Cincinnati Financial (CINF): A Fresh Look At Valuation After Its Recent Pullback

Cincinnati Financial (CINF) has quietly pulled back over the past week, even though the stock is still up this year and solidly positive over the past 3 years. That disconnect invites a closer look.

See our latest analysis for Cincinnati Financial.

At around $161 per share, that recent 1 week share price pullback sits against a still healthy year to date share price return and an impressive 3 year total shareholder return. This suggests momentum is cooling rather than breaking.

If Cincinnati Financial has you thinking about where else steady compounding might be hiding, it could be worth exploring fast growing stocks with high insider ownership as a fresh hunting ground.

With shares now trading modestly below analyst targets but at a premium to some valuation models, investors face a familiar dilemma: is Cincinnati Financial still undervalued, or is the market already pricing in future growth?

Most Popular Narrative Narrative: 6.6% Undervalued

With Cincinnati Financial last closing at $161.33 against a narrative fair value near $172.67, the story leans toward modest upside rooted in detailed long term forecasts.

Ongoing premium growth, particularly double digit net written premium growth in multiple years (with four out of the last five years), supported by expanding relationships with independent agents and entry into new specialty products and markets, is poised to drive long term revenue expansion.

Curious how steady premium growth, thinner margins and a richer future multiple can still add up to upside potential, even with falling earnings forecasts? Explore the full valuation blueprint that underpins that fair value estimate.

Result: Fair Value of $172.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative could crack if catastrophe losses spike again or if investment income falters in a weaker rate backdrop.

Find out about the key risks to this Cincinnati Financial narrative.

Another Lens On Value

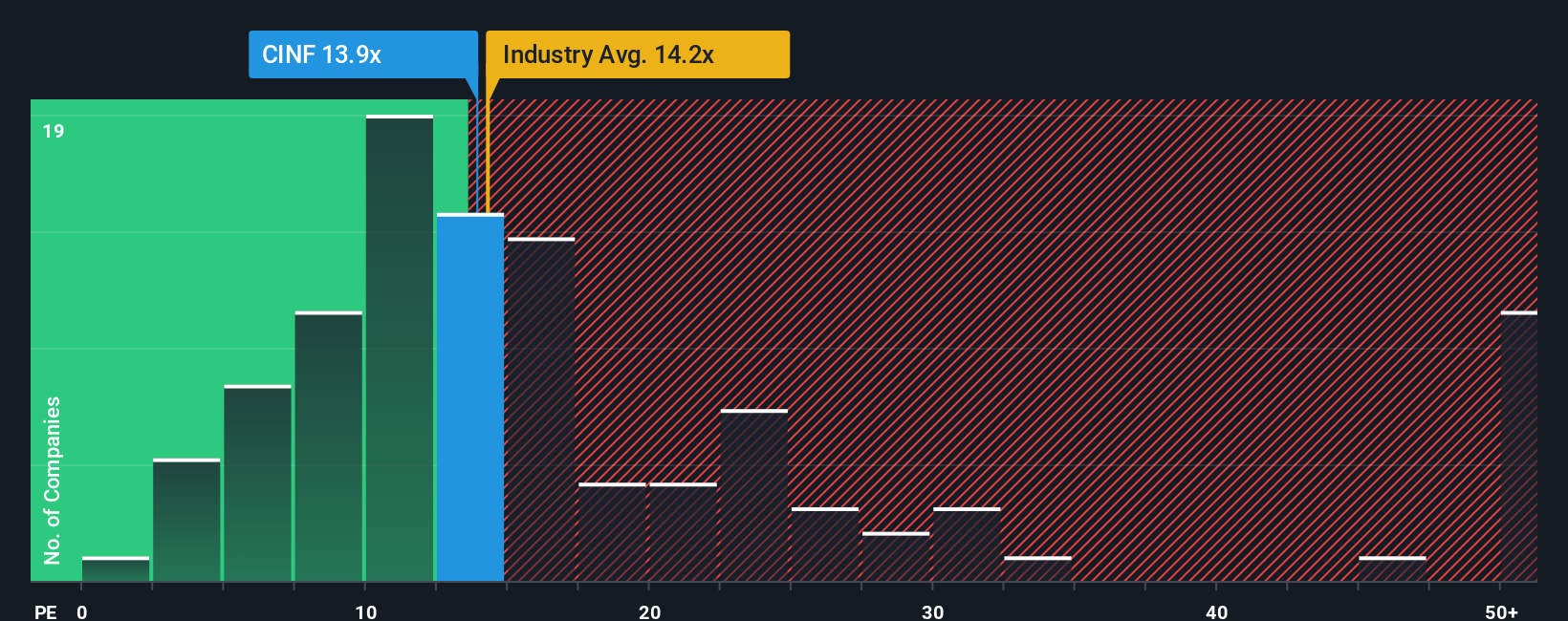

On earnings, Cincinnati Financial looks less forgiving. Its 11.9x price to earnings ratio sits below the US market but above our fair ratio of 8.7x, hinting at downside if sentiment cools. Is this a quality premium worth paying, or late cycle optimism?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cincinnati Financial Narrative

If you see the story differently or want to challenge the assumptions with your own research, you can build a full narrative in just minutes: Do it your way.

A great starting point for your Cincinnati Financial research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing edge?

Now is the moment to broaden your opportunity set. Use the Simply Wall St Screener to pinpoint stocks that match your strategy before the crowd catches on.

- Target reliable income streams by reviewing these 15 dividend stocks with yields > 3% that could strengthen your portfolio’s cash flow when markets turn choppy.

- Capitalize on mispriced potential by scanning these 903 undervalued stocks based on cash flows where strong cash flows are not yet fully reflected in market prices.

- Position yourself for structural growth trends by assessing these 30 healthcare AI stocks at the intersection of innovation, data, and long term healthcare demand.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal