General Electric (GE): Valuation Check as AI-Driven Power Demand and GE Aerospace Momentum Build

Why this AI powered energy angle matters for General Electric

General Electric (GE) is back in focus as investors connect two moving pieces: a cleaner, stand alone GE Vernova tied to AI driven power demand, and a stronger GE Aerospace following its successful spin out.

See our latest analysis for General Electric.

Despite a recent cooling off, with a 30 day share price return of minus 7.15 percent from a latest share price of $285.31, the year to date share price return of 69.23 percent and a three year total shareholder return of 461.55 percent suggest momentum is still firmly on General Electric’s side as investors warm to the AI driven power and aerospace story, supported by the latest dividend affirmation and steady execution at GE Vernova and GE Aerospace.

If this kind of rerating story interests you, it is a good moment to see what else is moving across aerospace and defense stocks.

With GE’s shares still up sharply over one and three years, yet trading nearly 20 percent below the average analyst target, the real debate now is simple: is this a fresh buying opportunity or is future growth already priced in?

Most Popular Narrative: 16% Undervalued

With the narrative fair value sitting well above the last close of $285.31, the story leans toward meaningful upside if its growth path plays out.

Major supply chain stabilization and productivity gains from the FLIGHT DECK operating model and $2B+ investment in capacity are unlocking pent up services demand and enabling double digit output growth, translating into sustained higher free cash flow conversion and improved operating leverage.

Want to see how this efficiency push supposedly supports richer margins, steady revenue growth and a premium earnings multiple usually reserved for market darlings? The full narrative spells out the bold assumptions behind that higher fair value.

Result: Fair Value of $339.69 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained supply chain pressures or a sharper than expected commercial aviation downturn could quickly challenge both the margin story and today’s premium multiple.

Find out about the key risks to this General Electric narrative.

Another Angle on Valuation

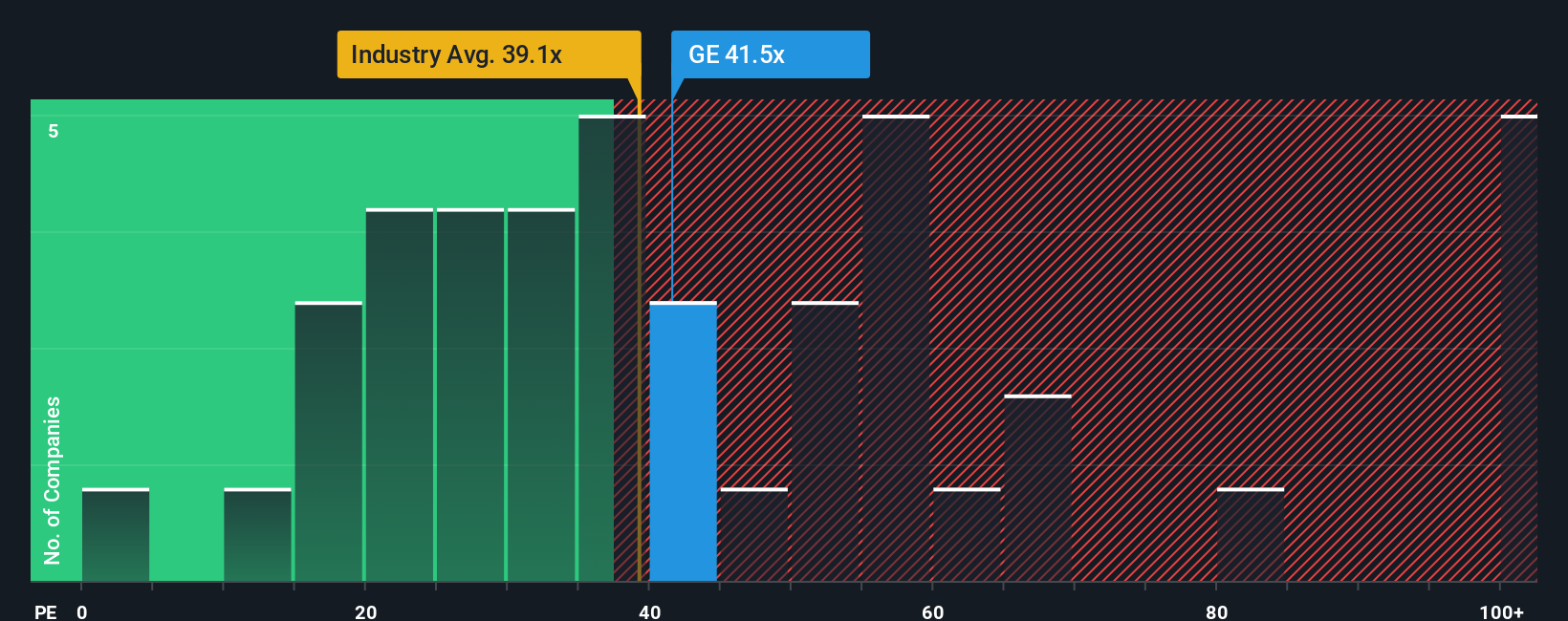

Analysts see upside to $339.69, but our ratio based view is more cautious. GE trades on a 37.6 times price to earnings ratio versus a 35.9 times fair ratio and 25.4 times for peers, which points to rich expectations and less margin for error if growth normalizes.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own General Electric Narrative

If you see the story differently or want to dig into the numbers yourself, build a fresh perspective in just a few minutes: Do it your way.

A great starting point for your General Electric research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Right now is the moment to broaden your playbook, because if you only watch GE, you could miss compelling opportunities quietly setting up elsewhere.

- Target income you can actually feel by scanning these 15 dividend stocks with yields > 3% offering yields above 3 percent backed by businesses with the potential to sustain their payouts.

- Position yourself ahead of the next wave in automation and productivity by reviewing these 27 AI penny stocks that could benefit as AI spending accelerates.

- Capitalize on market mispricing by running through these 903 undervalued stocks based on cash flows where strong cash flows are not yet fully reflected in share prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal