Under Armour (UAA): Rethinking Valuation After a Steep Share Price Slide

Under Armour (UAA) has been grinding through a difficult stretch, with the stock sliding around 11% over the past 3 months and more than 50% over the past year, despite modest revenue growth.

See our latest analysis for Under Armour.

That weak backdrop has left Under Armour’s 1 year total shareholder return down sharply and the longer term picture is similarly negative. This suggests momentum is still fading as investors reassess execution risk and brand strength against modest growth.

If UAA’s slump has you rethinking where you hunt for returns, it could be worth exploring fast growing stocks with high insider ownership as a way to spot more aligned, growth focused management teams.

With the share price languishing near multi year lows but analysts still seeing upside, investors now face a key question: is Under Armour genuinely undervalued or is the market already pricing in all the growth ahead?

Most Popular Narrative: 22.5% Undervalued

With Under Armour closing at $4.55 versus a narrative fair value near $5.87, the valuation case leans on a slow but profitable reset in the years ahead.

The ongoing transformation to a brand first strategy, with a focus on premiumization, tighter SKU assortments, and greater brand storytelling, positions Under Armour to increase average selling prices, improve full price sell through, and reduce reliance on discounting, which should positively impact net margins and long term earnings growth.

Curious how modest revenue growth, rising margins, and a richer earnings multiple all come together to justify a higher fair value? The narrative leans on targeted international expansion, a more profitable channel mix, and a tighter share count to support its forecasts, but the real intrigue lies in how these moving parts interact over time. Want to see which assumptions carry the most weight in that valuation math and how a higher future multiple is still being rationalised?

Result: Fair Value of $5.87 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent tariff driven margin pressure and ongoing footwear underperformance could delay any recovery, challenging the assumption that premiumization and brand elevation will quickly restore growth.

Find out about the key risks to this Under Armour narrative.

Another Lens on Valuation

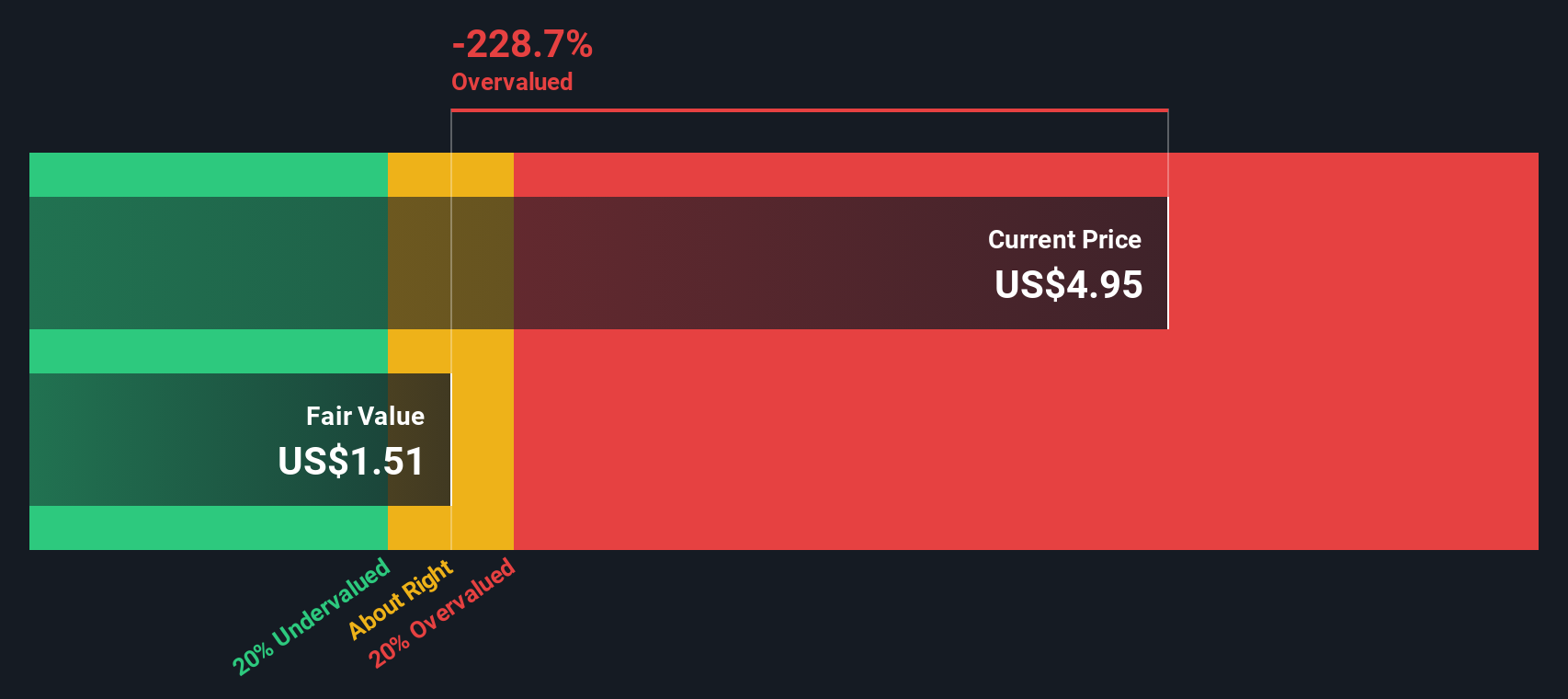

Our DCF model paints a much harsher picture, suggesting Under Armour is trading well above its estimated fair value, implying the stock could actually be overvalued rather than cheap. If future growth or margin recovery disappoints, how much downside are today’s buyers really accepting?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Under Armour for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 905 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Under Armour Narrative

If this perspective does not quite fit your view or you would rather dig into the numbers yourself, you can shape a custom narrative in minutes, Do it your way.

A great starting point for your Under Armour research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Do not stop at one opportunity when the market is full of under the radar ideas. Use the Simply Wall Street Screener now so you are not left behind.

- Capture potential mispricings by targeting companies trading below their intrinsic value through these 905 undervalued stocks based on cash flows and consider positioning yourself ahead of a possible rerating.

- Explore structural growth trends by focusing on innovators reshaping automation and data with these 26 AI penny stocks, before their stories become mainstream headlines.

- Seek recurring income potential by filtering for reliable payers using these 15 dividend stocks with yields > 3%, and aim to strengthen your portfolio with yields that may cushion future volatility.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal