Examining the Future: Dave & Buster's Enter's Earnings Outlook

Dave & Buster's Enter (NASDAQ:PLAY) is preparing to release its quarterly earnings on Tuesday, 2025-12-09. Here's a brief overview of what investors should keep in mind before the announcement.

Analysts expect Dave & Buster's Enter to report an earnings per share (EPS) of $-1.10.

The market awaits Dave & Buster's Enter's announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It's important for new investors to understand that guidance can be a significant driver of stock prices.

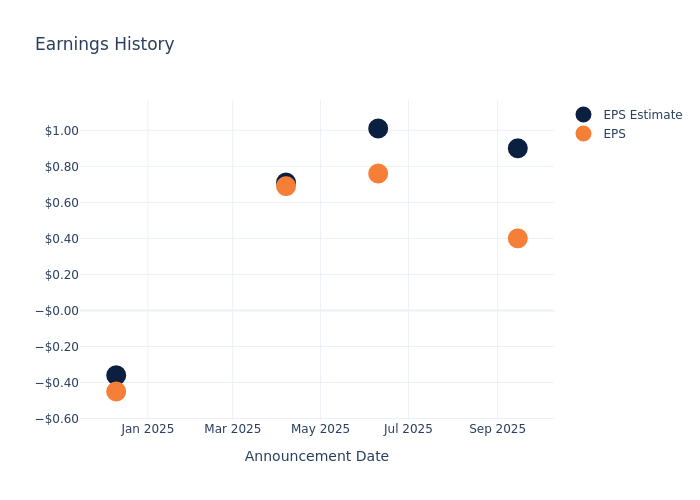

Historical Earnings Performance

Last quarter the company missed EPS by $0.50, which was followed by a 16.74% drop in the share price the next day.

Here's a look at Dave & Buster's Enter's past performance and the resulting price change:

| Quarter | Q2 2025 | Q1 2025 | Q4 2024 | Q3 2024 |

|---|---|---|---|---|

| EPS Estimate | 0.9 | 1.01 | 0.71 | -0.36 |

| EPS Actual | 0.4 | 0.76 | 0.69 | -0.45 |

| Price Change % | -17.0 | 18.00 | -1.00 | -20.00 |

Dave & Buster's Enter Share Price Analysis

Shares of Dave & Buster's Enter were trading at $17.32 as of December 05. Over the last 52-week period, shares are down 53.29%. Given that these returns are generally negative, long-term shareholders are likely unhappy going into this earnings release.

Analyst Views on Dave & Buster's Enter

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Dave & Buster's Enter.

Dave & Buster's Enter has received a total of 4 ratings from analysts, with the consensus rating as Neutral. With an average one-year price target of $22.25, the consensus suggests a potential 28.46% upside.

Comparing Ratings with Peers

In this analysis, we delve into the analyst ratings and average 1-year price targets of Pursuit Attractions, Six Flags Entertainment and Vail Resorts, three key industry players, offering insights into their relative performance expectations and market positioning.

- Analysts currently favor an Buy trajectory for Pursuit Attractions, with an average 1-year price target of $43.0, suggesting a potential 148.27% upside.

- Analysts currently favor an Buy trajectory for Six Flags Entertainment, with an average 1-year price target of $24.8, suggesting a potential 43.19% upside.

- Analysts currently favor an Neutral trajectory for Vail Resorts, with an average 1-year price target of $171.38, suggesting a potential 889.49% upside.

Peers Comparative Analysis Summary

In the peer analysis summary, key metrics for Pursuit Attractions, Six Flags Entertainment and Vail Resorts are highlighted, providing an understanding of their respective standings within the industry and offering insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Dave & Buster's Enter | Neutral | 0.05% | $481M | 7.28% |

| Pursuit Attractions | Buy | 32.24% | $221.21M | 13.01% |

| Six Flags Entertainment | Buy | -2.27% | $1.21B | -99.40% |

| Vail Resorts | Neutral | 2.22% | $-18.82M | -28.10% |

Key Takeaway:

Dave & Buster's Enter ranks at the bottom for Revenue Growth among its peers. It is in the middle for Gross Profit. For Return on Equity, it is at the bottom.

Delving into Dave & Buster's Enter's Background

Dave & Buster's Entertainment Inc owns and operates nearly a hundred entertainment and dining establishments in the United States where customers can eat, drink, play games, and watch televised sports. Each store offers a full menu of entries and appetizers, a complete selection of alcoholic and non-alcoholic beverages, and an extensive assortment of entertainment attractions centered around playing games and watching live sports and other televised events. It derives maximum revenue from Entertainment.

Understanding the Numbers: Dave & Buster's Enter's Finances

Market Capitalization Analysis: Falling below industry benchmarks, the company's market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: Dave & Buster's Enter displayed positive results in 3 months. As of 31 July, 2025, the company achieved a solid revenue growth rate of approximately 0.05%. This indicates a notable increase in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Consumer Discretionary sector.

Net Margin: Dave & Buster's Enter's net margin is impressive, surpassing industry averages. With a net margin of 2.05%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Dave & Buster's Enter's ROE stands out, surpassing industry averages. With an impressive ROE of 7.28%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Dave & Buster's Enter's ROA excels beyond industry benchmarks, reaching 0.28%. This signifies efficient management of assets and strong financial health.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 19.11, caution is advised due to increased financial risk.

To track all earnings releases for Dave & Buster's Enter visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal