FedEx (FDX) Valuation Check as Grounded Cargo Fleet Tightens Holiday Shipping Capacity

FedEx (FDX) just grounded a portion of its older cargo fleet after a deadly explosion, tightening air capacity precisely as the holiday rush peaks and putting fresh, highly visible pressure on near term earnings.

See our latest analysis for FedEx.

Despite the disruption, investors have treated it as a bump in an otherwise improving story. FedEx’s roughly 21.5 percent 3 month share price return contrasts with a near flat 1 year total shareholder return, suggesting momentum is rebuilding.

If this kind of logistics shock has you rethinking where resilience and growth might come from next, it could be worth exploring related aerospace and defense stocks as potential beneficiaries of shifting supply chain priorities.

With earnings pressure rising just as FedEx trades almost exactly at analyst targets but still screens at a hefty intrinsic discount, is the market overlooking a genuine value opportunity or already baking in the next leg of growth?

Most Popular Narrative Narrative: 1% Overvalued

The most followed narrative sees FedEx’s fair value sitting just below the latest close of $274.29, implying a modest premium in today’s price.

FedEx's DRIVE initiative is achieving significant cost savings, with a target of $2.2 billion for FY '25 and a total of $4 billion compared to the FY '23 baseline. This initiative is expected to enhance net margins through structural cost reductions.

Curious how a disciplined cost reset, modest growth expectations, and a carefully chosen future earnings multiple combine to justify this valuation edge? The full narrative unpacks the cash flow roadmap, margin lift, and capital allocation bets that have analysts converging around this fair value.

Result: Fair Value of $271.93 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that case still hinges on freight fundamentals and global trade holding up, with USPS contract loss and restructuring costs posing meaningful downside risks.

Find out about the key risks to this FedEx narrative.

Another View: Multiples Point to Undervaluation

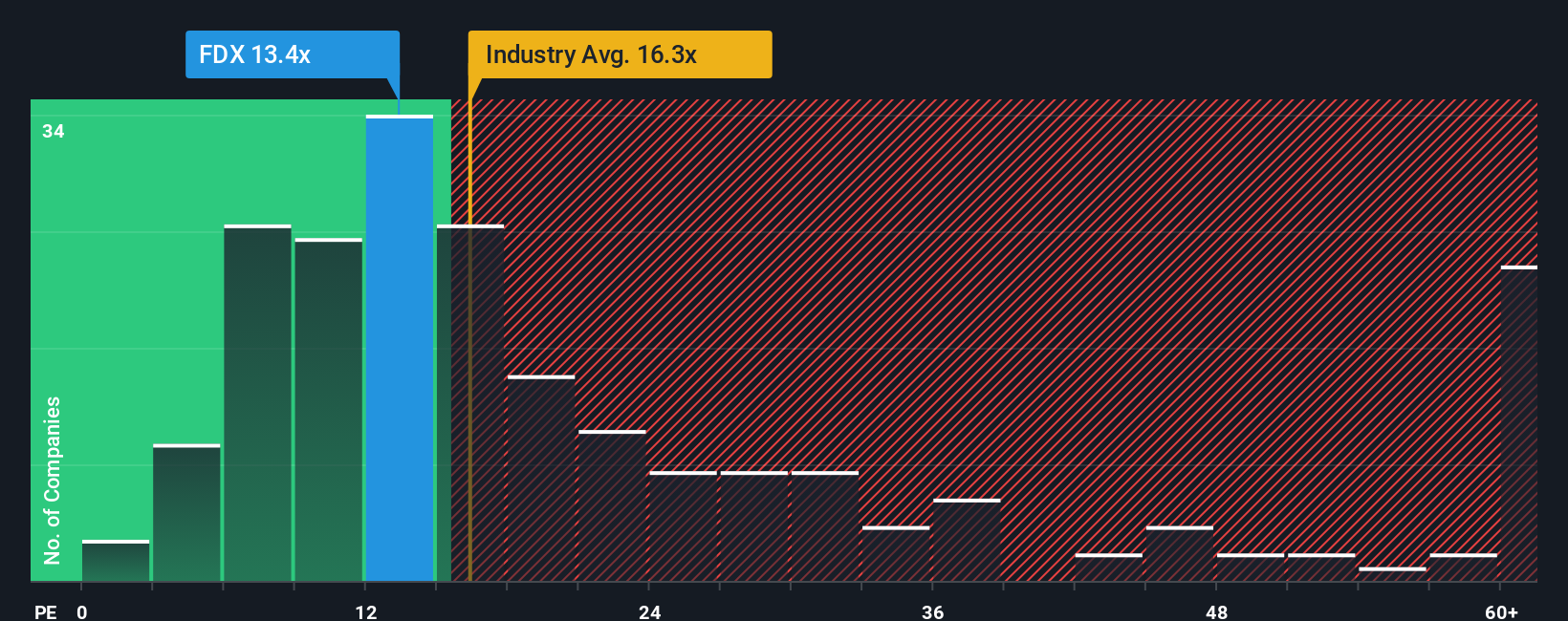

Set against that slight overvaluation call, FedEx’s current price to earnings ratio of 15.7 times looks modest beside the global logistics average of 16 times, peer average of 20.8 times, and a fair ratio of 19.2 times. If the market drifts toward that fair ratio, today’s price could be a starting line rather than a ceiling. Or is the discount really danger priced in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own FedEx Narrative

If you see the story differently or want to test your own thesis against the numbers, you can build a complete view in minutes: Do it your way.

A great starting point for your FedEx research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing edge?

Do not stop at FedEx. Use the Simply Wall Street Screener to pinpoint fresh, data backed opportunities that other investors may be overlooking right now.

- Capture potential mispricings by targeting companies trading below intrinsic value, starting with these 898 undervalued stocks based on cash flows that highlight strong cash flow support.

- Position ahead of the next tech wave by scanning these 27 AI penny stocks that blend rapid innovation with meaningful market traction.

- Strengthen your income stream by reviewing these 15 dividend stocks with yields > 3% that pair attractive yields with sustainable payout profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal