Financial Report Preview | The “filing moment” for AI monetization! Can Adobe (ADBE.US) win back investor trust?

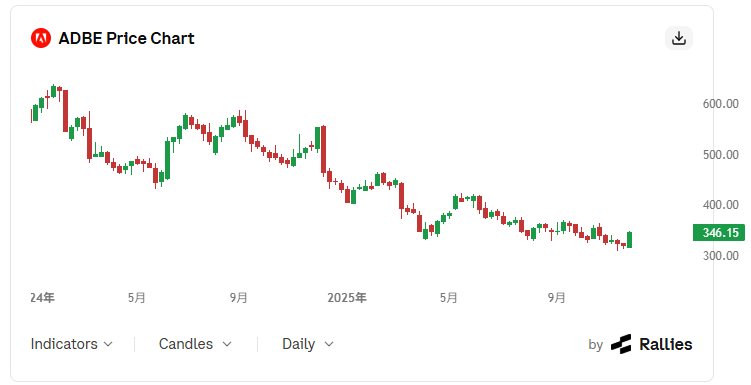

The Zhitong Finance App noticed that as the December 10 earnings release date approaches, Adobe (ADBE.US) has once again become the focus of the market. After experiencing weakness in the stock price of more than 50% from its peak in January 2024, the stock recently experienced a rebound, rising more than 7% in the past five trading days.

Market participants are betting that the company's AI strategy transformation will hand over satisfactory answers this quarter. Wall Street expects Adobe's fourth-quarter revenue to reach $6.1 billion, up 8.9% year over year; adjusted earnings per share are expected to be $5.39, which is expected to increase 12.1% over the same period last year.

The third quarter results were steady but lacked surprises

Adobe has shown steady financial performance in the third fiscal quarter, with revenue reaching US$5.99 billion, up 11% year over year, and adjusted earnings per share of US$5.31, exceeding market expectations.

Based on this momentum, management raised its full-year results guidance for the second time. It expects full-year revenue of $23.65 billion to $23.7 billion, and adjusted earnings per share of $20.80 to $20.85. However, the market still has doubts about the quality of Adobe's growth. After the financial report for the third fiscal quarter was announced, the stock price rose 8% after the market, but then the increase fell significantly to 2.77%.

This market reaction shows that investors are cautiously optimistic about Adobe's performance. The third fiscal quarter revenue of the digital media division of the core business was US$4.46 billion, up 12% year over year, and annual recurring revenue reached US$18.6 billion.

The digital experience business generated revenue of US$1.48 billion, up 9% year over year. However, analysts are not satisfied with the 11% annual recurring revenue increase and believe that this growth rate is unremarkable for a technology company. Any growth below double digits this quarter will be interpreted by the market as weak growth.

The Story the Market Wants to Hear: Advances in AI Monetization

This is the absolute focus of this earnings call. Investors are tired of the “how many images were generated by AI” vanity metrics; they focus on real revenue. Adobe faces competitive pressure from multiple dimensions. Emerging companies like Canva and Figma are seizing more market share, while tech giants like Meta are integrating more AI features.

Investors will be watching closely how Adobe turns its generative AI tools, such as Firefly, into actual revenue. Adoption rates and subscription growth of AI capabilities in the Creative Cloud and Document Cloud suites are key metrics.

Although Firefly is integrated into Photoshop and Illustrator, its direct incremental revenue through “generative credits” has remained unclear. The market is in dire need of management disclosure: How many enterprise users have upgraded to higher-priced subscription packages for AI features.

Investment banks' opinions are divided

<pstyle="margin:5px0px"> Wall Street's assessment of Adobe was significantly divided. Barclays Bank has set a target price of $415, which suggests room for a 26% increase. Citigroup, on the other hand, lowered its target price to $366 due to growth concerns. </pstyle= "margin: 5px0px" >

<pstyle="margin:5px0px"> Piper Sandler maintains Adobe's “overweight” rating and a target price of $470; Wells Fargo maintains an “excess” rating for Adobe, but lowered its target share price from $470 to $420. </pstyle= "margin: 5px0px" >

<pstyle="margin:5px0px"> The core logic for many is that Adobe's valuation is already at a historically low level, with an expected price-earnings ratio of about 15 times, and a return on free cash flow of about 6.5%. At the same time, the company actively repurchased shares, and the net repurchase yield was close to 8%, supporting shareholder returns. </pstyle= "margin: 5px0px" >

<pstyle="margin:5px0px"> The bears' concerns focus on signs of slowing growth and AI investment pressure. Citi pointed out that CreativeCloud's ARR growth may slow, while increased AI development spending may squeeze profit margins. </pstyle= "margin: 5px0px" >

<pstyle="margin:5px0px"> Adobe decided to stop disclosing digital media ARR separately starting next year. This decision further heightens market concerns about growth transparency. </pstyle= "margin: 5px0px" >

The new guidelines have become the biggest risk point

In the upcoming financial report, investors should focus on the following key indicators: the growth trend of digital media ARR, the actual month-on-month growth of the AI-priority product ARR, and management's growth guidance for the 2026 fiscal year.

Historical experience shows that Adobe's fiscal year guidance tends to be conservative. If the FY2025 revenue guidance suggests that the growth rate will fall below 10% (single-digit growth), the market will completely classify Adobe as a “low growth value stock,” and the valuation will move further downward.

If management emphasizes that the AI pricing strategy will be fully implemented in the second half of 2025 and provides guidance on profit margins higher than expected, this will rekindle investors' confidence in growth.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal