UBS (SWX:UBSG) Valuation Check as Switzerland Considers Softer Capital Rules After Reuters Report

UBS Group (SWX:UBSG) is back in focus after a Reuters report suggested Switzerland might soften proposed capital rules that would have forced the bank to fully fund key foreign subsidiaries with over $20 billion.

See our latest analysis for UBS Group.

The latest talk of softer capital rules has arrived alongside firm momentum in UBS Group, with a roughly 9.5 percent 1 month share price return and a powerful 5 year total shareholder return above 200 percent. This suggests investors are steadily reassessing both growth prospects and regulatory risk.

If this regulatory shift has you thinking more broadly about financials and risk taking, it could be a smart moment to explore fast growing stocks with high insider ownership as potential next wave candidates.

With the shares now trading close to analyst targets and only a modest intrinsic discount implied, is UBS still quietly undervalued after this regulatory relief, or are markets already fully pricing in the next leg of growth?

Most Popular Narrative Narrative: 1.9% Undervalued

With UBS Group last closing at CHF33.24 against a narrative fair value of roughly CHF33.89, the story hinges on whether medium term earnings can comfortably outrun rising capital demands.

The ongoing integration of Credit Suisse is progressing ahead of schedule, driving meaningful cost savings, increased scale, and improved operating efficiency. As these synergies are realized through further platform migration and operational streamlining, UBS's net margins and return on equity are likely to improve, supporting higher earnings growth.

Curious how modest revenue growth, sharp margin expansion, and a lower future earnings multiple can still support upside from today, the narrative connects those levers in a way that may surprise you.

Result: Fair Value of $33.89 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent regulatory tightening and potential execution missteps around Credit Suisse integration could still derail earnings momentum and limit the upside implied by this narrative.

Find out about the key risks to this UBS Group narrative.

Another Lens on Valuation

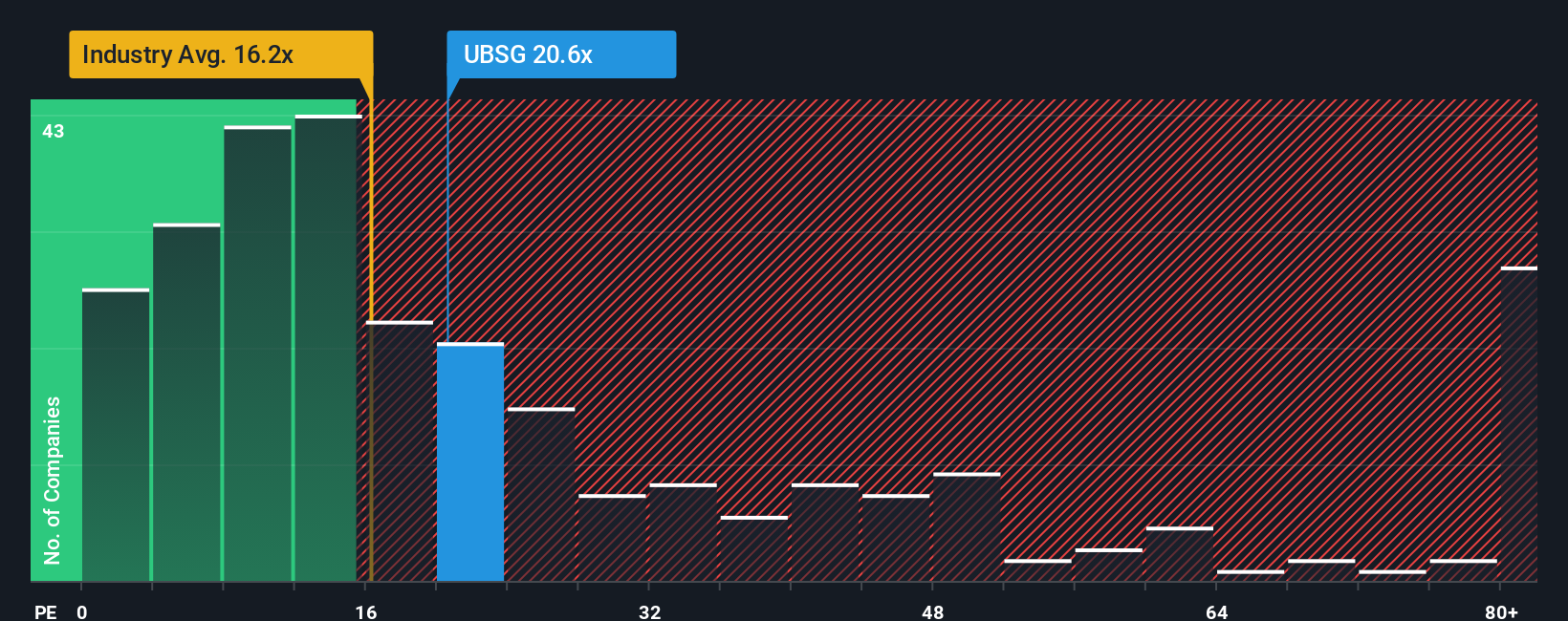

Step away from narratives and UBS looks pricy on earnings, trading at 17.8 times versus 14.9 times for the wider European capital markets group and a peer average of 21 times. Yet our fair ratio sits higher at 24.4 times. This raises a tougher question: is this a premium or still a relative bargain?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own UBS Group Narrative

If you see the story differently or prefer to dig into the numbers yourself, you can shape a fresh UBS narrative in minutes: Do it your way.

A great starting point for your UBS Group research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before you move on, put UBS in context by lining it up against other opportunities that could sharpen your strategy and uncover trends you will not want to miss.

- Capture potential income opportunities by scanning these 15 dividend stocks with yields > 3% that aim to balance yield with solid underlying businesses.

- Tap into structural growth by reviewing these 27 AI penny stocks positioned at the intersection of data, automation, and intelligent software.

- Strengthen your value playbook by targeting these 903 undervalued stocks based on cash flows that may offer attractive upside based on future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal