JFE Holdings (TSE:5411) Valuation After India Joint Venture Call With JSW Steel Fuels Investor Optimism

JFE Holdings (TSE:5411) is back in focus after scheduling a special call to discuss its integrated steel plant joint venture with JSW Steel in India, a move that points to strategic expansion.

See our latest analysis for JFE Holdings.

The buzz around the India joint venture seems to be feeding into sentiment, with a 1 month share price return of 9.4 percent and a 1 year total shareholder return of 19.8 percent suggesting momentum is building rather than fading.

If this kind of strategic expansion has your attention, it could be a good time to see what else is out there by exploring fast growing stocks with high insider ownership.

But with the share price already near analyst targets and long term returns strong, is JFE still trading below its true value, or is the market already factoring in the India driven growth story?

Price-to-Earnings of 16.3x: Is it justified?

JFE Holdings trades on a Price-to-Earnings ratio of 16.3x, which, at the current share price of ¥1955.5, suggests the market is paying up relative to peers.

The Price-to-Earnings ratio compares the company’s share price with its earnings per share. It gives a snapshot of how much investors are willing to pay for each unit of current profit, a key lens for a cyclical, capital intensive steel and materials group.

Here, the picture is mixed. JFE screens as good value versus its estimated fair Price-to-Earnings ratio of 20.5x, yet looks expensive versus the JP Metals and Mining industry on 12.3x and the peer group on 13.9x. The market therefore appears to be pricing in stronger earnings growth and a potential re-rating towards that higher fair ratio over time.

Compared with an industry trading on 12.3x earnings, a 16.3x multiple stands out. It signals investors are assigning JFE a premium multiple well above sector norms and peer averages, and potentially positioning for the company to converge towards the higher 20.5x level implied by the fair ratio.

Explore the SWS fair ratio for JFE Holdings

Result: Price-to-Earnings of 16.3x (OVERVALUED)

However, sustained premium pricing depends on execution, with cyclically weak steel demand or delays at the India joint venture potentially undermining the growth narrative.

Find out about the key risks to this JFE Holdings narrative.

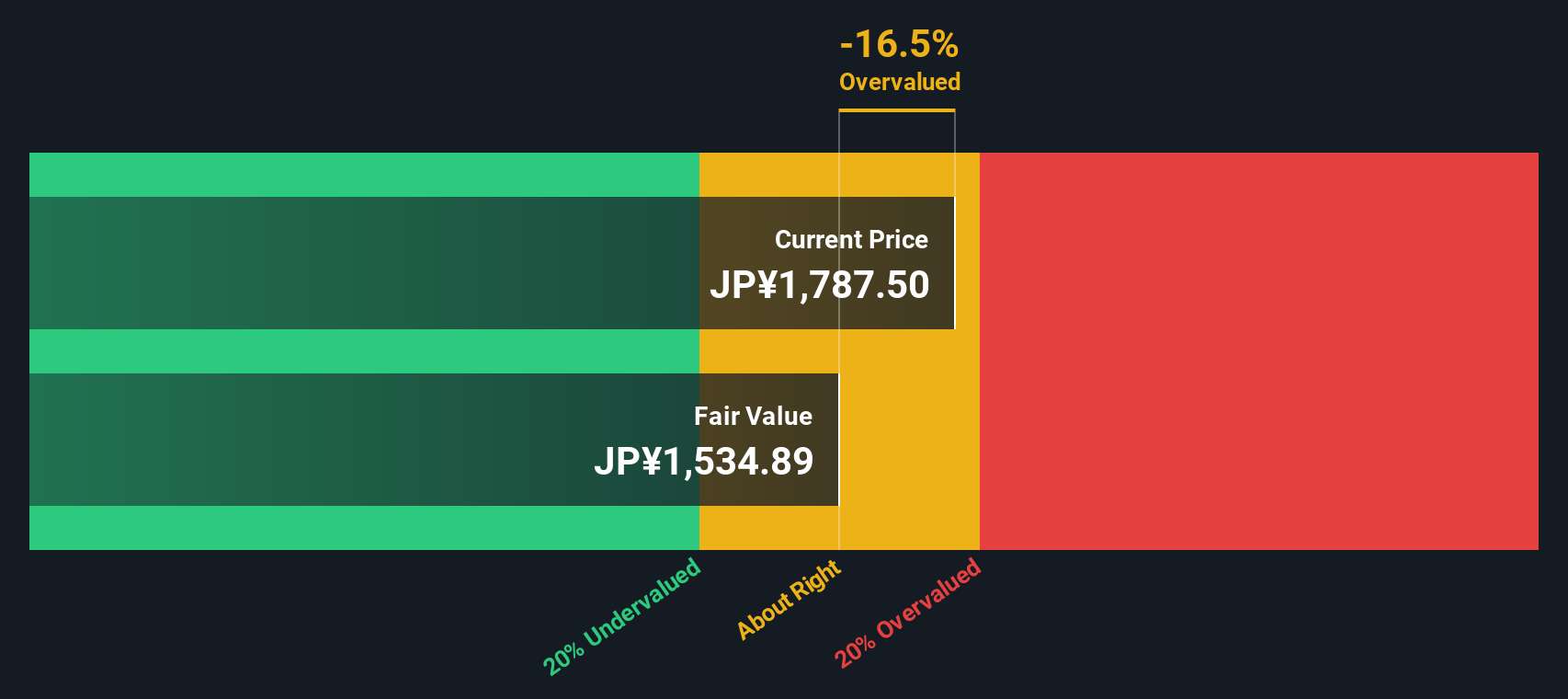

Another View From Our DCF Model

While the earnings multiple suggests the market is paying a premium, our DCF model paints a harsher picture, indicating JFE may be overvalued with fair value closer to ¥1,559 than the current ¥1,955.5. Is the market overexcited about India driven growth, or is the model too cautious?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out JFE Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 899 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own JFE Holdings Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a tailored view in under three minutes: Do it your way.

A great starting point for your JFE Holdings research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in an edge by scanning fresh opportunities on Simply Wall Street’s powerful screener and keep your portfolio positioned ahead of the crowd.

- Capture potential bargains early by reviewing these 899 undervalued stocks based on cash flows that strong cash flow analysis suggests the market has not fully appreciated yet.

- Lean into structural healthcare trends by targeting these 30 healthcare AI stocks applying advanced analytics to diagnostics, treatment, and operational efficiency.

- Tap into the volatility and upside of digital assets through these 81 cryptocurrency and blockchain stocks shaping payments, infrastructure, and blockchain enabled business models.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal