Home Bancshares (HOMB): Revisiting Valuation After Recent Share Price Softness and Long-Term Return Strength

Home Bancshares (HOMB) has been drifting slightly lower over the past year despite steady revenue and earnings growth, leaving investors weighing whether the recent pullback around 27 dollars offers a reasonable entry point.

See our latest analysis for Home Bancshares (Conway AR).

At around 27.82 dollars, the recent softness in HOMB’s share price follows a modest pullback from earlier highs, even as its three year total shareholder return above 30 percent signals underlying momentum rather than a broken story.

If you are weighing HOMB against other regional names, it can also be useful to see how the broader financial space is priced, starting with fast growing stocks with high insider ownership.

With consistent top and bottom line growth, a share price below analyst targets, and a sizable implied intrinsic discount, investors now face a key question: is HOMB quietly undervalued, or is the market already pricing in future gains?

Most Popular Narrative Narrative: 16% Undervalued

With the narrative fair value clustered in the low 30 dollar range versus a last close of 27.82 dollars, the framework points to moderate upside while hinging on specific earnings and multiple expansion assumptions.

Analysts expect earnings to reach $512.9 million (and earnings per share of $2.66) by about September 2028, up from $434.2 million today. The analysts are largely in agreement about this estimate.

Curious how steady, mid single digit growth and slightly fatter margins can justify a richer earnings multiple than the broader banking sector? The narrative leans heavily on compounding profitability, disciplined share count reduction, and a valuation reset that treats HOMB more like a structural compounder rather than a typical regional. Want to see exactly how those moving parts stack up to reach that fair value band?

Result: Fair Value of $33.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside case could unravel if acquisition driven growth stumbles or credit quality weakens in concentrated loan segments, which could pressure margins and earnings.

Find out about the key risks to this Home Bancshares (Conway AR) narrative.

Another Angle on Valuation

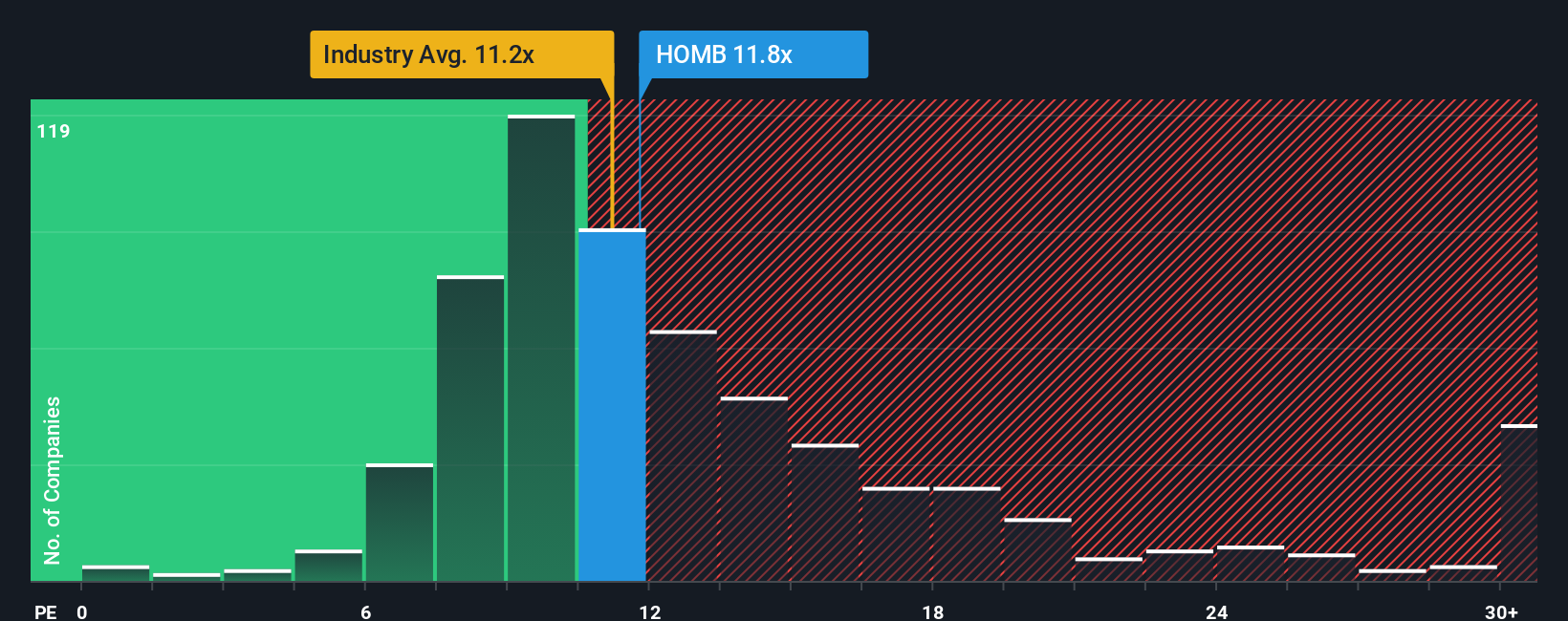

On a price to earnings basis, HOMB looks less clear cut. It trades at about 12.2 times earnings, slightly above an estimated fair ratio of 11.2 times and near peers at 13.5 times, which hints at limited rerating potential unless earnings surprise to the upside.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Home Bancshares (Conway AR) Narrative

If you see the dynamics differently, or simply prefer to dig into the numbers yourself, you can build a custom view in just minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Home Bancshares (Conway AR).

Ready for more investment ideas?

Once you have weighed up HOMB, do not stop there. The right next idea from our screeners could be the edge your portfolio is missing.

- Secure steadier portfolio income by reviewing these 15 dividend stocks with yields > 3% that aim to balance yield with sustainable payout ratios and resilient business models.

- Capitalize on structural growth trends by assessing these 30 healthcare AI stocks connecting cutting edge innovation with long term demand in medical diagnostics and treatment.

- Position yourself early in potential market disruptors by scanning these 80 cryptocurrency and blockchain stocks shaping new payment rails, digital asset infrastructure, and blockchain based services.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal