IPO outlook | The world's largest ASIC scaler chip provider, Xihua Technology lost more than 460 million yuan in four years

In the AI era, smart display chips and smart sensing chips are becoming a spurt of market demand, yet Xihua Technology, the world's largest ASIC scaler chip provider, lost more than 460 million yuan in less than four years.

The Zhitong Finance App learned that Xihua Technology recently submitted a statement to the main board of the Hong Kong Stock Exchange, and Agricultural Bank International is its sole sponsor. The company is a provider of end-side AI chips and solutions. According to the Frost & Sullivan report, in 2024, the company ranked second in the global scaler industry, with a market share of 18.8%, and ranked first in the world in the ASIC scaler industry, with a market share of 55%.

The company has industry-leading R&D capabilities, mature mass production experience, and cutting-edge technical capabilities. The mass-produced chip product portfolio can meet the different needs of customers in emerging markets such as consumer electronics, the automotive industry and physical intelligence. The company's performance grew strongly. Revenue increased from 87 million yuan to 244 million yuan in 2024, a compound growth rate of 67.5%, and continued to grow 24.2% in the first nine months of 2025.

However, the company's profitability showed a downward trend. From 2022 to the first 9 months of 2025, gross margin fell from 35.7% to 22.1%. Currently, it is still in a state of net loss year after year, but the loss margin has narrowed. The cumulative net loss amount for the period was 462 million yuan, and the cumulative loss ratio was 59.08%. As of September 2025, it had cash equivalents of 60 million yuan, while short-term interest-bearing bank loans were 102 million yuan.

Dual business combination strategy, significant profit improvement

Established in 2018, Xihua Technology provides independent chips and comprehensive solutions integrating proprietary chips with basic software, development kits and key algorithms. The company's technical solutions are based on an “MCU+ perception/display” architecture. As of September 2025, it has 2 product line combinations with 17 chip models, and exports products and services to the automotive and consumer electronics industries through direct sales or distribution models.

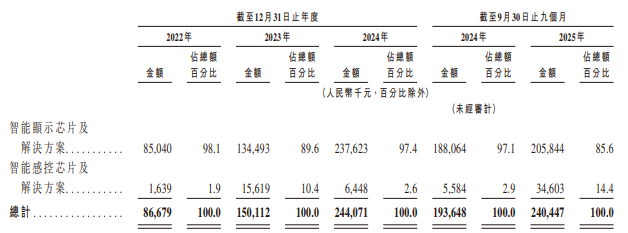

The company has two major businesses: smart display chips and solutions, the main products are AI scaler and STDI chips; and intelligent sensing chips and solutions. The main products are TMCU, general MCU, touch chip and smart cockpit solutions. The former is core income, but the latter is growing rapidly. The revenue structure has changed markedly in recent years. The revenue share for the first 9 months of 2025 was 85.6% and 14.4%, respectively.

Photo source: Company hearing materials

The AI scaler and STDI chip are the company's top products, generating revenue in 2022 and 2024 respectively, while GM MCU and TMCU generated revenue in 2023 and 2024 respectively. The smart cockpit solution only generated revenue this year, but the launch was rapid, and the revenue share increased rapidly. From a client perspective, the company mainly provides products and services to customers through direct sales and distribution. Direct sales gradually became the mainstream sales model. Revenue contributions for the first 9 months of 2025 were 59.1% and 10.9%, respectively, while customer retention rates were 22% and 69%, respectively.

The company has a high concentration of customers. Four of the top five customers are direct sales customers. From 2022 to the first 9 months of 2025, the top five customers contributed 89.9%, 78.6%, 88.8% and 82.2% of revenue, respectively. Among them, the largest customers (distribution) contributed 76.7%, 57.9%, 66.5% and 37.4%, respectively. At the same time, the company is also highly dependent on the supply chain. The top five suppliers accounted for 81.8%, 83.7%, 83.6% and 76.6% of the procurement volume during the period, respectively.

It is worth mentioning that Xihua Technology's profitability is not optimistic. In the first 9 months of 2025, the gross profit margin was 22.1%, down 13.6 percentage points from 2022. Among them, the gross margin of the two major businesses showed a downward trend. Among them, the gross profit margin of smart display chips and solutions was 27.6%, a decrease of 11.5 percentage points during the period, and the gross profit margin for intelligent sensing chips and solutions was 9.2%, and the decline was as high as 37 percentage points during the period.

As an R&D-driven technology company, Xihua Technology has always accounted for the majority of R&D expenses, but due to the release of product achievements, the R&D cost rate continued to be optimized, falling from 131.9% in 2022 to 27.8% in the first 9 months of 2025. Up to now, the company has 169 granted patents, including 128 invention patents, 41 utility model patents, and 150 pending patent applications. It also has 38 software copyrights and 38 registered trademarks.

The company has also drastically reduced the level of various other expenses in order to achieve product results, so that overall profitability continues to improve. For example, from 2022 to the first 9 months of 2025, the sales expense ratio was optimized by 10.4 percentage points to 9.1%, and the administrative expenses ratio was optimized by 22.7 percentage points to 14.8%. The company's adjusted net loss ratio was drastically reduced by 98 percentage points to 14.73% during the period. If performance is further released, it is expected to achieve break-even.

Core products are competitive, and are still receiving attention under the AI investment trend

From an industry perspective, the key downstream sectors driving the growth of global display and sensing chips include smart phones, TWS headsets, AR/VR, automobiles, robotics, and industrial automation. Among them, in terms of growth prospects, AR/VR and robots have the most room for growth. According to Frost & Sullivan, from 2020 to 2029, AR/VR shipments will increase by 106 million units from 6.8 million units, a compound growth rate of 35.7%, and the AI penetration rate will increase to 55.2%; the robot market size will increase from 181.6 billion yuan to 878.5 billion yuan, with a compound growth rate of 19.1% and embedded intelligence penetration rate of 26.5%.

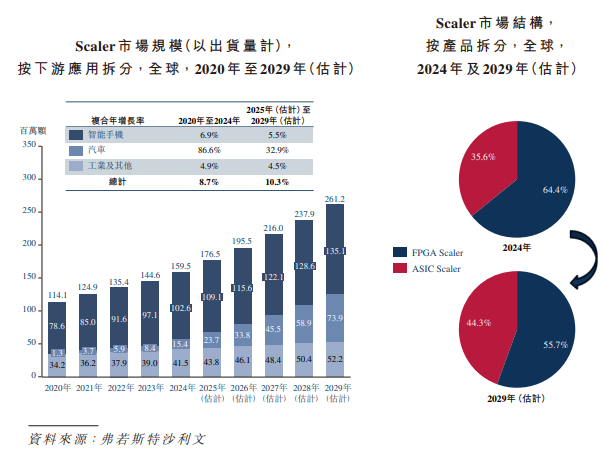

Looking at specific markets, scalers can be divided into two categories: ASIC scalers and FPGA scalers. Global scaler shipments increased from 114 million units to 160 million units in 2020-2024, with a compound growth rate of 8.7%. It is expected to reach 261 million units by 2029, with a compound growth rate of 10.3%. Among them, the penetration rate of specialized ASIC products will increase to 44.3%. Looking at application scenarios, automobiles are the core growth scenario. The compound market growth rate in the next five years will exceed 30%.

STDI is the most promising functional chip for display drivers. As the trend of integration continues to deepen, display driver chips are evolving from traditional DDIC to TDDI and further to STDI solutions. In terms of market size, mainstream TDDI is smaller and growing slowly. It was 14.8 billion yuan in 2024. There has been a decline in the past five years, but it is expected to reach 18 billion yuan by 2029, with a compound growth rate of 5.1%.

In addition, the mainstream products of sensing chips are touch and MCU. The market size of touch chips has maintained compound growth in medium to high units. Mainstream application scenarios include smartphones, TWS headsets, and automobiles. Apart from the decline in smartphones, the other two major scenarios showed a compound double-digit growth rate. MCUs are highly integrated embedded control chips. In 2024, the global MCU market is about 56.8 billion yuan, and is expected to reach 96.9 billion yuan by 2029, with a compound growth rate of 12.2%. Both automotive-grade and non-automotive-grade MCUs will maintain a scale growth of more than 10%.

Xihua Technology's core products, AI Scaler and STDI chips, are highly competitive in the industry. Scaler's market share is highly concentrated. In terms of shipments, the top five shares were 70.8%, while the company ranked second with an 18.8% market share of 37 million units. However, the company mainly shipped ASIC Scaler, which had a 55% market share among suppliers of this product, which is 33 percentage points higher than the second place.

The wave of AI applications will drive the company to seize market opportunities, but as mentioned above, the company is an R&D company, has few fixed assets, and relies on suppliers for production capacity. This has also led to a high concentration of supplier purchases and weak bargaining power. The company has established stable partnerships with 7 major foundry companies and 9 packaging testing suppliers to ensure stable production capacity and cost competitiveness, and promote the localization of the chip supply chain.

Overall, Xihua Technology has built a dual business combination strategy of “smart display chips and solutions and intelligent sensing chips and solutions”, driven by R&D. The market share of core products is leading, and the industry maintains a high growth trend. Diversified driving revenue continues to increase, while product achievements have been released, various expenses have been greatly optimized, and profitability has also been greatly improved. However, the company is highly dependent on customers and suppliers, and has high revenue and production capacity guarantees, but there are also certain risks.

However, under the wave of AI investment, whether in the short term or long term, the main capital in the market and institutional investors are eager for every segment leader. Xihua Technology may be a good investment target.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal