Will Upgraded EPS Guidance and Premium Hikes Change UnitedHealth Group's (UNH) Margin Recovery Narrative?

- In recent days, UnitedHealth Group raised its 2025 adjusted EPS guidance to at least $16.25, highlighted 16% year-over-year revenue growth in its core UnitedHealthcare segment, and detailed premium increases of roughly 20%–30% to help offset higher medical costs and regulatory pressures.

- Management’s signal that margins could recover and growth may accelerate in 2026, alongside improving investor sentiment, suggests the company’s earlier operational and regulatory setbacks are beginning to ease.

- We’ll now explore how this upgraded earnings guidance and clearer path to margin recovery could reshape UnitedHealth Group’s broader investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

UnitedHealth Group Investment Narrative Recap

To own UnitedHealth Group, you generally need to believe it can manage Medicare-driven volatility, regulatory scrutiny and rising care costs while restoring margins in its core franchises. The upgraded 2025 EPS guidance and strong UnitedHealthcare revenue growth support that margin recovery is a key short term catalyst, while the ongoing Department of Justice investigation into Medicare billing practices remains the biggest overhang. This latest news reinforces the recovery narrative but does not remove that regulatory risk.

The most relevant recent announcement is management’s decision to lift 2025 adjusted EPS guidance to at least US$16.25 while implementing premium increases of roughly 20% to 30%. For investors focused on catalysts, this combination directly targets higher medical costs and Medicare pressures, and helps frame how repricing could support the margin recovery story that many analysts now see building into 2026 and beyond.

Yet, despite improving guidance, investors should be aware of the ongoing DOJ Medicare investigation and the possibility of...

Read the full narrative on UnitedHealth Group (it's free!)

UnitedHealth Group's narrative projects $501.1 billion revenue and $20.0 billion earnings by 2028. This requires 5.8% yearly revenue growth and a $1.3 billion earnings decrease from $21.3 billion today.

Uncover how UnitedHealth Group's forecasts yield a $388.52 fair value, a 17% upside to its current price.

Exploring Other Perspectives

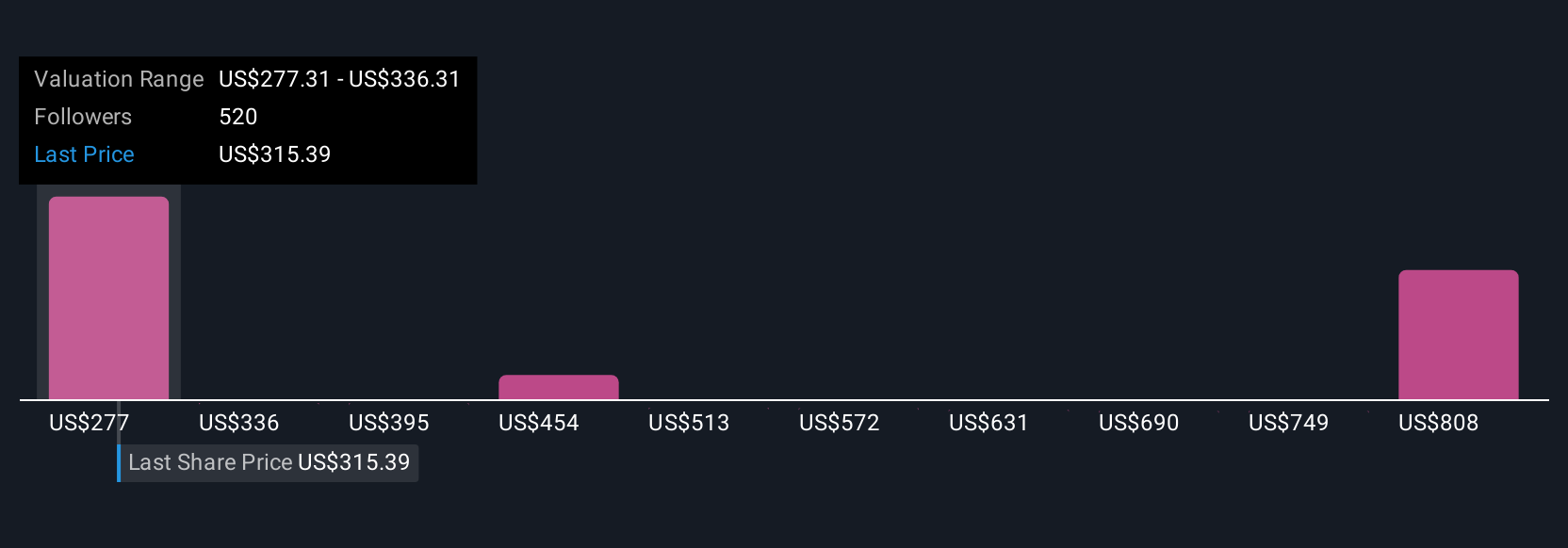

Across 86 fair value estimates from the Simply Wall St Community, views on UnitedHealth’s worth range widely from US$290 to about US$847 per share. When you set that against concerns about rising care utilization in Medicare and the need for premium increases to protect margins, it is clear there are many different ways investors are thinking about the company’s future performance and you may want to compare several of those viewpoints before deciding what makes sense for you.

Explore 86 other fair value estimates on UnitedHealth Group - why the stock might be worth 12% less than the current price!

Build Your Own UnitedHealth Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your UnitedHealth Group research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free UnitedHealth Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate UnitedHealth Group's overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal