Recursion Pharmaceuticals (RXRX): Revisiting Valuation After a Tentative Share Price Rebound

Recursion Pharmaceuticals (RXRX) has been quietly regrouping after a tough year in the market, with the stock edging higher over the past week and month even as its year-to-date return stays deep in the red.

See our latest analysis for Recursion Pharmaceuticals.

That recent 7 day share price return of 10.78 percent and a 30 day share price gain of 4.55 percent suggests momentum is tentatively rebuilding, even though the year to date share price return and 1 year total shareholder return remain sharply negative.

If Recursion’s rebound has you thinking more broadly about the sector, this could be a good time to explore other healthcare stocks that might fit your watchlist.

With shares still down sharply over the past year but trading at a discount to analyst targets, is Recursion an underappreciated growth story, or are investors already pricing in its ambitious pipeline and platform potential?

Most Popular Narrative: 24% Undervalued

With Recursion’s last close at $4.83 versus a most popular narrative fair value of about $6.33, the story leans firmly toward upside potential.

Rapid integration and iterative improvement of the Recursion OS 2.0 platform, incorporating advanced AI and ML tools (such as Boltz-2 and causal AI for clinical trial design), are expected to drive faster, more cost effective drug discovery and development, improving R&D efficiency and supporting long-term margin expansion.

Curious how aggressive revenue growth, future margins, and a premium earnings multiple come together to justify that upside? The narrative’s financial blueprint might surprise you.

Result: Fair Value of $6.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing cash burn and heavy reliance on big pharma partnerships mean funding setbacks or collaboration disappointments could quickly undermine the bullish thesis.

Find out about the key risks to this Recursion Pharmaceuticals narrative.

Another Angle on Valuation

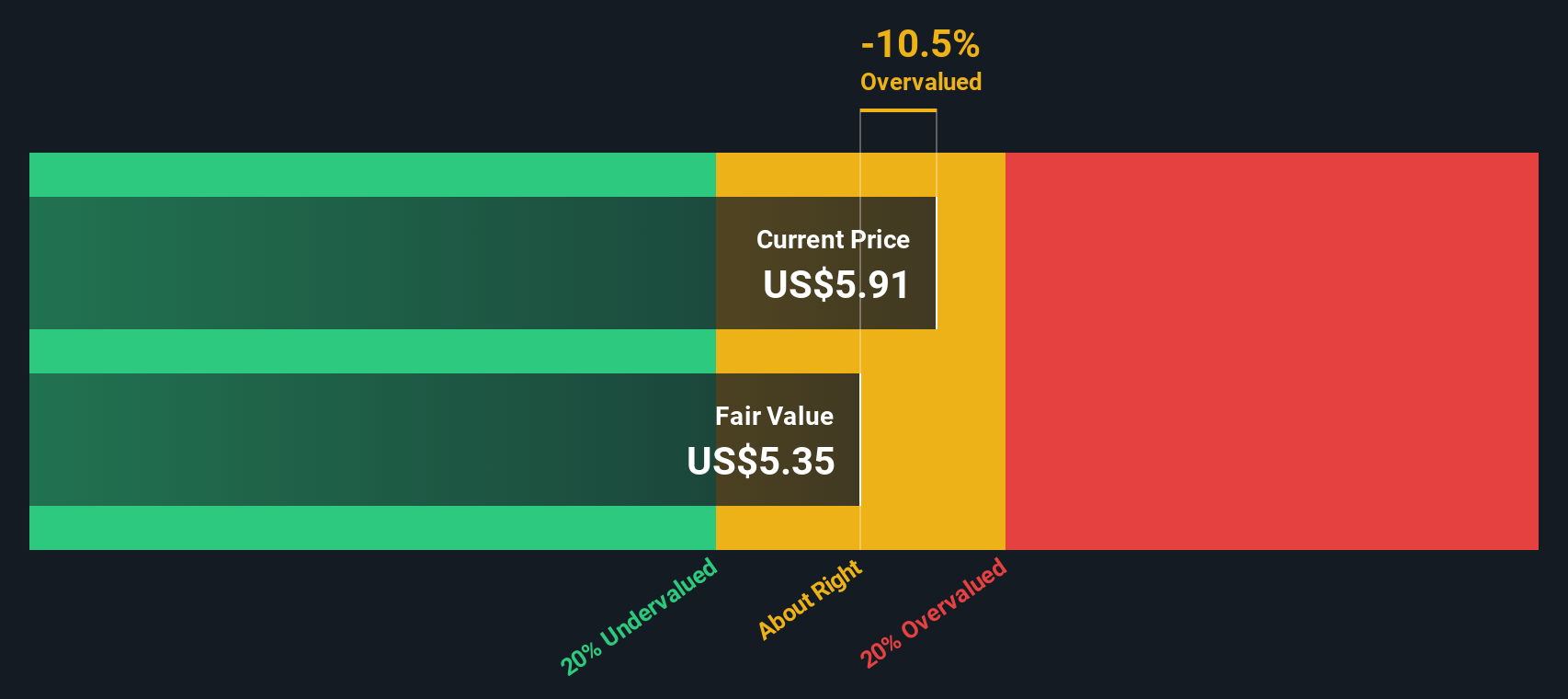

Our DCF model paints a cooler picture, pointing to a fair value of around $4.36, which would make Recursion slightly overvalued at today’s $4.83 share price. If cash burn stays high or milestones slip, could that gap widen instead of closing?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Recursion Pharmaceuticals for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 902 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Recursion Pharmaceuticals Narrative

If you see Recursion differently or want to dig into the numbers yourself, you can build a personalized view in just minutes: Do it your way.

A great starting point for your Recursion Pharmaceuticals research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before you move on, lock in an edge by scanning fresh opportunities on Simply Wall Street. Targeted screeners can help surface ideas most investors overlook.

- Capitalize on potential multi-baggers early by scanning these 3580 penny stocks with strong financials that already show stronger balance sheets and fundamentals than typical speculative names.

- Ride the transformation of every industry by targeting these 27 AI penny stocks positioned at the intersection of intelligent software and scalable commercial applications.

- Lock in value-focused opportunities by filtering for these 902 undervalued stocks based on cash flows where market prices lag the strength of underlying cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal