Asian Penny Stocks To Watch In December 2025

As global markets anticipate the Federal Reserve's final meeting of the year, Asian markets are drawing attention with their unique opportunities and challenges. Amid this backdrop, penny stocks—typically smaller or newer companies—remain a compelling area for investors seeking growth potential at lower price points. While the term "penny stock" may seem outdated, these investments can offer significant upside when backed by strong financials and sound fundamentals.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| JBM (Healthcare) (SEHK:2161) | HK$2.72 | HK$2.22B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.47 | HK$909.23M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.61 | HK$2.17B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.02 | SGD413.39M | ✅ 4 ⚠️ 1 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.92 | THB2.95B | ✅ 3 ⚠️ 3 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.102 | SGD53.4M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.39 | SGD13.34B | ✅ 5 ⚠️ 1 View Analysis > |

| F & J Prince Holdings (PSE:FJP) | ₱2.20 | ₱859.28M | ✅ 2 ⚠️ 3 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$1.00 | NZ$142.34M | ✅ 2 ⚠️ 5 View Analysis > |

| Scott Technology (NZSE:SCT) | NZ$3.02 | NZ$253.97M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 953 stocks from our Asian Penny Stocks screener.

Let's review some notable picks from our screened stocks.

UNQ Holdings (SEHK:2177)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: UNQ Holdings Limited, with a market cap of HK$527.55 million, operates as a brand e-commerce retail and wholesale solutions provider in the People's Republic of China.

Operations: The company's revenue segments include B2B General Trade with CN¥469.61 million, B2C General Trade at CN¥425.04 million, Provision of Services totaling CN¥9.17 million, B2B Cross-Border E-Commerce generating CN¥195.88 million, and B2C Cross-Border E-Commerce contributing CN¥215.48 million.

Market Cap: HK$527.55M

UNQ Holdings, with a market cap of HK$527.55 million, has shown significant financial improvement. The company's debt to equity ratio has dramatically reduced over the past five years, and it now holds more cash than its total debt. Despite a low Return on Equity of 3.2%, UNQ's earnings have surged by 445% in the past year, surpassing industry averages and improving profit margins from 0.3% to 1.9%. However, negative operating cash flow indicates challenges in covering debt through operations. Both the management team and board are experienced, contributing to stable weekly volatility at 8%.

- Take a closer look at UNQ Holdings' potential here in our financial health report.

- Gain insights into UNQ Holdings' historical outcomes by reviewing our past performance report.

Logory Logistics Technology (SEHK:2482)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Logory Logistics Technology Co., Ltd. offers road freight transportation services and solutions in China, with a market cap of approximately HK$1.05 billion.

Operations: The company generates CN¥7.31 billion in revenue from its digital freight businesses and related services.

Market Cap: HK$1.05B

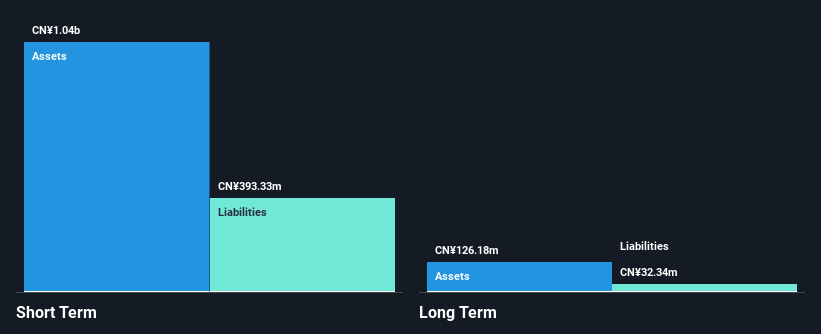

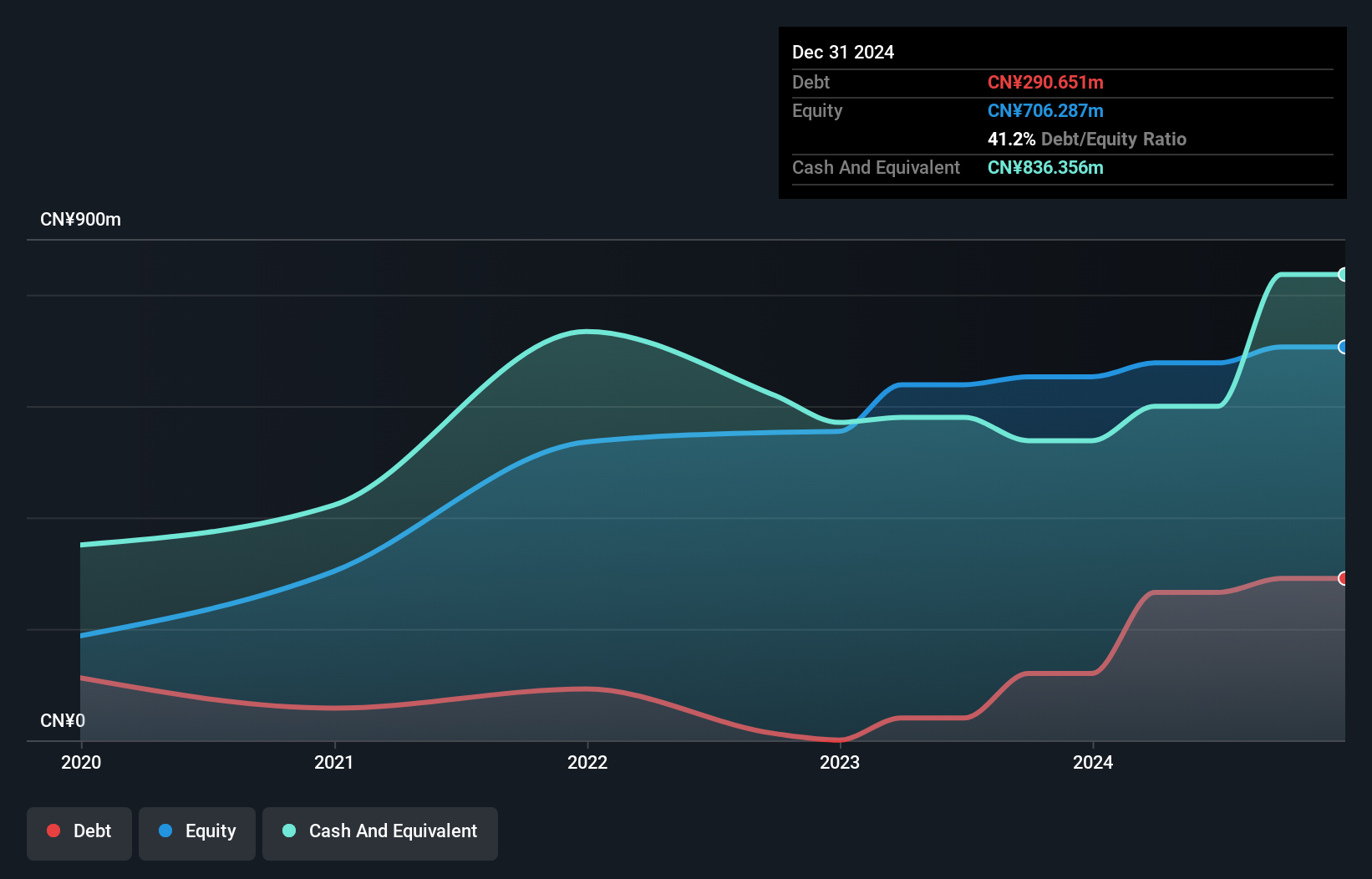

Logory Logistics Technology, with a market cap of HK$1.05 billion, has demonstrated robust financial growth. Its earnings surged by 161.7% over the past year, far outpacing the logistics industry average and its own five-year growth rate of 21.7% per year. Despite a low Return on Equity at 6.7%, the company's debt is well-managed, evidenced by operating cash flow covering 33.3% of its debt and having more cash than total debt obligations. The management team and board are experienced with an average tenure of 4.3 years each, while recent stability in weekly volatility remains higher than most Hong Kong stocks at 15%.

- Dive into the specifics of Logory Logistics Technology here with our thorough balance sheet health report.

- Explore historical data to track Logory Logistics Technology's performance over time in our past results report.

Beyond Securities (SET:BYD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Beyond Securities Public Company Limited operates in the securities business in Thailand with a market capitalization of approximately THB3.23 billion.

Operations: The company generates revenue from two main segments: the Investment Business, contributing THB859.59 million, and the Securities and Derivatives Business, which accounts for THB426.78 million.

Market Cap: THB3.23B

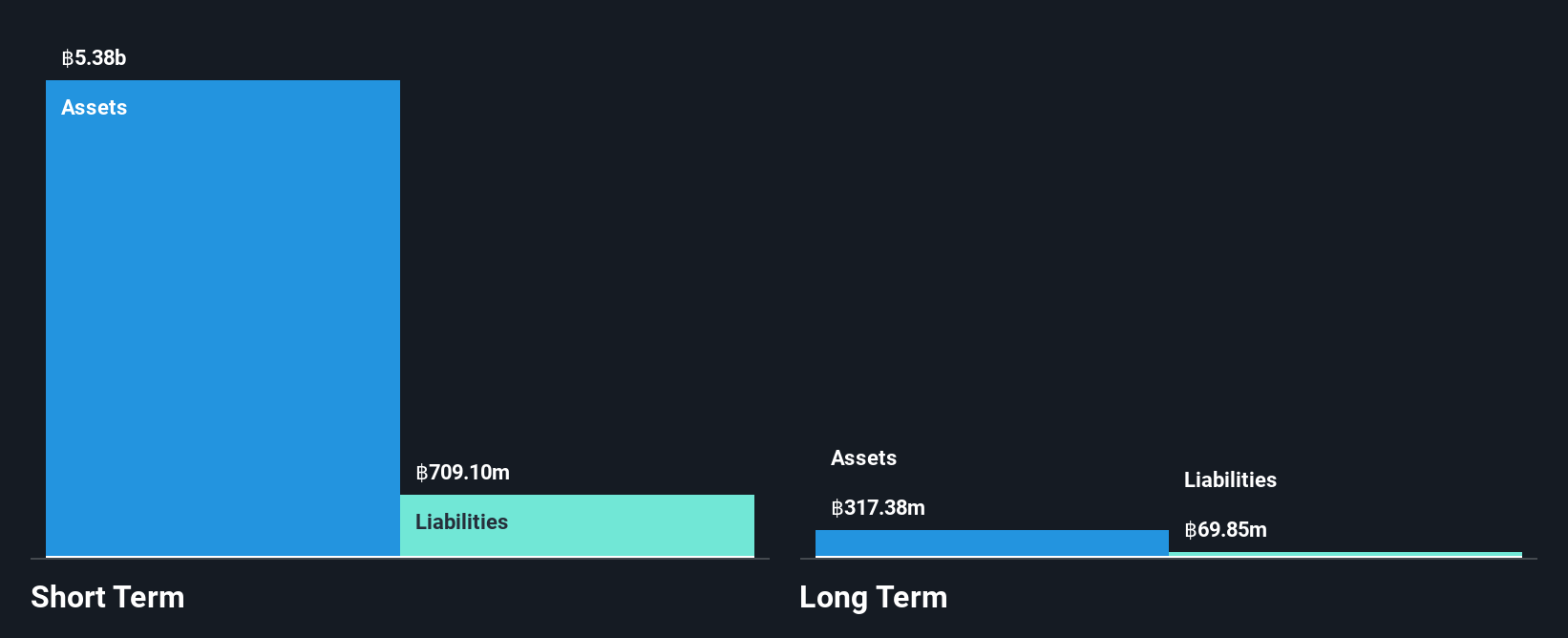

Beyond Securities, with a market cap of THB3.23 billion, operates in Thailand's securities sector and is currently unprofitable. Despite this, it maintains a strong cash position, having more cash than debt and sufficient runway for over three years due to positive free cash flow. The management team is seasoned with an average tenure of 9.2 years. Recent earnings reports showed increased revenue but also highlighted significant net losses over nine months ending September 2025. Shareholders have not faced meaningful dilution recently; however, the stock remains highly volatile compared to other Thai stocks.

- Unlock comprehensive insights into our analysis of Beyond Securities stock in this financial health report.

- Examine Beyond Securities' past performance report to understand how it has performed in prior years.

Key Takeaways

- Navigate through the entire inventory of 953 Asian Penny Stocks here.

- Looking For Alternative Opportunities? This technology could replace computers: discover the 28 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal