Should Inpex’s Buyback and Leadership Shift Reshape Capital Allocation Priorities for Inpex (TSE:1605) Investors?

- In November 2025, INPEX Corporation reported acquiring 6,072,000 treasury shares under a Board-approved plan to repurchase up to 60.00 million shares by January 31, 2026, with Hiroshi Fujii set to step down as Representative Director and Senior Executive Vice President and become Director and Corporate Advisor from January 1, 2026.

- This combination of a sizeable, time-bound buyback program and leadership transition underscores how INPEX is actively reshaping capital allocation and governance priorities.

- We will now examine how INPEX's sizable share buyback program could influence the company’s investment narrative and long-term shareholder returns.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Inpex Investment Narrative Recap

To own INPEX, you need to believe that long-term energy demand, especially for LNG in Asia, plus disciplined capital allocation can offset periods of weaker prices and volume pressure. The expanded, time-bound buyback and board change look incremental rather than transformative for the near term, where crude price volatility and earnings forecasts remain the key catalyst and risk.

The November decision to lift the buyback authorization to ¥100,000 million for up to 60,000,000 shares ties directly into INPEX’s commitment to a 50% plus total return ratio and progressive dividends. This makes the execution and sustainability of shareholder returns an important near term focus, especially if consensus expectations for revenue and earnings over the next few years prove too optimistic in the face of commodity and currency swings.

Yet investors should also be aware that if earnings fall faster than expected, the current pace of buybacks and dividends could...

Read the full narrative on Inpex (it's free!)

Inpex’s narrative projects ¥1853.8 billion in revenue and ¥308.2 billion in earnings by 2028.

Uncover how Inpex's forecasts yield a ¥3150 fair value, in line with its current price.

Exploring Other Perspectives

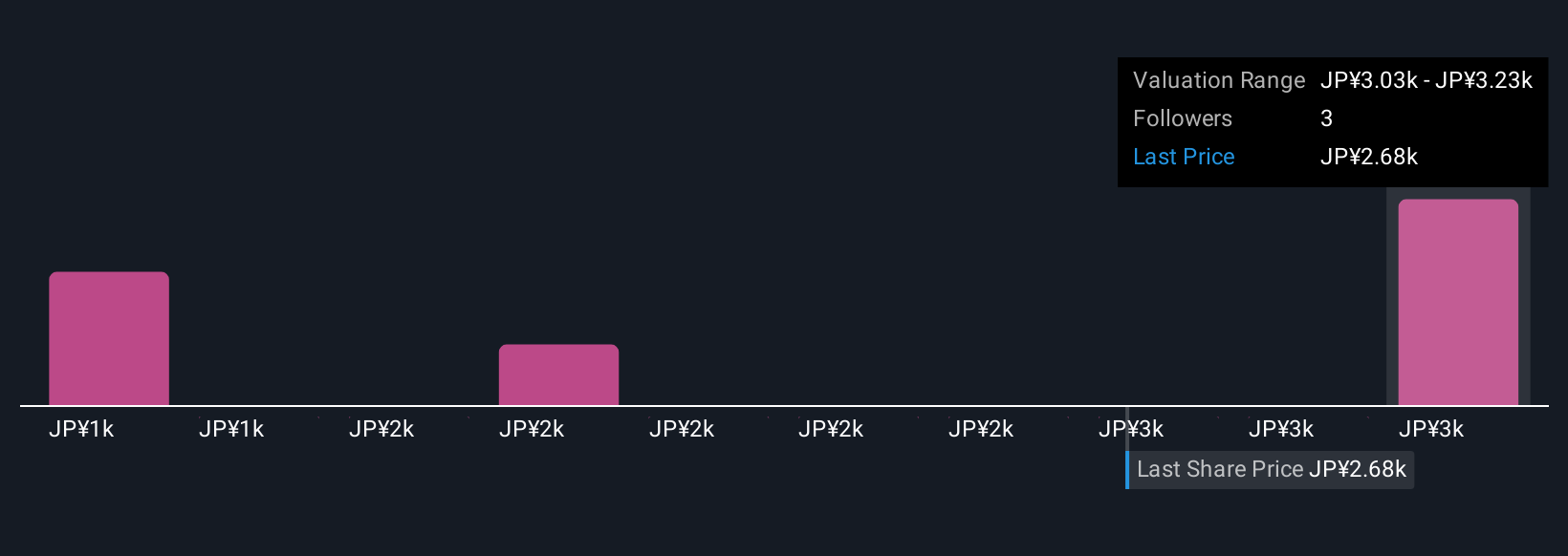

Three Simply Wall St Community fair value estimates for INPEX span from ¥1,225.16 to ¥5,335.25, showing how far apart individual views can be. Before you rely on any single outlook, consider how much hinges on INPEX delivering the aggressive shareholder return policies that many see as central to its future performance, and compare several perspectives to understand the full range of expectations.

Explore 3 other fair value estimates on Inpex - why the stock might be worth less than half the current price!

Build Your Own Inpex Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Inpex research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Inpex research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Inpex's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal