SP Systems Co.,Ltd. (KOSDAQ:317830) Stock Rockets 43% As Investors Are Less Pessimistic Than Expected

SP Systems Co.,Ltd. (KOSDAQ:317830) shareholders have had their patience rewarded with a 43% share price jump in the last month. The last month tops off a massive increase of 263% in the last year.

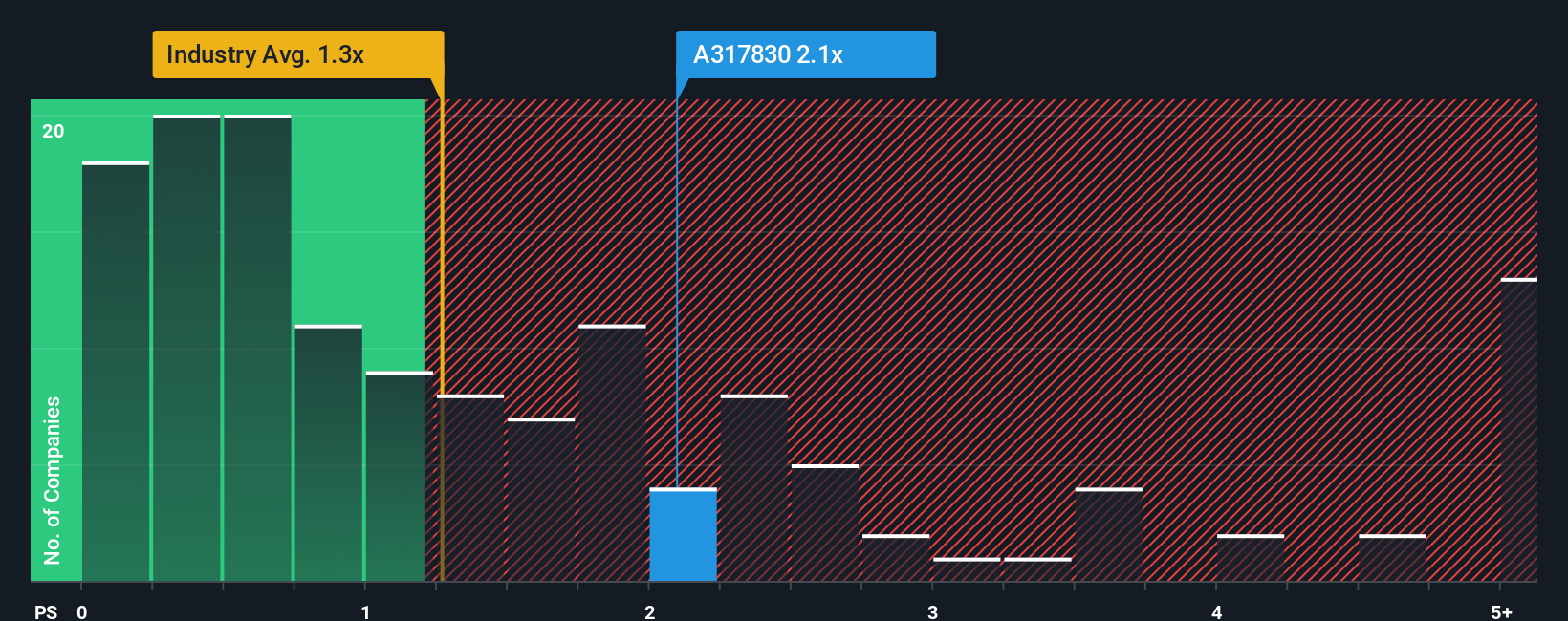

After such a large jump in price, you could be forgiven for thinking SP SystemsLtd is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.1x, considering almost half the companies in Korea's Machinery industry have P/S ratios below 1.3x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for SP SystemsLtd

What Does SP SystemsLtd's P/S Mean For Shareholders?

For instance, SP SystemsLtd's receding revenue in recent times would have to be some food for thought. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Although there are no analyst estimates available for SP SystemsLtd, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is SP SystemsLtd's Revenue Growth Trending?

In order to justify its P/S ratio, SP SystemsLtd would need to produce impressive growth in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 2.9%. Regardless, revenue has managed to lift by a handy 27% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 24% shows it's noticeably less attractive.

In light of this, it's alarming that SP SystemsLtd's P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Final Word

SP SystemsLtd shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

The fact that SP SystemsLtd currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. Right now we aren't comfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

You should always think about risks. Case in point, we've spotted 3 warning signs for SP SystemsLtd you should be aware of, and 2 of them are a bit concerning.

If these risks are making you reconsider your opinion on SP SystemsLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal