Chubu Electric Power (TSE:9502): Checking the Valuation After a Recent Share Price Pullback

Chubu Electric Power Company (TSE:9502) has quietly pulled back about 7% over the past week, even though shares remain up roughly 37% this year, setting up an interesting entry check for investors.

See our latest analysis for Chubu Electric Power Company.

That recent 7 day share price pullback looks more like a pause within a strong run, with the year to date share price return still robust and long term total shareholder returns pointing to steadily improving sentiment toward Chubu Electric Power’s earnings resilience and balance sheet.

If Chubu’s move has you rethinking your sector mix, it could be worth exploring aerospace and defense stocks as another pocket of the market where defensive cash flows meet structural growth stories.

With the stock still near its 12 month highs, trading only slightly below analyst targets despite negative recent revenue and profit growth, is Chubu Electric now a stretched defensive play or a mispriced utility with more upside?

Price-to-Earnings of 7.7x: Is it justified?

On a price-to-earnings basis, Chubu Electric Power trades at 7.7 times earnings, a level that sends mixed signals when lined up against different benchmarks.

The price-to-earnings ratio compares the current share price with the company’s earnings per share. It is a quick gauge of how much investors are paying for each unit of profit in a capital intensive, regulated utility like Chubu.

Versus the broader Japanese market, Chubu’s 7.7x multiple appears to represent reasonable value. It sits below the JP market’s 14x level and suggests investors are not paying a premium for its earnings despite strong recent share price performance and long term total returns.

However, against closer peers the picture is more nuanced. Chubu looks expensive versus its direct peer group on 4.4x earnings but still materially cheaper than the wider Asian Electric Utilities industry on 15.9x. It is also trading below an estimated fair price-to-earnings ratio of 9.4x, which indicates scope for the market to re rate the stock if sentiment or fundamentals improve.

Explore the SWS fair ratio for Chubu Electric Power Company

Result: Price-to-Earnings of 7.7x (ABOUT RIGHT)

However, softer revenue and earnings momentum, alongside a modest premium to domestic peers, could limit further re rating if fundamentals disappoint or regulation tightens.

Find out about the key risks to this Chubu Electric Power Company narrative.

Another View Using Our DCF Model

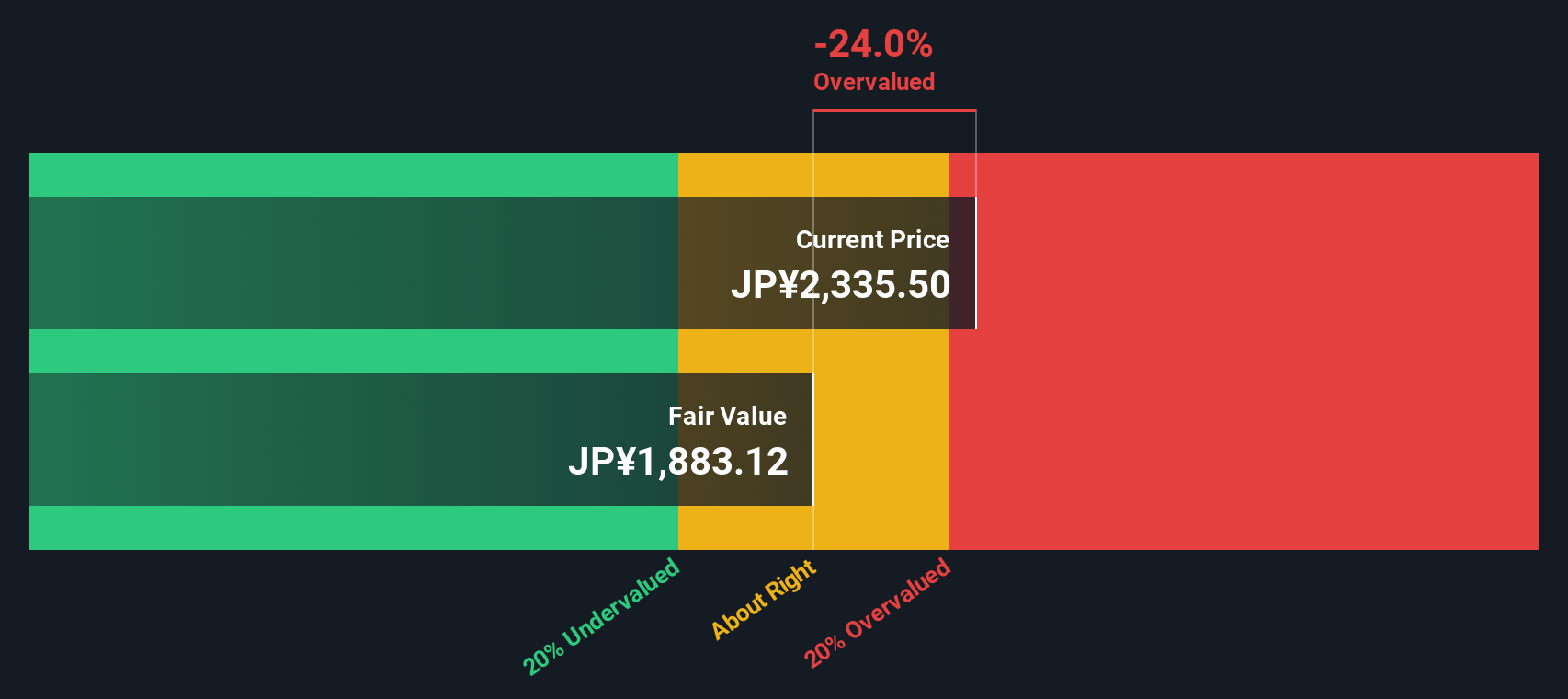

While earnings multiples suggest Chubu Electric Power is roughly fairly priced, our DCF model paints a cooler picture. With the shares trading around ¥2,264 versus a fair value estimate near ¥1,883, the stock appears overvalued, which raises the question of how much defensive premium is already reflected in the price.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Chubu Electric Power Company for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 905 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Chubu Electric Power Company Narrative

If this view does not fully align with your own, or you prefer digging into the numbers yourself, you can build a tailored perspective in just a few minutes, Do it your way.

A great starting point for your Chubu Electric Power Company research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before you move on, lock in your edge by using the Simply Wall St Screener to spot compelling ideas you might otherwise overlook in today’s market.

- Capture potential mispricings by targeting quality companies trading below intrinsic value with these 905 undervalued stocks based on cash flows.

- Ride structural tailwinds in automation and data by filtering cutting edge innovators through these 26 AI penny stocks.

- Strengthen your income stream by hunting for reliable payers using these 15 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal