Improved Earnings Required Before Interflex Co., Ltd. (KOSDAQ:051370) Stock's 27% Jump Looks Justified

Interflex Co., Ltd. (KOSDAQ:051370) shareholders would be excited to see that the share price has had a great month, posting a 27% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 42% in the last year.

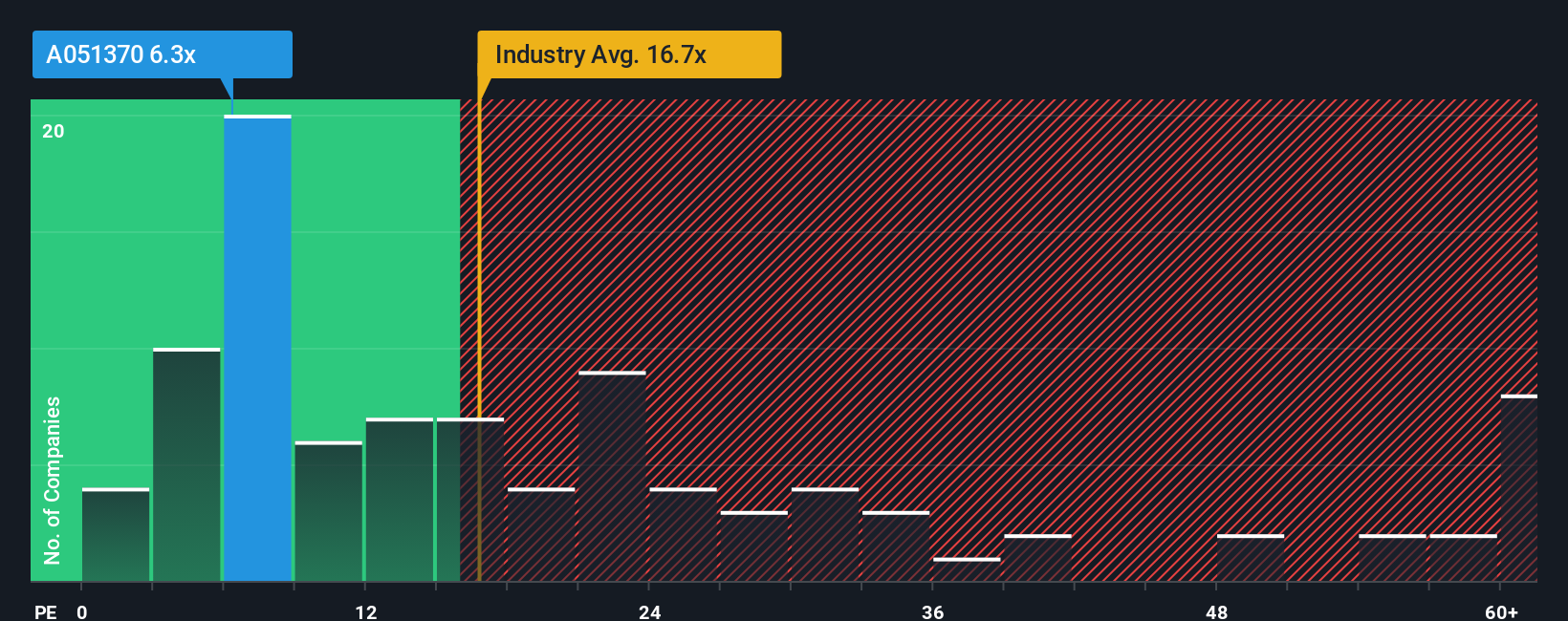

Even after such a large jump in price, given about half the companies in Korea have price-to-earnings ratios (or "P/E's") above 14x, you may still consider Interflex as a highly attractive investment with its 6.3x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

Recent times have been advantageous for Interflex as its earnings have been rising faster than most other companies. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Interflex

How Is Interflex's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as depressed as Interflex's is when the company's growth is on track to lag the market decidedly.

Retrospectively, the last year delivered an exceptional 20% gain to the company's bottom line. As a result, it also grew EPS by 24% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of earnings growth.

Shifting to the future, estimates from the sole analyst covering the company suggest earnings growth is heading into negative territory, declining 32% over the next year. Meanwhile, the broader market is forecast to expand by 38%, which paints a poor picture.

In light of this, it's understandable that Interflex's P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Bottom Line On Interflex's P/E

Even after such a strong price move, Interflex's P/E still trails the rest of the market significantly. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Interflex maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you take the next step, you should know about the 1 warning sign for Interflex that we have uncovered.

Of course, you might also be able to find a better stock than Interflex. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal