UK Stocks Trading Below Estimated Value In December 2025

As the FTSE 100 and FTSE 250 indices face downward pressure due to weak trade data from China, investors in the United Kingdom are keenly observing how global economic challenges impact domestic markets. In such a climate, identifying stocks trading below their estimated value can present opportunities for those looking to navigate these uncertain times with strategic investments.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Pinewood Technologies Group (LSE:PINE) | £3.70 | £7.09 | 47.8% |

| PageGroup (LSE:PAGE) | £2.36 | £4.55 | 48.1% |

| Nichols (AIM:NICL) | £9.98 | £18.53 | 46.1% |

| Motorpoint Group (LSE:MOTR) | £1.39 | £2.74 | 49.3% |

| Hochschild Mining (LSE:HOC) | £4.208 | £8.39 | 49.8% |

| Fintel (AIM:FNTL) | £2.07 | £3.82 | 45.8% |

| Fevertree Drinks (AIM:FEVR) | £8.11 | £15.82 | 48.7% |

| Begbies Traynor Group (AIM:BEG) | £1.105 | £2.21 | 50% |

| Airtel Africa (LSE:AAF) | £3.09 | £5.82 | 46.9% |

| Advanced Medical Solutions Group (AIM:AMS) | £2.26 | £4.20 | 46.1% |

Here's a peek at a few of the choices from the screener.

Airtel Africa (LSE:AAF)

Overview: Airtel Africa Plc, with a market cap of £11.27 billion, operates in Nigeria, East Africa, and Francophone Africa offering telecommunications and mobile money services through its subsidiaries.

Operations: The company's revenue is derived from Mobile Money services ($1.15 billion) and Mobile Services in Nigeria ($1.25 billion), East Africa ($2.01 billion), and Francophone Africa ($1.41 billion).

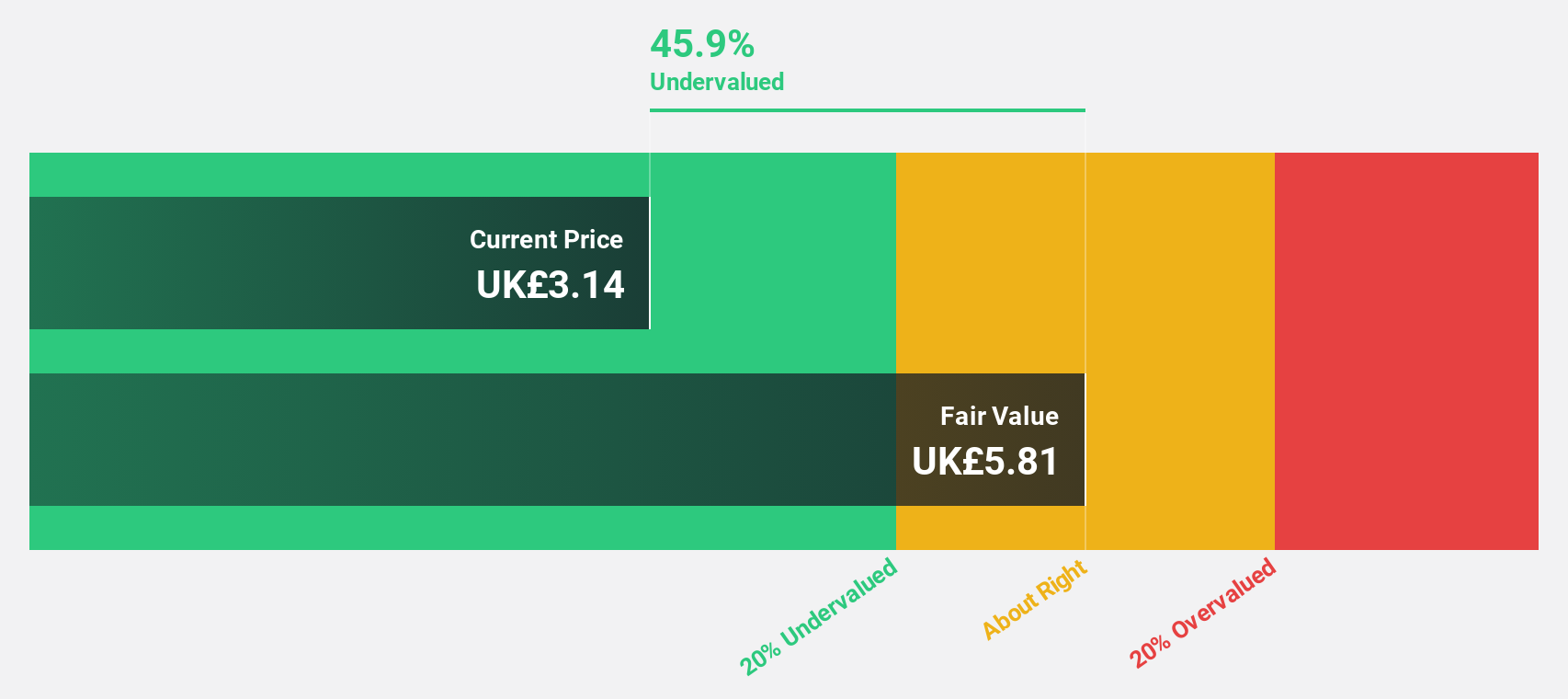

Estimated Discount To Fair Value: 46.9%

Airtel Africa appears to be significantly undervalued, trading at £3.09, which is 46.9% below its estimated fair value of £5.82. The company has recently achieved profitability and reported substantial revenue growth with sales reaching US$2.98 billion for the half year ended September 2025, up from US$2.37 billion a year ago. Despite interest payments not being well covered by earnings, its projected annual profit growth of 26.19% surpasses the UK market average of 14.3%.

- The analysis detailed in our Airtel Africa growth report hints at robust future financial performance.

- Click here to discover the nuances of Airtel Africa with our detailed financial health report.

ASA International Group (LSE:ASAI)

Overview: ASA International Group PLC is a microfinance institution operating in Asia and Africa with a market cap of £192 million.

Operations: The company's revenue segments include $40.66 million from South Asia, $65.82 million from East Africa, $65.29 million from West Africa, and $34.92 million from South East Asia.

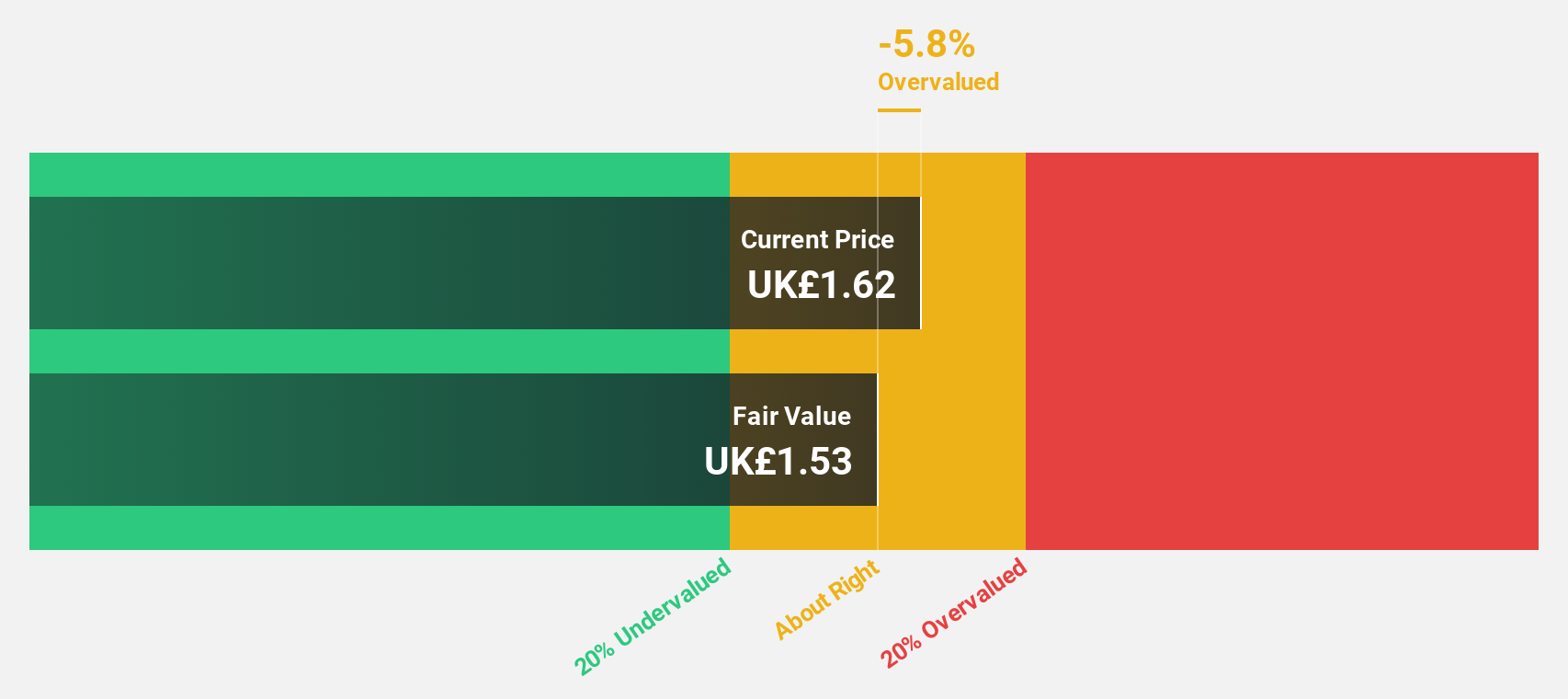

Estimated Discount To Fair Value: 12.6%

ASA International Group is trading at £1.92, slightly below its estimated fair value of £2.2, suggesting some undervaluation based on cash flows. The company forecasts robust revenue growth of 18.9% annually, outpacing the UK market average of 4.3%. Recent earnings guidance indicates net profit for 2025 will significantly exceed consensus estimates of US$48.3 million due to strong client demand and loan portfolio expansion, although its dividend isn't well covered by free cash flows.

- Upon reviewing our latest growth report, ASA International Group's projected financial performance appears quite optimistic.

- Delve into the full analysis health report here for a deeper understanding of ASA International Group.

Trustpilot Group (LSE:TRST)

Overview: Trustpilot Group plc operates an online review platform connecting businesses and consumers across the United Kingdom, North America, Europe, and internationally, with a market cap of £593.28 million.

Operations: The company's revenue is primarily derived from its Internet Information Providers segment, totaling $233.80 million.

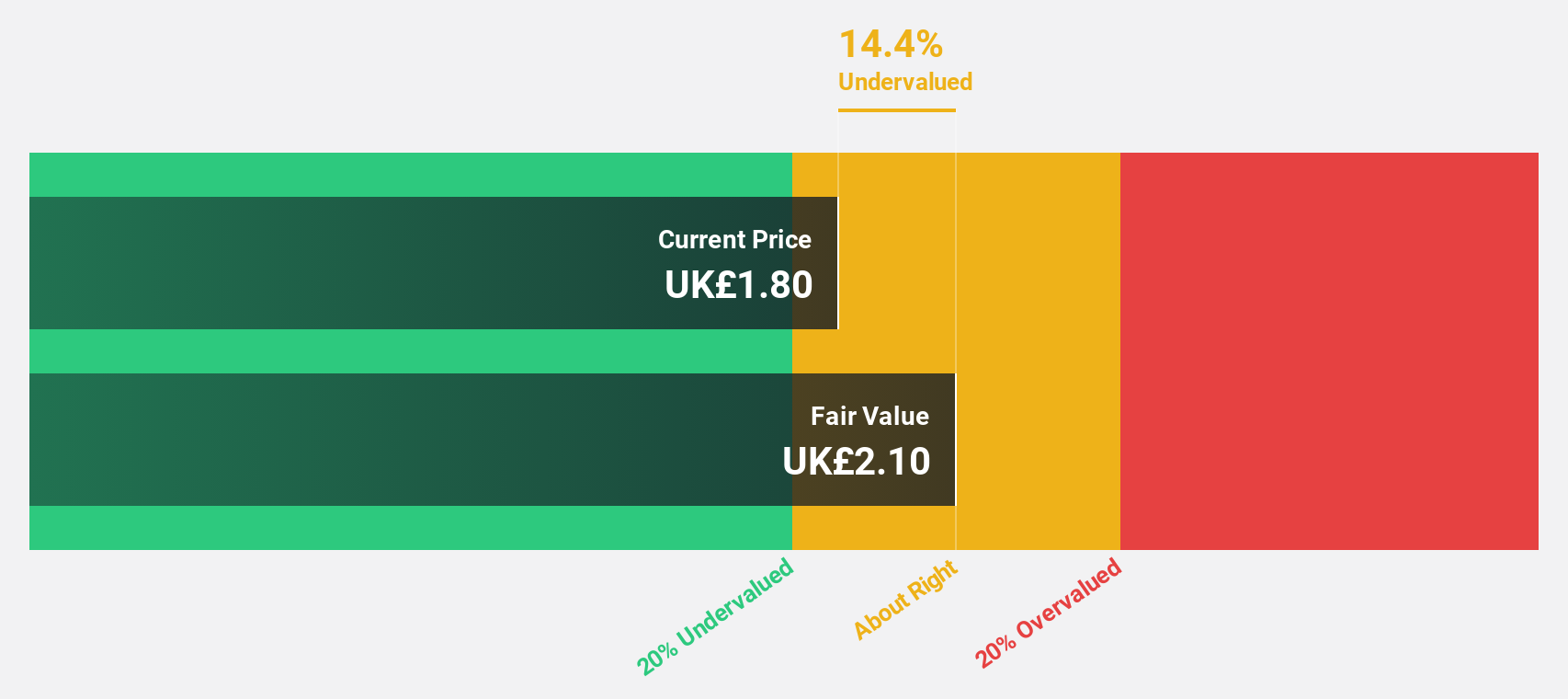

Estimated Discount To Fair Value: 14.4%

Trustpilot Group is trading at £1.46, below its estimated fair value of £1.71, indicating undervaluation based on cash flows. Despite a volatile share price recently, earnings are projected to grow significantly at 68.6% annually over the next three years, surpassing UK market expectations. The company's revenue growth forecast of 15.2% per year also exceeds the market average and is supported by a recent buyback program worth £30 million aimed at reducing share capital and enhancing shareholder value.

- Insights from our recent growth report point to a promising forecast for Trustpilot Group's business outlook.

- Get an in-depth perspective on Trustpilot Group's balance sheet by reading our health report here.

Where To Now?

- Click here to access our complete index of 53 Undervalued UK Stocks Based On Cash Flows.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal