Stoke Therapeutics (STOK): Reassessing Valuation After New Zorevunersen Data at the 2025 AES Meeting

Stoke Therapeutics (STOK) just delivered another data update on zorevunersen at the 2025 American Epilepsy Society meeting, and it matters because it strengthens the long term disease modification story in Dravet syndrome.

See our latest analysis for Stoke Therapeutics.

The latest AES data drop lands after a big run, with the 30 day share price return of 35.04 percent and year to date share price return of 173.91 percent supporting a strong 1 year total shareholder return of 124.35 percent. However, the 5 year total shareholder return remains negative, so momentum is clearly building but from a still bruised longer term base.

If this kind of late stage biotech re rating has you curious, it could be worth exploring other specialised healthcare stocks that are starting to attract similar attention.

With the stock now hovering just below analyst targets after a huge year to date move, is Stoke still trading at a discount to zorevunersen’s long term potential, or is the market already pricing in its next leg of growth?

Price-to-Earnings of 43.5x: Is it justified?

On a trailing basis, Stoke Therapeutics trades at a price to earnings ratio of 43.5 times, well above both the wider US market and biotech peers, which suggests investors are paying up for a relatively small current profit base.

The price to earnings multiple compares the company’s equity value to its net profit and is a common way to benchmark how much the market is paying for each dollar of earnings, particularly in profitable biotechs that are still early in their commercial journey.

In Stoke’s case, that 43.5 times multiple looks rich relative to its fundamentals, especially with consensus pointing to earnings declining by roughly a quarter per year and revenue also shrinking in the medium term. This makes it harder to argue that the market is simply front loading aggressive growth.

Against that context, the premium really stands out when you see that the US biotech sector sits nearer 19.1 times earnings and Stoke’s own peers average about 30.1 times. Our regression based fair ratio work suggests something closer to 13.3 times as a level the market could eventually converge toward if optimism cools.

Explore the SWS fair ratio for Stoke Therapeutics

Result: Price-to-Earnings of 43.5x (OVERVALUED)

However, risks remain, including zorevunersen’s clinical setbacks or regulatory delays, and any reversal in earnings momentum that challenges today’s premium valuation.

Find out about the key risks to this Stoke Therapeutics narrative.

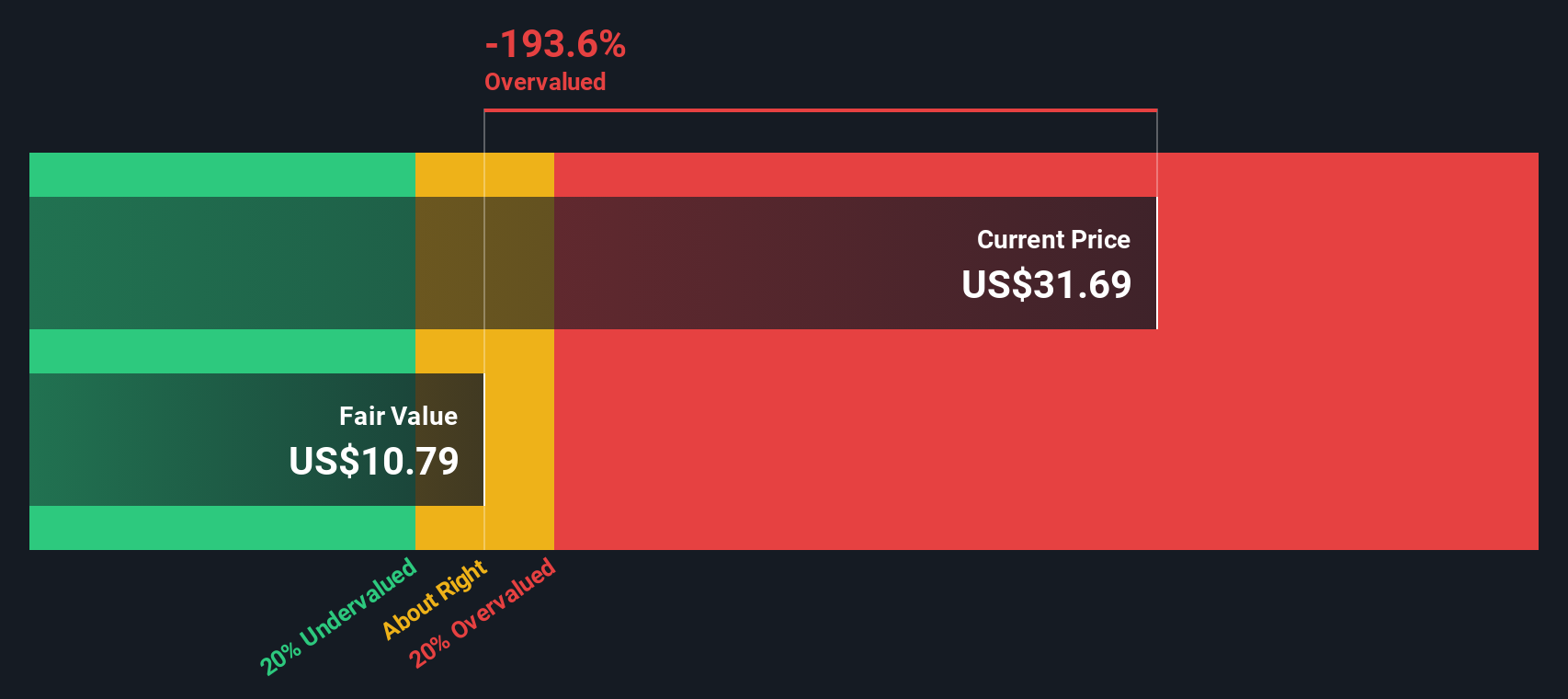

Another View Using Our DCF Model

Our DCF model paints an even starker picture, suggesting fair value near $12.37 versus the current $30.87 share price. As a result, Stoke screens as materially overvalued on cash flows as well as earnings. If profits are set to shrink, what upside is left for new buyers at these levels?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Stoke Therapeutics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 905 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Stoke Therapeutics Narrative

If our view does not fully align with yours, or you would rather interrogate the numbers yourself, you can craft a personalised thesis in minutes, Do it your way.

A great starting point for your Stoke Therapeutics research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Ready for your next investing edge?

Before you move on, you may wish to explore your next potential idea by using the Simply Wall St Screener to uncover targeted opportunities that most investors overlook.

- Look for early momentum by scanning these 3578 penny stocks with strong financials that already show solid financial foundations, before the broader market fully reacts.

- Explore structural trends by focusing on these 30 healthcare AI stocks that are involved in patient outcomes and operational efficiency across hospitals, diagnostics, and drug development.

- Research potential income opportunities by examining these 15 dividend stocks with yields > 3% that offer dividend payouts alongside the possibility of capital growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal