Archer Aviation (ACHR): Valuation Check After Tiltrotor Deal and Miami Air Taxi Network Expansion Plans

Archer Aviation (ACHR) just laid out two big steps in its story: an exclusive tiltrotor tech deal with Karem Aircraft and an ambitious Miami air taxi network plan that tightens both commercial and defense angles.

See our latest analysis for Archer Aviation.

Those dual commercial and defense milestones come against a backdrop where Archer’s share price sits at about $8.60, with a 7 day share price return of 15.28 percent. Its 1 year total shareholder return of 9.97 percent and 3 year total shareholder return of 300 percent suggest long term optimism has been building despite recent volatility.

If Archer’s eVTOL push has your attention, this could be a good moment to compare it with other high growth tech and aviation innovators using high growth tech and AI stocks.

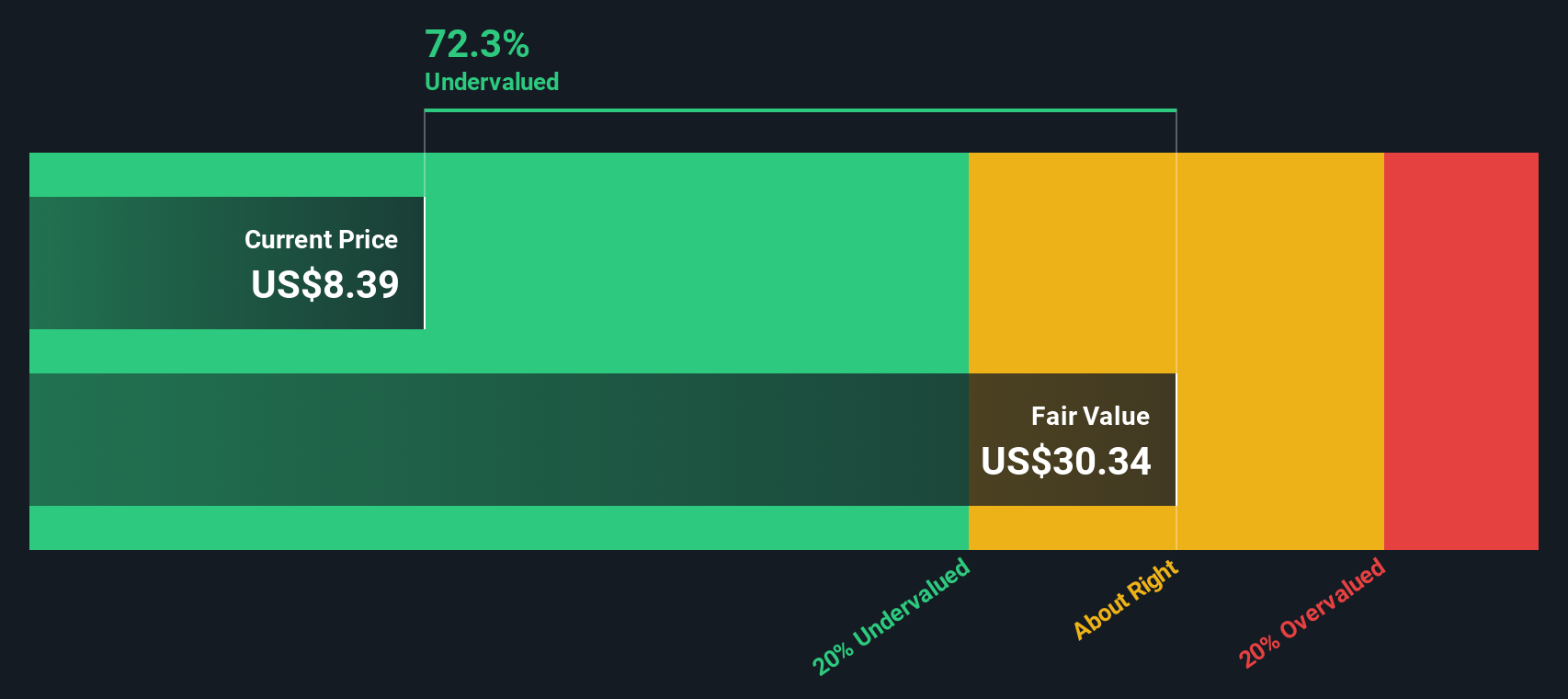

Yet with shares still trading at a sizable discount to analyst targets and intrinsic estimates, investors now face a key question: Is Archer’s rapid dual use ramp up an overlooked buying opportunity, or is the market already pricing in its future growth?

Price to Book of 3.8x: Is it justified?

On a price to book basis, Archer Aviation’s 3.8x multiple sits above both its aerospace and defense peers and the broader US industry. This suggests investors are already paying a premium at the last close of $8.60.

The price to book ratio compares a company’s market value to the accounting value of its net assets. It is a common yardstick for capital intensive sectors like aerospace and defense where hard assets and development spending dominate balance sheets.

For Archer, paying 3.8x book value while the US Aerospace and Defense industry averages 3.5x and direct peers average just 2.3x implies the market is assigning extra value to its future eVTOL platform rather than its current asset base or profitability profile.

That premium looks punchy given the company is still unprofitable, has reported zero revenue so far, is forecast to remain loss making over the next three years and has substantially diluted shareholders in the past year, even if revenue growth is expected to be rapid once commercialization ramps.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price to Book of 3.8x (OVERVALUED)

However, investors still face execution risk related to certification timelines and funding needs, which could trigger further dilution or delay Archer’s path to meaningful revenue.Find out about the key risks to this Archer Aviation narrative.

Another View: DCF Points the Other Way

While the 3.8x price to book suggests Archer is expensive versus peers, our DCF model paints a very different picture, with fair value estimated around $22.32, roughly 61.5 percent above the current $8.60 price. Is the market underestimating long term cash flows, or is the model too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Archer Aviation for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 905 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Archer Aviation Narrative

If you see things differently or want to dig into the numbers yourself, you can quickly build a personalized view in just a few minutes: Do it your way.

A great starting point for your Archer Aviation research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Do not stop at a single stock when you can quickly surface focused shortlists built from hard data, clear fundamentals, and real market performance signals.

- Target powerful uptrends and potential multi baggers by scanning these 3578 penny stocks with strong financials that already pair tiny share prices with balance sheets and fundamentals that appear comparatively solid.

- Explore the AI theme by reviewing these 26 AI penny stocks that combine technology narratives with metrics that may point to meaningful, scalable growth.

- Build income focused strategies by assessing these 15 dividend stocks with yields > 3% that offer yields above 3 percent while still meeting essential quality and sustainability criteria.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal