D-Wave Quantum (QBTS) Is Up 26.1% After Launching U.S. Federal-Focused Quantum Computing Unit – What's Changed

- D-Wave Quantum Inc. recently created a dedicated business unit, led by government-sector veteran Jack Sears Jr., to expand adoption of its quantum computing products and services across U.S. federal agencies.

- The move positions D-Wave to pursue mission-focused applications in defense, national security, and logistics at a time when U.S.–China quantum competition is intensifying and government interest in the technology is rising.

- Next, we’ll examine how this focused U.S. government unit could reshape D-Wave’s investment narrative around federal demand and commercialization.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is D-Wave Quantum's Investment Narrative?

To own D-Wave, you really have to believe that today’s small, volatile business can turn cutting‑edge quantum hardware and software into sticky, paying customers before cash and patience run thin. The story has always revolved around two catalysts: converting proofs of concept like BASF’s scheduling pilot into larger commercial deals, and convincing deep‑pocketed partners in defense and AI/HPC that D-Wave’s hybrid quantum approach is worth backing despite heavy losses. The new U.S. government unit fits directly into that second pillar, potentially sharpening the company’s focus on federal contracts at a time when Washington is ramping up attention to quantum in the context of U.S.–China competition. That said, the stock’s very large one‑year run, rich price‑to‑book multiple, ongoing dilution and insider selling mean execution risk and downside volatility remain front and center.

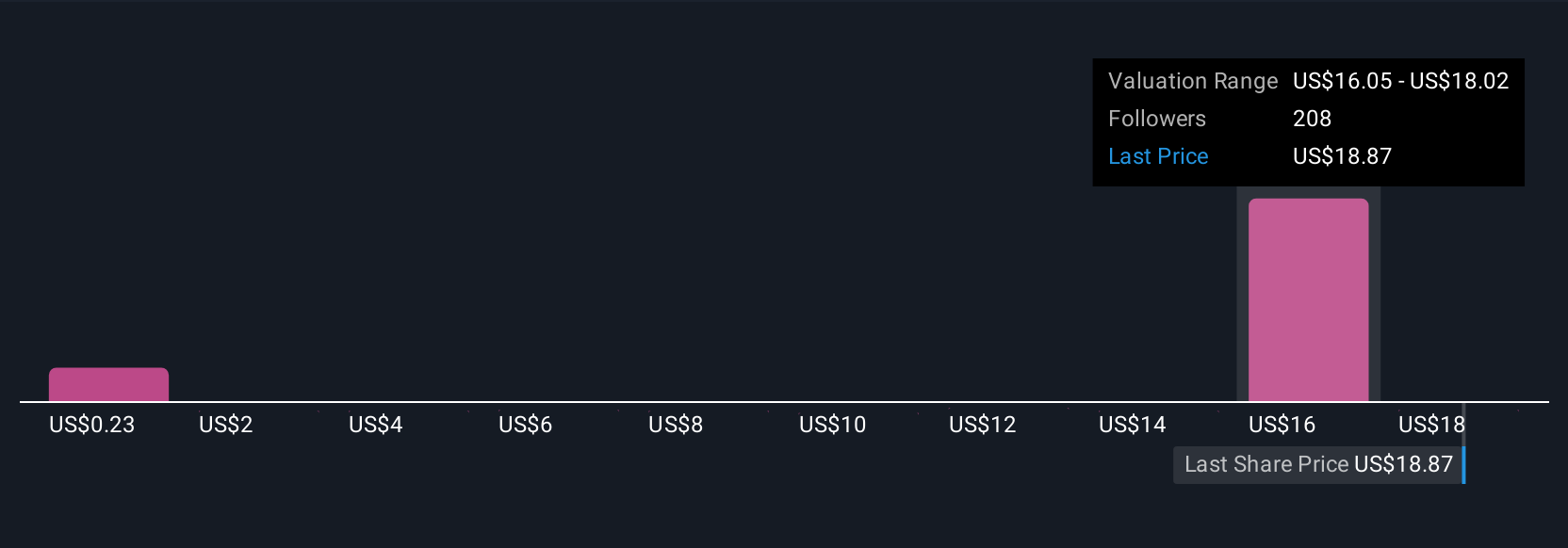

However, recent insider selling and ongoing losses are key issues investors should be aware of. Upon reviewing our latest valuation report, D-Wave Quantum's share price might be too optimistic.Exploring Other Perspectives

Explore 90 other fair value estimates on D-Wave Quantum - why the stock might be worth as much as 40% more than the current price!

Build Your Own D-Wave Quantum Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your D-Wave Quantum research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free D-Wave Quantum research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate D-Wave Quantum's overall financial health at a glance.

No Opportunity In D-Wave Quantum?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal