Evaluating CoreWeave After Its 115% Surge Amid AI Infrastructure Expansion

- If you are wondering whether CoreWeave is still a smart buy after its rapid rise, or if you are late to the party, you are in the right place to unpack what the current price is really baking in.

- The stock has jumped 11.7% over the last week, even after a sharp 17.3% pullback over the past month, and it is still up an eye catching 115.1% year to date.

- That roller coaster has played out against a backdrop of nonstop AI infrastructure headlines, as CoreWeave has been positioning itself as a key GPU cloud player in a market where demand is outstripping supply. Investors have been reacting to big partnerships, capacity expansion plans, and the broader AI land grab narrative that continues to fuel expectations for high growth and rising competitive stakes.

- Right now, CoreWeave only scores a 2 out of 6 on our valuation checks. This suggests the market may already be pricing in a lot of that AI optimism. However, there is more than one way to judge whether it is truly expensive or still mispriced, and we will walk through those methods before finishing with a more nuanced way to think about its real long term value.

CoreWeave scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: CoreWeave Dividend Discount Model (DDM) Analysis

The Dividend Discount Model estimates what a stock is worth by projecting all future dividend payments and discounting them back to today, then comparing that value with the current share price.

For CoreWeave, the model starts with a modest dividend per share of $0.0078, but combines it with a very negative return on equity of about -88% and an unusual payout ratio of roughly -7.45%. Plugging these inputs into the DDM results in an implied dividend growth rate of about -94.5%, which effectively assumes dividends will shrink rapidly rather than compound over time.

Given these assumptions, the model arrives at an intrinsic value of roughly $0.0075 per share. Compared with today’s market price, the DDM indicates that CoreWeave is about 1,153,793% overvalued, suggesting that the current share price is being driven by expectations that extend far beyond what its dividend profile can support.

Result: OVERVALUED

Our Dividend Discount Model (DDM) analysis suggests CoreWeave may be overvalued by 1153792.9%. Discover 902 undervalued stocks or create your own screener to find better value opportunities.

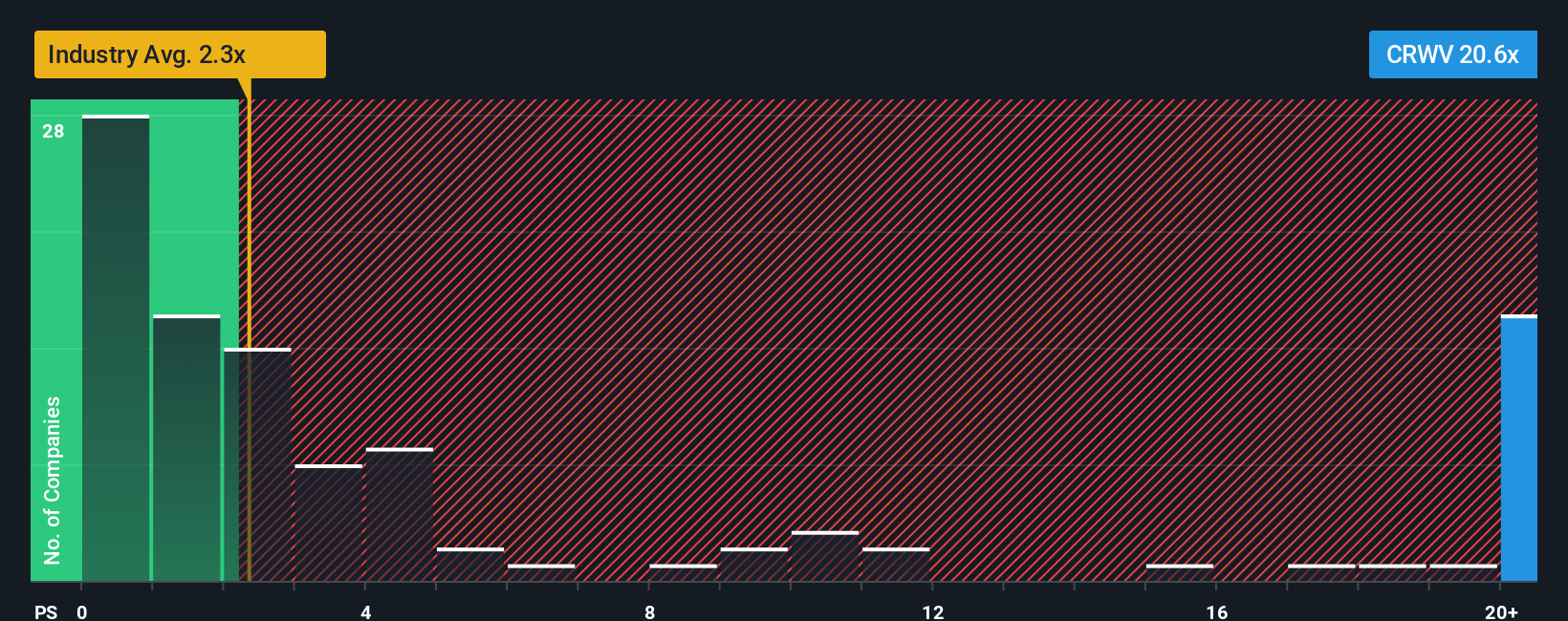

Approach 2: CoreWeave Price vs Sales

For high growth, often unprofitable companies like CoreWeave, the Price to Sales (P S) ratio is usually more informative than earnings-based metrics, because revenue is less distorted by early stage investment and accounting losses.

In general, a higher multiple can be justified when investors expect strong, durable growth and see relatively low risk. Slower or more uncertain growth tends to warrant a lower, more conservative multiple. That context matters when we look at CoreWeave’s current P S of 9.96x, which already sits well above the broader IT industry average of about 2.47x, though still below the 30.22x average of its higher flying peers.

To move beyond blunt peer comparisons, Simply Wall St uses a Fair Ratio, which estimates the P S you would reasonably expect after adjusting for CoreWeave’s specific growth outlook, risks, margins, industry, and market cap. This Fair Ratio comes out at 28.61x, compared with the current 9.96x being paid in the market, indicating that the stock trades at a discount relative to what its fundamentals and risk profile might justify.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1452 companies where insiders are betting big on explosive growth.

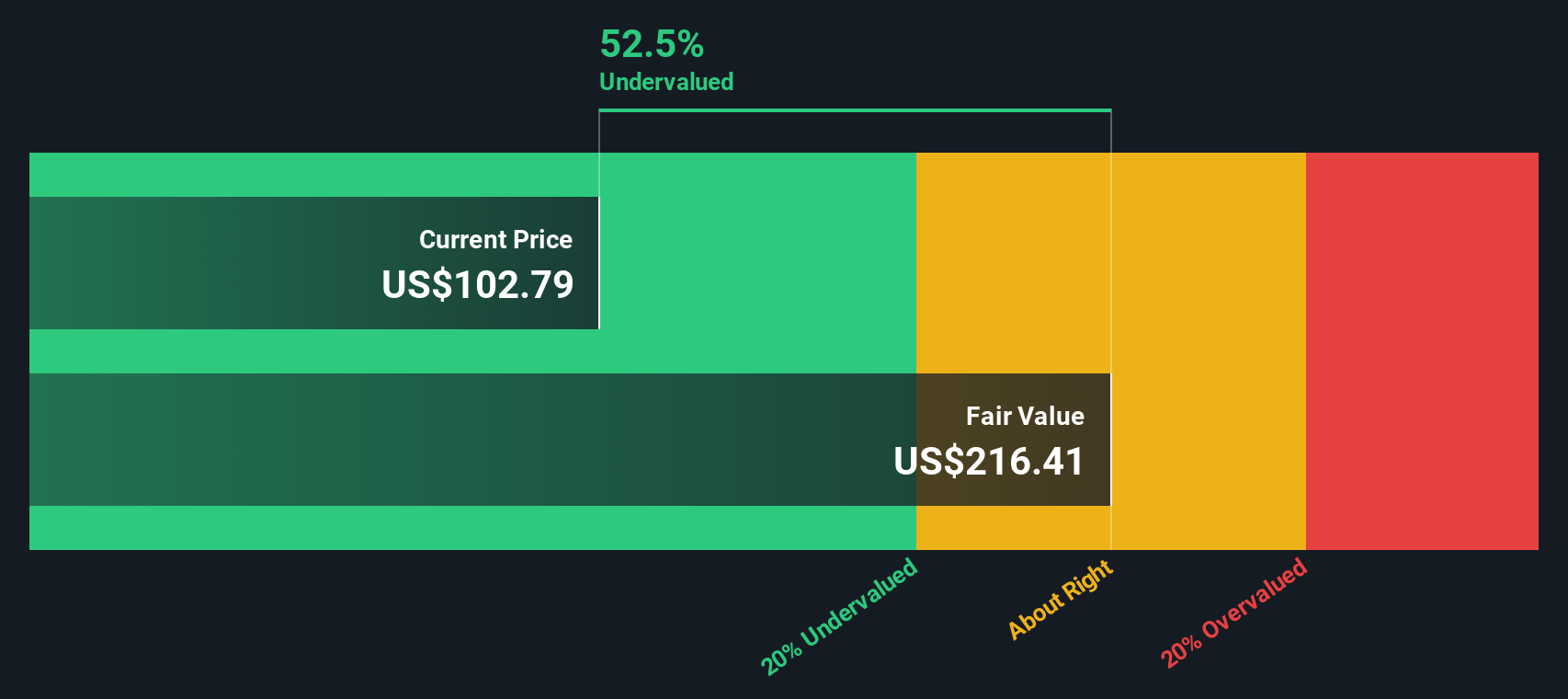

Upgrade Your Decision Making: Choose your CoreWeave Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which turn CoreWeave’s raw numbers into a clear, investable story. A Narrative is your own interpretation of a company, where you connect what you believe about its business, competitive edge, risks, and AI opportunity to specific assumptions for future revenue, earnings, and profit margins. On Simply Wall St, Narratives live in the Community page, making it easy for millions of investors to plug their story into a dynamic forecast that then flows through to a fair value estimate. This means you can quickly see whether your Narrative suggests that CoreWeave is worth more or less than today’s share price, and you can use that gap between Fair Value and Price to inform a decision to buy, hold, or sell. Narratives automatically update as fresh news, results, or guidance arrive, so your view evolves with the company instead of going stale. For example, some CoreWeave Narratives assume extremely rapid, long lasting revenue growth and premium margins, while others bake in slower adoption and more intense competition, leading to far lower fair values.

Do you think there's more to the story for CoreWeave? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal