Reassessing Choice Hotels (CHH) Valuation After Q3 Earnings Miss, RevPAR Guidance Cut and Analyst Downgrades

Choice Hotels International (CHH) just delivered a mixed third quarter, with earnings falling short of forecasts even as revenue came in ahead and guidance now incorporates a small U.S. RevPAR decline.

See our latest analysis for Choice Hotels International.

The reaction has been swift, with a 1 month share price return of negative 12.96 percent and a year to date share price return of negative 39.47 percent. The 1 year total shareholder return of negative 39.65 percent underlines how momentum has been fading as investors reassess growth prospects and RevPAR risk after earnings and recent analyst downgrades.

If this kind of reset in expectations has you rethinking your watchlist, it may be a good moment to explore fast growing stocks with high insider ownership as potential fresh ideas.

With earnings wobbling, RevPAR under pressure and analysts trimming targets even as the stock trades at a steep discount to consensus, investors are asking whether Choice Hotels is now mispriced value or whether the market is rightly skeptical about its future growth.

Most Popular Narrative Narrative: 21.5% Undervalued

Compared with Choice Hotels International's last close of $85.76, the most popular narrative implies a materially higher fair value based on future cash flows and margins.

The analysts have a consensus price target of $132.929 for Choice Hotels International based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $160.0, and the most bearish reporting a price target of just $117.0.

Want to see how steady revenue growth, shifting margins and a higher future earnings multiple all combine into that upside case? The strength of the story is in how those assumptions interact over time, not in any single headline number. Curious which parts of the model do the heavy lifting, and how a modest change could swing the valuation?

Result: Fair Value of $109.27 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing RevPAR softness and execution risk in new international master franchise markets could easily derail the optimistic cash flow recovery narrative.

Find out about the key risks to this Choice Hotels International narrative.

Another View: Earnings Multiple Sends a Different Signal

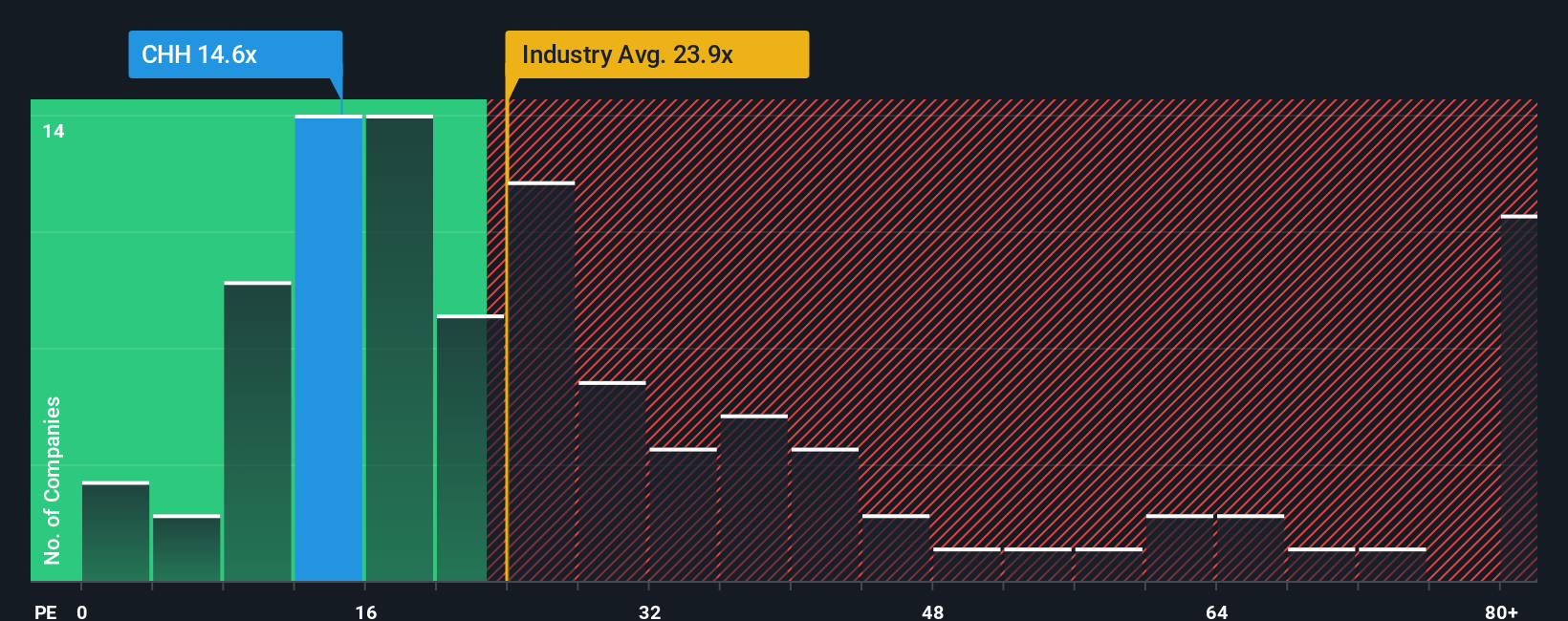

While the narrative model points to upside, the current price to earnings ratio of 10.4 times sits well below both the estimated fair ratio of 14.8 times and the US hospitality peer average of 26.6 times. This frames CHH as statistically cheap but raises the question of whether this discount reflects a real execution risk investors should heed.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Choice Hotels International for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 902 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Choice Hotels International Narrative

If you see the numbers differently or want to dive into the assumptions yourself, you can construct a complete narrative in just a few minutes: Do it your way.

A great starting point for your Choice Hotels International research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop at one stock. Use the Simply Wall Street Screener to target fresh, data backed ideas before the crowd catches on and prices them in.

- Capture early stage growth by scanning these 3577 penny stocks with strong financials that pair tiny market caps with surprisingly strong financial foundations.

- Position your portfolio for structural trends by focusing on these 30 healthcare AI stocks transforming diagnostics, patient outcomes and efficiency across the medical landscape.

- Consider potential income streams by reviewing these 15 dividend stocks with yields > 3% offering yields above 3 percent with fundamentals that support ongoing payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal