Societe Generale Securities: Non-bank changes in the year-end and New Year windows are often an important sign of the beginning of a restless market

The Zhitong Finance App learned that Societe Generale Securities released a research report saying that the non-banking sector's share of transactions fell back to 2%, an effective time selection index. Historically, after the share of non-bank transactions fell back to around 2%, cooperation with external catalysts was often able to start an excess market. Also, referring to historical experience, in the year-end and New Year window, changes in non-bank banks (increase of more than 3% in a single day) are often an important sign of the beginning of a restless market. After non-bank changes in the year-end and New Year window, the overall market also often ushered in an upward phase.

Societe Generale Securities's main views are as follows:

An effective timing indicator for the non-banking sector: the share of transactions fell back to 2%. Historically, after the share of non-bank transactions fell back to around 2%, cooperation with external catalysts was often able to start an excess market. Looking at this round, the share of transactions in the non-banking sector fell to the lowest level of 1.5% in the early period. As insurance capital lowered the investment risk factor on December 5 and Chairman Wu Qing proposed “moderately broadening brokers' capital space and leverage limits” on December 6, the non-bank sector was catalyzed to usher in an excess market.

Also, referring to historical experience, in the year-end and New Year window, changes in non-bank banks (increase of more than 3% in a single day) are often an important sign of the beginning of a restless market. The non-banking sector is an important “weather vane” for market sentiment. At the end of the year and the beginning of the year, which is a window where it is easy to nurture restless markets, changes in the non-banking sector can significantly boost market sentiment. Referring to historical experience, the end of the year and the beginning of the New Year are approaching the spring turbulence window. If there are changes in banks, it is also often an important sign that the market is starting. Of the 15 year-end and New Year windows since 2010, there were 7 times of restlessness when the market started along with changes in the non-banking sector.

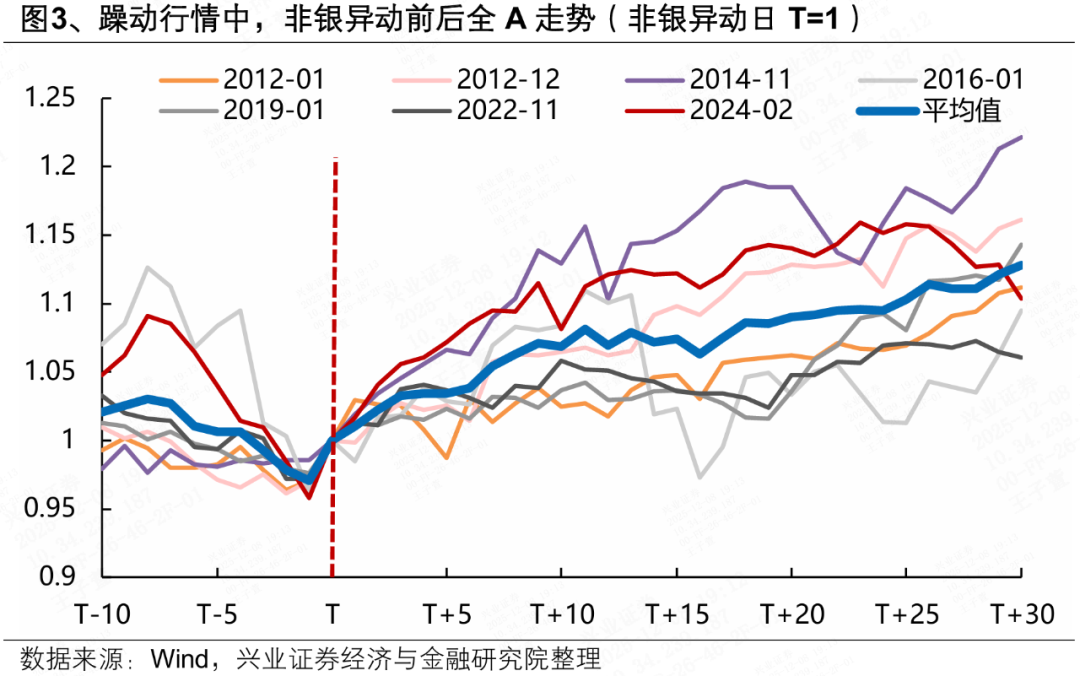

Historically, after non-bank changes occurred during the year-end and New Year window, the overall market also often ushered in an upward phase. Over the next 10/20/30 trading days, All A increased by an average of 6.8%/9%/12.8%.

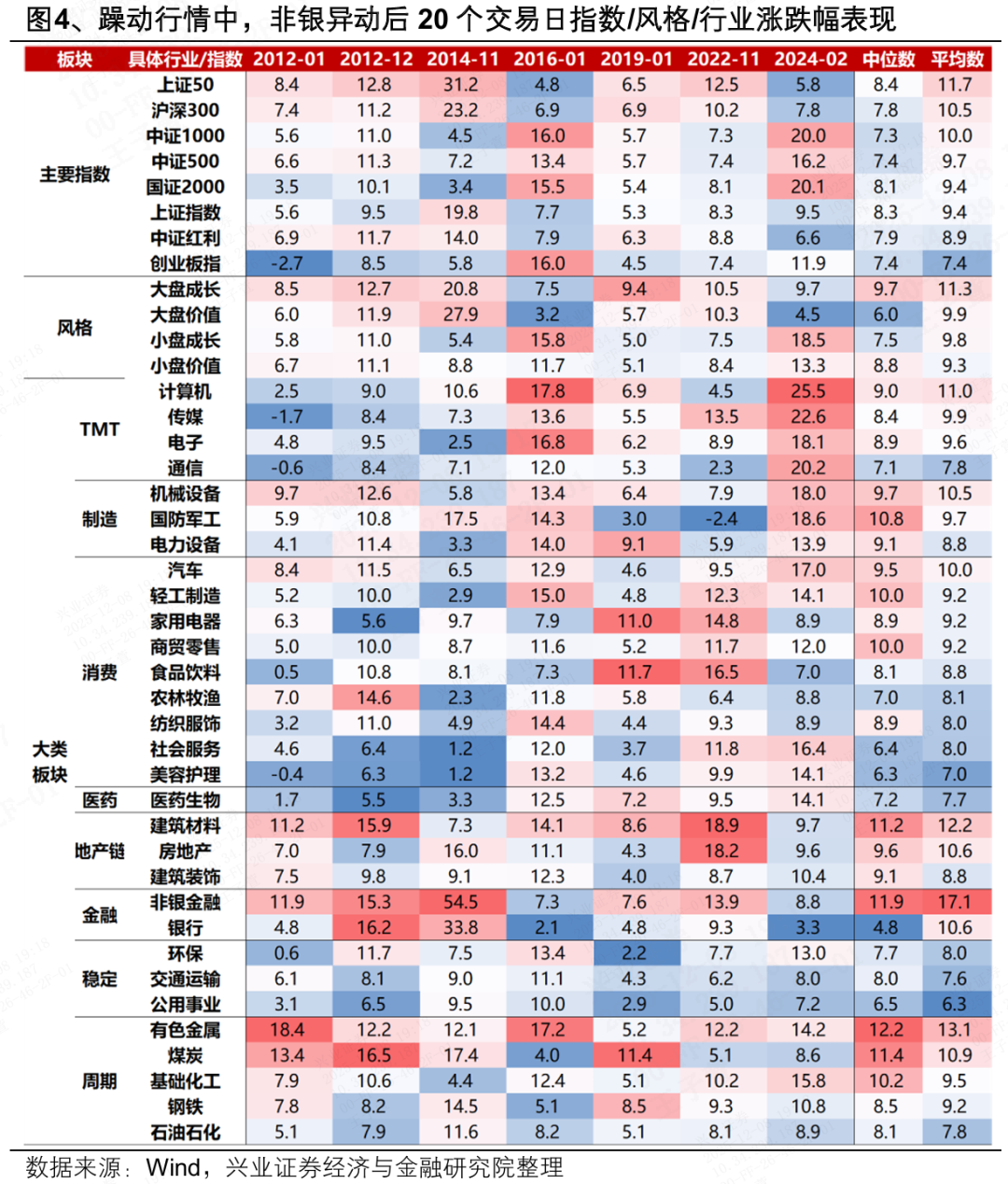

Looking at each index/style/industry, in the 20 trading days after the non-bank change, the Shanghai Stock Exchange 50, Shanghai and Shenzhen 300, and China Securities 1000 performed well at the index level; at the style level, the average return on market growth and market value was the highest; at the industry level, non-banking, non-ferrous, building materials, computers, and coal performed relatively well.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal