Commvault (CVLT) Valuation Check After 35% Three-Month Share Price Pullback

Commvault Systems (CVLT) has quietly given back ground over the past quarter, with the stock down about 35% in the past 3 months and roughly 20% this year, even as revenue and earnings continue to grow.

See our latest analysis for Commvault Systems.

The recent pullback caps a sharp reversal in sentiment, with the 90 day share price return of minus 34.68 percent dragging the year to date share price return to minus 20.46 percent. Even so, the 5 year total shareholder return of 129.32 percent still reflects a strong long term compounding story rather than a broken one.

If Commvault’s volatility has you reassessing your tech exposure, it could be a good moment to explore other high growth tech and AI stocks that might better match your risk and return goals.

With double digit revenue and profit growth, but a sharp share price reset, investors now face a key question: is Commvault a mispriced compounder trading at a discount, or is the market already baking in its future growth?

Most Popular Narrative Narrative: 38% Undervalued

Compared with Commvault Systems’ last close of $120.99, the most followed narrative sees fair value much higher, framing the recent selloff as a potential mismatch between price and long term earnings power.

Rapid expansion and successful cross sell or upsell momentum within the SaaS (Metallic) platform evidenced by 63% SaaS ARR growth, a 45% increase in multi product customers, and 125% SaaS net dollar retention point to continued improvement in the quality and predictability of future revenues, directly supporting margin expansion and higher earnings visibility.

Want to see what justifies such a confident upside call? The narrative focuses on powerful revenue compounding, rising margins, and a punchy future earnings multiple. Curious how those moving parts add up to the fair value target?

Result: Fair Value of $193.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shorter term contracts and ongoing margin pressure could still derail the upside case if renewal dynamics worsen or integration costs escalate.

Find out about the key risks to this Commvault Systems narrative.

Another Angle on Valuation

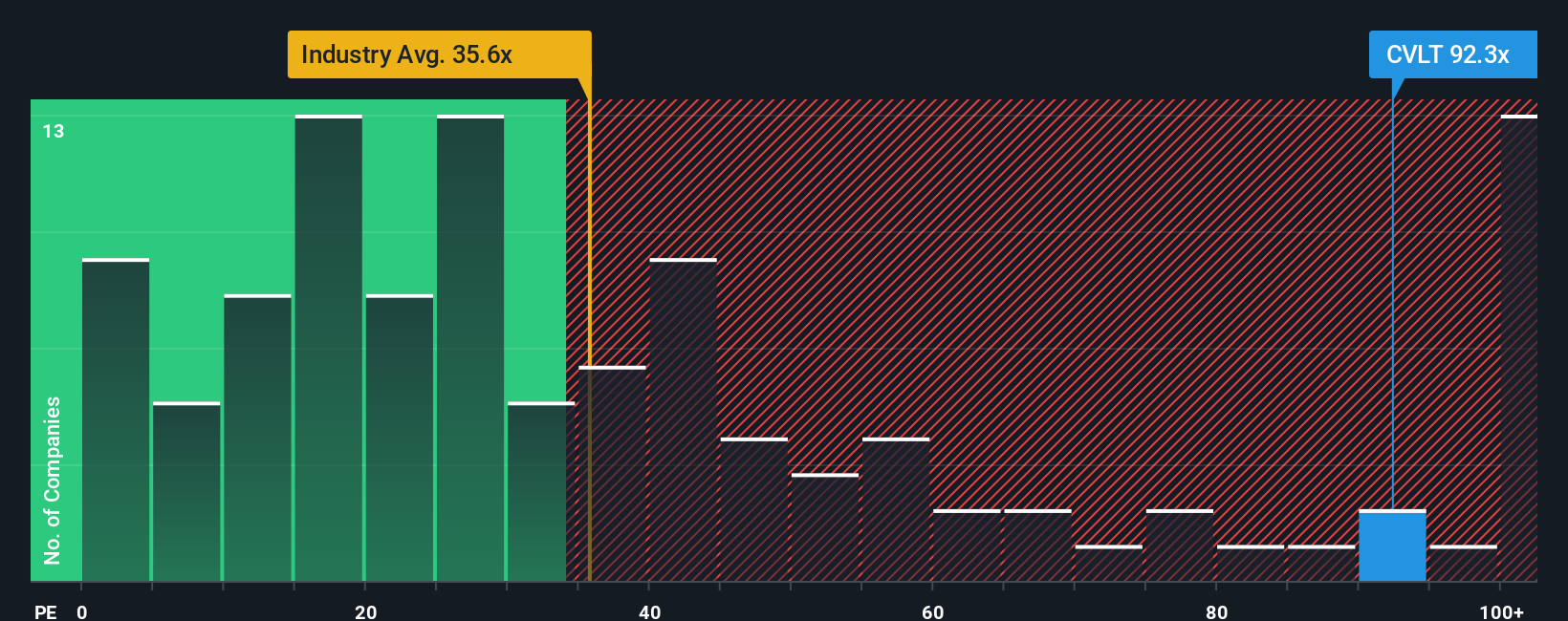

On simple earnings terms, the story looks very different. Commvault trades on about 66.5 times earnings, versus 31.5 times for the US software sector and a fair ratio of 32.9 times. That rich gap suggests real multiple downside risk if sentiment sours further, regardless of growth.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Commvault Systems Narrative

If you see the numbers differently or want to stress test your own thesis, you can build a fresh narrative in minutes: Do it your way.

A great starting point for your Commvault Systems research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more high conviction opportunities?

Before the next market swing, lock in a watchlist of fresh ideas using the Simply Wall Street Screener, tailored to how you actually like to invest.

- Capitalize on mispriced quality by scanning these 902 undervalued stocks based on cash flows that pair solid fundamentals with attractive cash flow based valuations.

- Ride the next wave of innovation by targeting these 26 AI penny stocks positioned at the crossroads of software, data, and automation.

- Boost your income potential with these 15 dividend stocks with yields > 3% that combine meaningful yields with sustainable payout profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal