Merchants Bancorp (MBIN) valuation: reassessing an apparent discount after insider sales, strong ROE and dividend support

Renewed attention on Merchants Bancorp (MBIN) has been sparked by a bullish value thesis, fresh insider share sales by Chairman and CEO Michael Petrie, and the bank’s steady dividend, all set against a backdrop of elevated delinquencies.

See our latest analysis for Merchants Bancorp.

Despite the recent headlines around delinquencies and insider selling, Merchants Bancorp’s share price at $34.39 reflects a 1 month share price return of 9.11 percent. Its 3 year total shareholder return of 42.79 percent and 5 year total shareholder return of 91.15 percent suggest longer term momentum has been solid even as near term sentiment remains choppy.

If this mix of value and uncertainty has your attention, it could be a good moment to widen your lens and explore fast growing stocks with high insider ownership as potential next ideas.

With the stock trading below book value while still showing solid long term ROE and growth, investors are left weighing whether current fears around delinquencies are masking a genuine bargain, or if the market is already pricing in a rebound in earnings and future growth.

Price-to-Earnings of 7.9x: Is it justified?

On a price-to-earnings basis, Merchants Bancorp looks undervalued at the last close of $34.39, with the stock trading on a 7.9x multiple that sits well below peers.

The price to earnings ratio compares the current share price with the company’s per share earnings, making it a core yardstick for banks and diversified financials where profitability and capital efficiency drive value. For Merchants Bancorp, this lens suggests investors are paying a relatively low price for each dollar of earnings given its established multi segment banking model and history of profit growth.

Compared to the US Diversified Financial industry average P E of 13.6x and a peer average of 11.2x, Merchants Bancorp’s 7.9x stands out as meaningfully cheaper, implying the market may be discounting its earnings power more harshly than sector norms. Against an estimated fair P E of 14.3x, the current multiple also sits well below the level our analysis indicates the market could ultimately move towards if fundamentals and sentiment converge.

Explore the SWS fair ratio for Merchants Bancorp

Result: Price-to-Earnings of 7.9x (UNDERVALUED)

However, lingering concerns over rising delinquencies and any unexpected slowdown in multifamily or warehouse lending could quickly challenge the current value-focused narrative.

Find out about the key risks to this Merchants Bancorp narrative.

Another View: Discounted Cash Flow Check

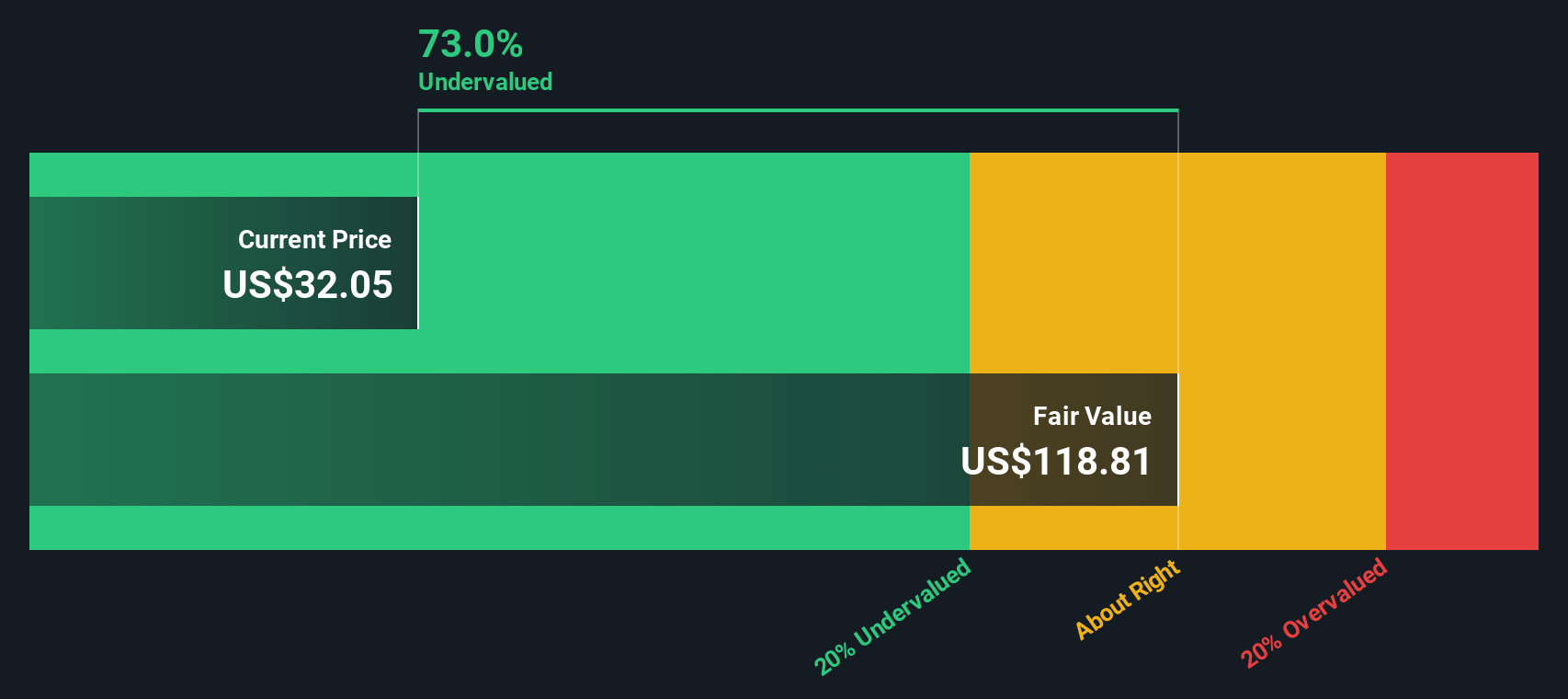

While the low price to earnings ratio points to value, our DCF model is even more aggressive, suggesting fair value near $66.98, roughly 48.7 percent above the current $34.39 share price. If both signals are right, it raises the question of whether the market is simply too fearful on credit quality.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Merchants Bancorp for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 905 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Merchants Bancorp Narrative

If these conclusions do not fully align with your view, or you prefer to dive into the numbers yourself, you can build a tailored version in just a few minutes by starting with Do it your way.

A great starting point for your Merchants Bancorp research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

If Merchants Bancorp is on your radar, do not stop here, the Simply Wall Street Screener uncovers fresh opportunities you might regret overlooking later.

- Capture potential mispricings by targeting companies trading below their cash flow value through these 905 undervalued stocks based on cash flows and position yourself ahead of a rerating.

- Ride powerful secular trends by screening for innovation focused names using these 26 AI penny stocks and tap into businesses reshaping how industries operate.

- Strengthen your income strategy by filtering for reliable payers via these 15 dividend stocks with yields > 3% and lock in yields that can support long term returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal