Could Mercury Systems' (MRCY) EW Product Push Reshape Its Competitive Moat in Defense Modernization?

- In early December 2025, Mercury Systems showcased its expanding electronic warfare portfolio at the AOC International Symposium, unveiling the compact DRF4581L direct RF digital signal processing module and highlighting deployments across more than 300 programs in 35 countries.

- This emphasis on advanced spectrum operations, cyber-electromagnetic activities, and open-architecture EW solutions underscores Mercury’s push to be a key technology enabler in future defense modernization.

- Next, we’ll examine how Mercury’s new DRF4581L RF module and broader EW focus could influence its existing investment narrative.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Mercury Systems Investment Narrative Recap

To own Mercury Systems, you need to believe its specialized defense electronics and EW capabilities can translate into steadier growth and eventual profitability despite recent losses and modest near term revenue expectations. The AOC 2025 showcase, including the DRF4581L module, reinforces the technology story but does not materially change the key near term catalyst of executing the existing backlog while improving margins, or the major risk that legacy low margin contracts and pulled forward revenue keep pressuring reported performance.

Among recent developments, the amended US$850,000,000 revolving credit facility stands out as most relevant here, because it supports Mercury’s ability to fund EW investments like the DRF4581L while it works through older contracts and unbilled receivables. For investors, how effectively the company balances this balance sheet flexibility with disciplined execution across its EW programs will likely matter at least as much as any single product announcement.

However, investors should also be aware that Mercury’s history of accelerating deliveries and revenue recognition could eventually leave future periods more exposed to...

Read the full narrative on Mercury Systems (it's free!)

Mercury Systems' narrative projects $1.1 billion revenue and $44.5 million earnings by 2028. This requires 6.1% yearly revenue growth and an $82.4 million earnings increase from -$37.9 million today.

Uncover how Mercury Systems' forecasts yield a $86.00 fair value, a 22% upside to its current price.

Exploring Other Perspectives

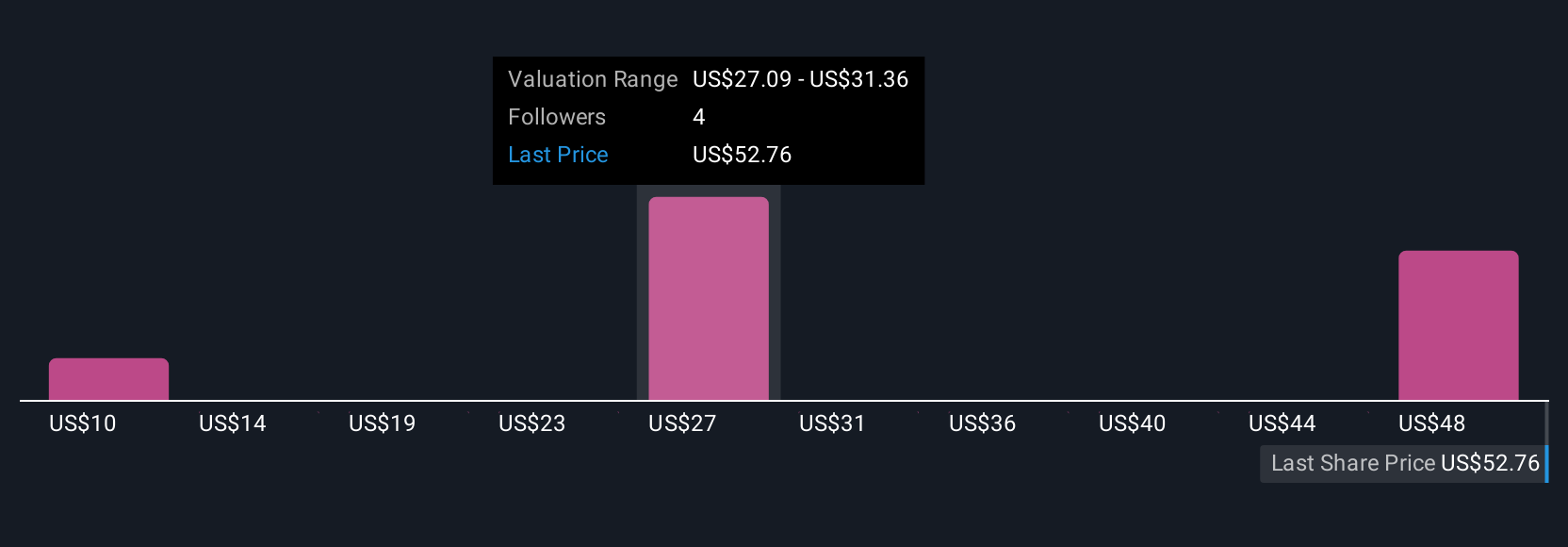

Three members of the Simply Wall St Community currently see fair value for Mercury between US$39.57 and US$86.00, underscoring how far apart individual views can be. Set against concerns about legacy low margin backlog and modest forecast revenue growth, this wide range of opinions invites you to weigh multiple scenarios for how quickly Mercury can translate its EW investments into more consistent financial performance.

Explore 3 other fair value estimates on Mercury Systems - why the stock might be worth 44% less than the current price!

Build Your Own Mercury Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mercury Systems research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Mercury Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mercury Systems' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal