Do New High‑Grade Drill Results Reshape The Long‑Term Mine Plan For Pan American Silver (TSX:PAAS)?

- In early December 2025, Pan American Silver Corp. reported extensive new drill results across mines including Jacobina, La Colorada, Timmins and several others, highlighting near-mine exploration and resource conversion efforts within a roughly 540,000‑metre 2025 drilling program.

- The update underscored meaningful resource extensions and new high-grade zones, particularly at Jacobina and La Colorada, which could reshape longer-term mine planning and portfolio optionality.

- With the shares recently posting a 7-day decline, we’ll examine how these high-grade discoveries influence Pan American Silver’s broader investment narrative.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Pan American Silver's Investment Narrative?

To own Pan American Silver today, you really have to buy into a simple idea: that a diversified precious‑metals producer with improving profitability can keep turning geology into cash flow without losing discipline on costs or capital. Near term, the key swing factors still sit at the asset level, including operational delivery at Huaron, Cerro Moro, El Peñon and Timmins after a mixed Q3, as well as progress at the large La Colorada Skarn project. The December drill update slots into this picture as more of a quality‑of‑asset story than an immediate financial catalyst; the share price’s recent 7‑day pullback, after a very strong year, suggests the market is not treating these results as game changing yet. The bigger risk is that ongoing heavy exploration and growth spending, even when technically successful, may not translate into returns that justify the current premium valuation.

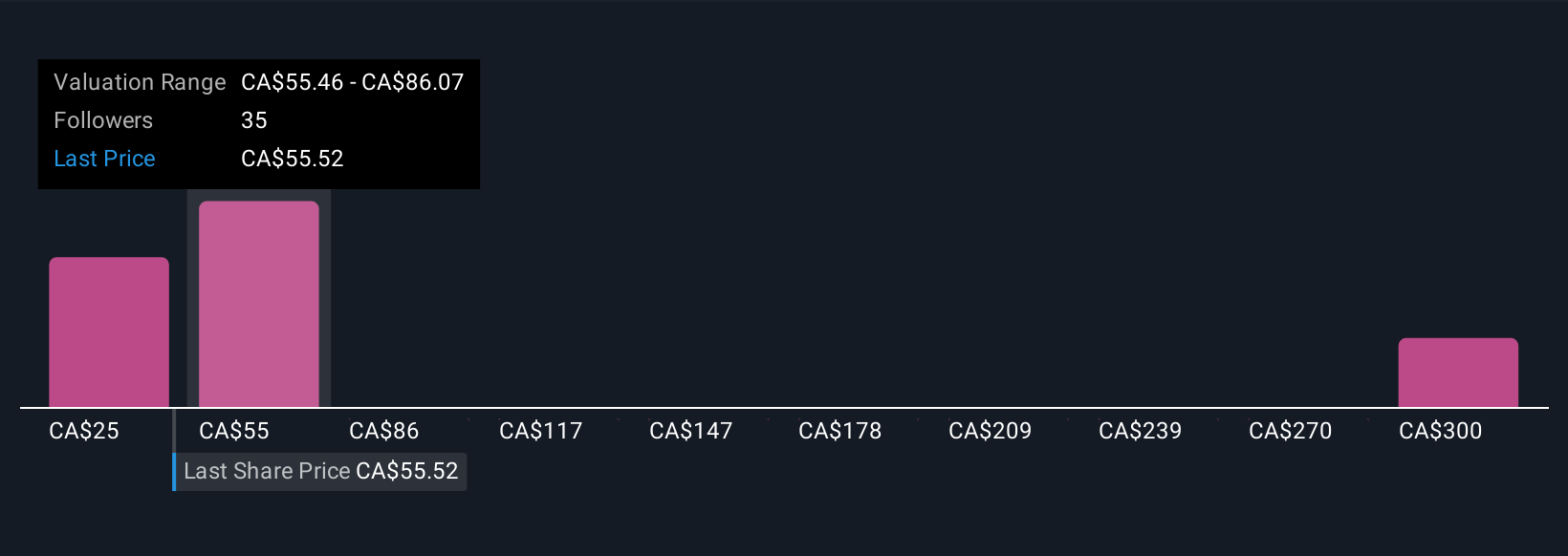

However, one operational and cost risk in particular is worth investors understanding in more depth. Despite retreating, Pan American Silver's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Five fair value estimates from the Simply Wall St Community span about US$24 to well above US$140 per share, underlining how differently people view Pan American’s upside. Set that against the current focus on mine‑level execution risks and higher exploration spend, and it is clear why opinions on how much of the recent earnings momentum is sustainable can diverge so sharply.

Explore 5 other fair value estimates on Pan American Silver - why the stock might be worth over 2x more than the current price!

Build Your Own Pan American Silver Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pan American Silver research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Pan American Silver research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pan American Silver's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal