How Investors Are Reacting To National Bank of Canada (TSX:NA) Strong Q4 Earnings And Dividend Hike

- In the past week, National Bank of Canada reported Q4 2025 results showing net income of CA$1,059 million and net interest income of CA$1,169 million, alongside CA$62 million of impairment losses on intangible assets and a higher quarterly common dividend of CA$1.24 per share.

- The board also declared a wide slate of preferred share dividends and reiterated its focus on acquisition synergies and return on equity targets, underscoring management’s emphasis on both capital returns and integration progress following recent bank acquisitions.

- We’ll now examine how the stronger earnings alongside the raised common dividend could reshape National Bank of Canada’s investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

National Bank of Canada Investment Narrative Recap

To own National Bank of Canada, you need to believe it can turn its recent acquisitions into durable earnings power while managing regional and economic risks. The latest Q4 2025 results, including higher net income and a larger dividend, support the near term earnings and capital return story, while the CA$62 million intangible impairment does not appear to materially change the key catalyst of integration progress or the main risk around credit quality in a softer economy.

The 6 cent increase in the quarterly common dividend to CA$1.24 per share is the most relevant development here, as it directly connects to management’s confidence in ongoing earnings and cash generation. For investors focused on catalysts, this higher payout aligns with the bank’s return on equity ambitions and its plan to extract cost and revenue synergies from the Canadian Western Bank and Laurentian transactions.

Yet behind the stronger dividend and earnings, investors should be aware of how rising provisions for credit losses could interact with...

Read the full narrative on National Bank of Canada (it's free!)

National Bank of Canada's narrative projects CA$16.2 billion revenue and CA$4.2 billion earnings by 2028. This requires 10.3% yearly revenue growth and about a CA$0.5 billion earnings increase from CA$3.7 billion today.

Uncover how National Bank of Canada's forecasts yield a CA$167.93 fair value, in line with its current price.

Exploring Other Perspectives

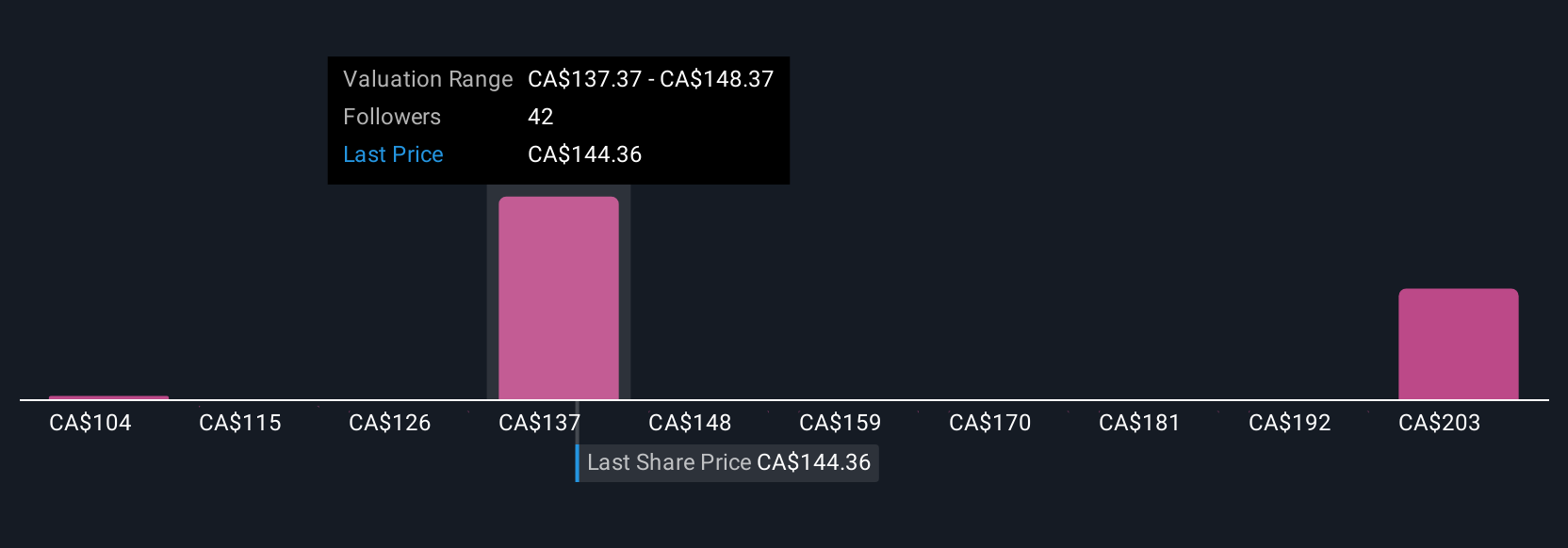

Four members of the Simply Wall St Community currently see National Bank of Canada’s fair value between CA$116.94 and CA$236.83, reflecting a wide span of views. When you set those against the integration driven earnings catalyst, it underlines why many investors look at several perspectives before judging how acquisition synergies might flow through to long term performance.

Explore 4 other fair value estimates on National Bank of Canada - why the stock might be worth as much as 39% more than the current price!

Build Your Own National Bank of Canada Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your National Bank of Canada research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free National Bank of Canada research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate National Bank of Canada's overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal