MP Materials (MP) Is Up 6.9% After DoD‑Backed Mine‑to‑Magnet Push - Has The Bull Case Changed?

- Morgan Stanley recently upgraded MP Materials to Overweight, highlighting its role in building a fully domestic US mine‑to‑magnet rare earths supply chain and its joint venture with the Department of Defense and Saudi Arabian Mining Company to develop a refinery in Saudi Arabia.

- These moves deepen MP Materials’ involvement in securing Western rare earth access for electric vehicles, wind turbines, and advanced electronics, potentially reshaping how governments and manufacturers source critical magnet materials.

- We’ll now examine how the Department of Defense‑backed mine‑to‑magnet ambitions may reshape MP Materials’ investment narrative for long‑term investors.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

MP Materials Investment Narrative Recap

To own MP Materials, you have to believe in a long term shift toward secure, non Chinese rare earth supply and MP’s ability to execute on a full mine to magnet build out. The Morgan Stanley upgrade and Saudi refinery JV strengthen the near term story around government backed demand, but they do not remove the core execution risk tied to scaling new downstream facilities and returning the business to consistent profitability.

The Saudi Arabian refinery joint venture, backed by the U.S. Department of Defense financing and Maaden’s majority stake, looks most relevant here. It extends MP’s reach beyond Mountain Pass into allied refining capacity, which could reinforce the catalyst of government supported offtake and value added processing, while also increasing the operational and project delivery risks investors need to watch closely.

Yet behind the government support and global partnerships, investors still need to be aware of concentration risk in key customers and...

Read the full narrative on MP Materials (it's free!)

MP Materials’ narrative projects $1.0 billion revenue and $236.3 million earnings by 2028.

Uncover how MP Materials' forecasts yield a $79.11 fair value, a 27% upside to its current price.

Exploring Other Perspectives

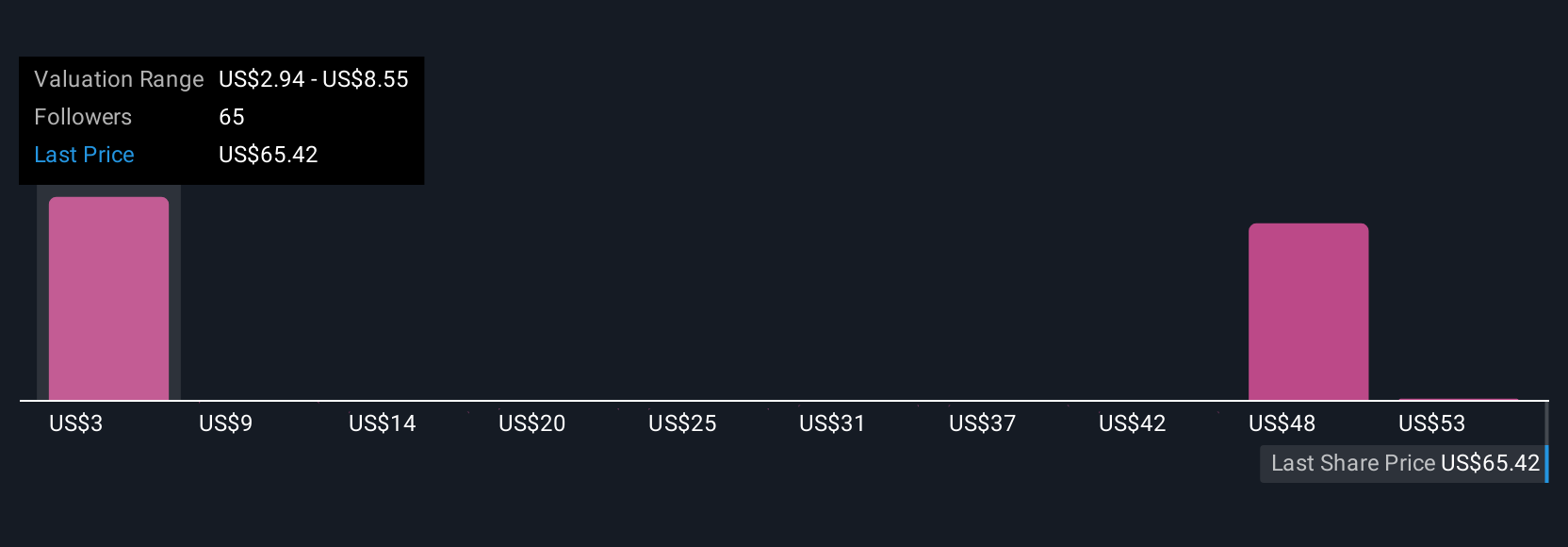

Nineteen members of the Simply Wall St Community value MP Materials between US$9.67 and US$85, highlighting very different expectations for the same business. As you weigh those views, consider how much confidence you place in MP’s downstream expansion and mine to magnet execution, given its recent losses and ongoing scale up challenges.

Explore 19 other fair value estimates on MP Materials - why the stock might be worth as much as 37% more than the current price!

Build Your Own MP Materials Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MP Materials research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free MP Materials research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MP Materials' overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal