Tradeweb Markets (TW): Valuation Check After Record November Volumes and New ETF RFQ Integration

Tradeweb Markets (TW) just logged record November trading volumes, with average daily activity up roughly 22% year over year. Its ETF RFQ integration into Fidessa adds another nudge toward deeper client engagement.

See our latest analysis for Tradeweb Markets.

Yet despite these upbeat operating trends, Tradeweb’s share price has eased back, with a year to date share price return of negative 17.94%, even as its five year total shareholder return of 69.98% still points to solid long term wealth creation.

If Tradeweb’s electronic trading story has your attention, it could be a good moment to see what else is out there and explore high growth tech and AI stocks.

With trading volumes surging, earnings still growing and analysts seeing nearly a 20% upside to their price targets, is Tradeweb quietly slipping into undervalued territory, or is the market already discounting years of future growth?

Most Popular Narrative Narrative: 16.3% Undervalued

With Tradeweb closing at $107.77 against a narrative fair value of about $128.77, the story leans toward upside potential rooted in structural growth.

The company's international and multi asset expansion, particularly in emerging markets and APAC, is delivering above average growth rates (e.g., 41% international revenue growth and EM swaps revenue up 40%+), reflecting cross border flows and the need for global, multi currency platform connectivity, supporting long term diversification of revenues and reducing geographic concentration.

Want to see what kind of revenue runway and margin lift could warrant this step up in value? The narrative pulls together ambitious growth, richer profitability and a punchy future earnings multiple that might surprise you if you only look at today’s price.

Result: Fair Value of $128.77 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent fee pressure and rising tech investment could crimp margins and dull the upside if electronification or digital asset adoption turns out to be slower than expected.

Find out about the key risks to this Tradeweb Markets narrative.

Another Angle on Valuation

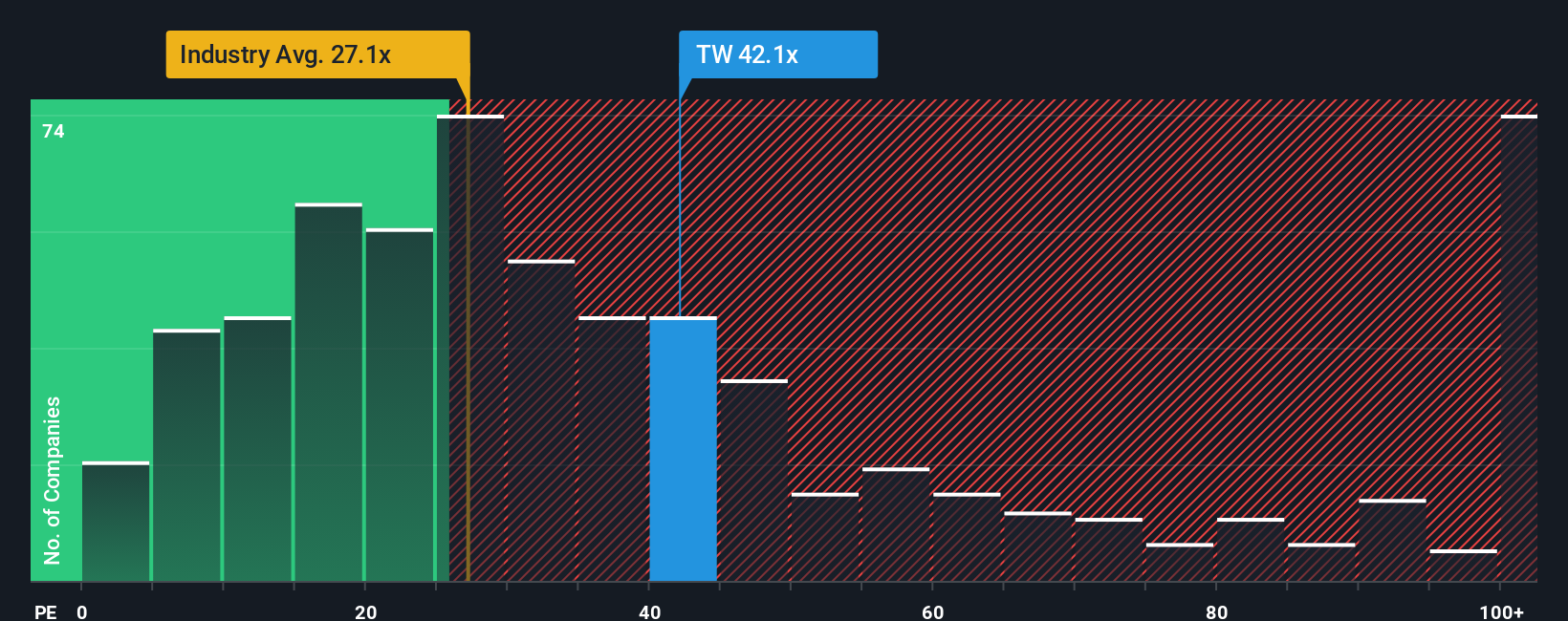

On price to earnings though, Tradeweb looks rich. It trades at about 36.5 times earnings, versus 25 times for the US capital markets group and a fair ratio near 16.5 times. This suggests investors are paying up for perceived quality and growth that could disappoint if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tradeweb Markets Narrative

If you see the story differently or want to test your own assumptions using the numbers, you can build a complete view in minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Tradeweb Markets.

Ready for more investment ideas?

Before you move on, lock in your next opportunity by using the Simply Wall Street Screener to uncover stocks that match your exact strategy and risk appetite.

- Capitalize on potential mispricings by using these 904 undervalued stocks based on cash flows to spot companies whose cash flows suggest their share prices have room to run.

- Ride powerful innovation waves with these 26 AI penny stocks, highlighting businesses at the forefront of artificial intelligence transformation.

- Strengthen your income stream through these 15 dividend stocks with yields > 3%, showcasing companies offering yields above 3% backed by real fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal