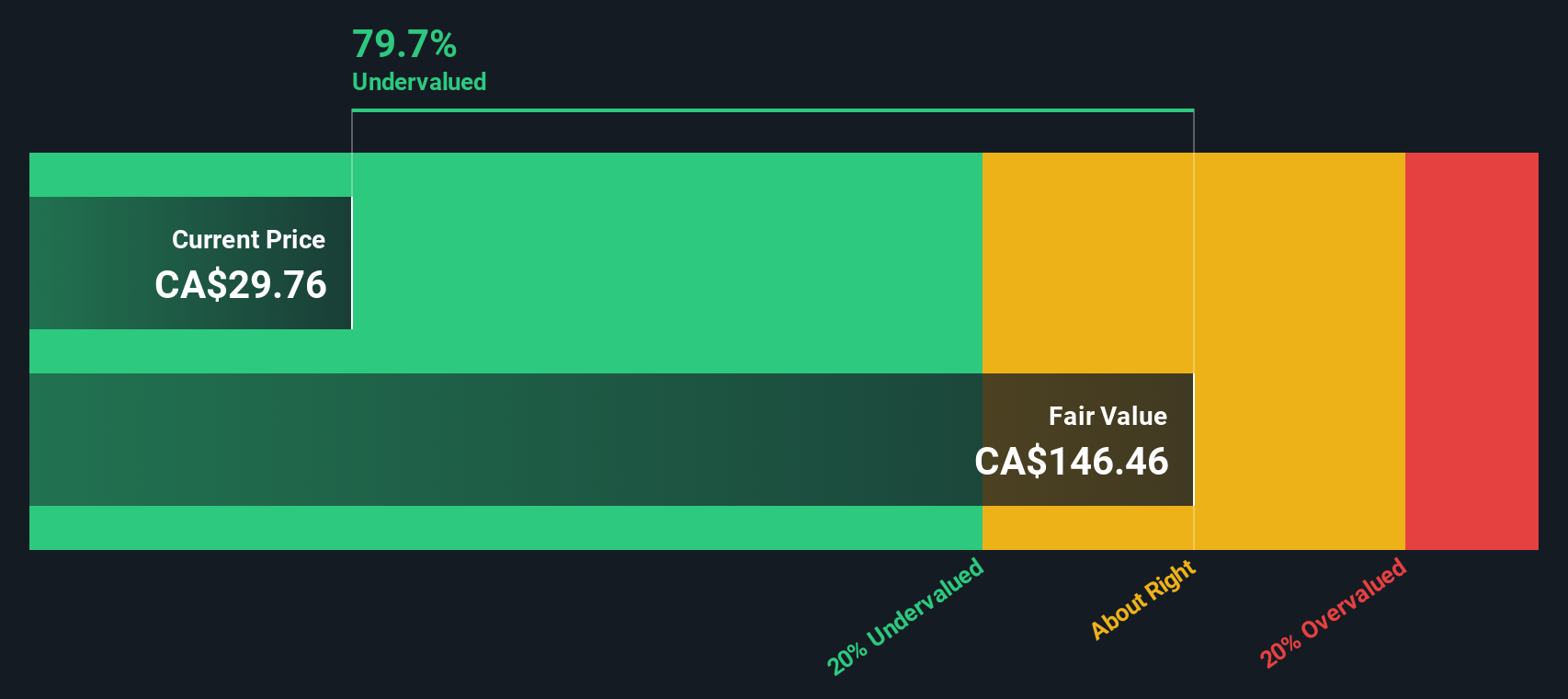

With the shares trading well below analyst targets despite double digit revenue growth, investors now face a key question: is Boralex quietly undervalued, or are markets already pricing in the next leg of its renewable growth?

Most Popular Narrative: 34.9% Undervalued

With Boralex last closing at CA$24.01 against a narrative fair value near the mid CA$30s, the story hinges on aggressive long term earnings power.

Analysts expect earnings to reach CA$162.7 million (and earnings per share of CA$1.58) by about September 2028, up from CA$ 10.0 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as CA$115 million.

Curious how this shift from losses to sizable profits supposedly unfolds? The narrative quietly leans on bold revenue expansion, rising margins, and a premium future earnings multiple. Want to see the exact assumptions behind that confidence and the discount rate used to justify today’s upside?

Result: Fair Value of $36.90 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer French contract prices and rising debt costs could pressure margins and cash flows and challenge the upbeat long term growth narrative.

Find out about the key risks to this Boralex narrative.

Another Angle on Value

While the narrative fair value pegs Boralex at CA$36.90 and calls the stock undervalued, our DCF model goes much further, implying a fair value near CA$123.78. That gap suggests either a deep mispricing or overly optimistic long range cash flow assumptions. Which side do you lean toward?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Boralex Narrative

If you are not fully convinced by this storyline or want to stress test the assumptions yourself, you can build a custom view in under three minutes, Do it your way

A great starting point for your Boralex research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before you move on, lock in your advantage by scanning fresh opportunities on Simply Wall St’s Screener, where curated ideas help you act with confidence today.

- Target steady income potential by reviewing these 15 dividend stocks with yields > 3% that combine attractive yields with underlying business strength.

- Capitalize on market mispricing by scanning these 903 undervalued stocks based on cash flows where strong cash flows are not yet fully recognized in the share price.

- Position yourself early in transformative trends by assessing these 28 quantum computing stocks poised to benefit from breakthroughs in computing power.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal