Will EVO Integration And Earnings Momentum Change Global Payments' (GPN) Technology-First Platform Narrative?

- Global Payments Inc. recently presented at the UBS Global Technology and AI Conference 2025 in Scottsdale, Arizona, where CEO Cameron M. Bready discussed the company’s direction and financial performance.

- The company’s integration of EVO Payments and its continued earnings growth, including higher EPS and revenue, underline management’s focus on building a more technology-enabled, software-centered payments platform despite a sizeable debt burden.

- We’ll now explore how the EVO Payments integration and recent earnings results could reshape Global Payments’ existing investment narrative for investors.

Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

Global Payments Investment Narrative Recap

To own Global Payments, you need to believe in its shift toward a more software-driven, integrated payments platform while accepting execution risk from acquisitions and a meaningful debt load. The UBS conference appearance reinforces this long term tech focus but does not materially change the near term catalyst around successful EVO Payments integration, nor the key risk that ongoing consolidation and portfolio reshaping could strain operations and balance sheet flexibility.

The most directly relevant update here is Global Payments’ recent Q3 2025 earnings, which showed continued revenue and EPS growth while the company is still digesting EVO Payments. Those results give investors more current evidence on how well the combined platform is performing and whether integration is supporting the push into higher margin, software-led services, a critical factor if the company is to offset competitive and margin pressures in payments over time.

Yet even as earnings improve, investors should be aware that integration and execution risk around acquisitions like EVO and Worldpay could still...

Read the full narrative on Global Payments (it's free!)

Global Payments' narrative projects $12.3 billion revenue and $1.7 billion earnings by 2028. This requires 7.0% yearly revenue growth and about a $0.2 billion earnings increase from $1.5 billion today.

Uncover how Global Payments' forecasts yield a $104.36 fair value, a 32% upside to its current price.

Exploring Other Perspectives

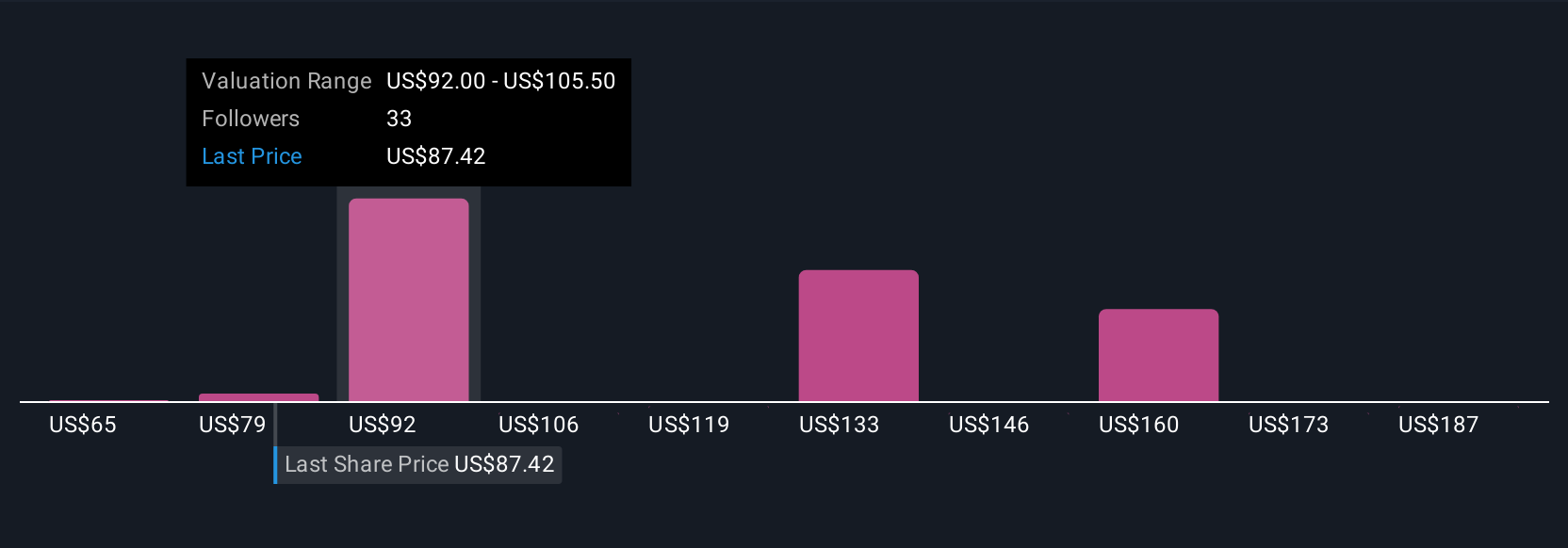

Twelve members of the Simply Wall St Community currently see Global Payments’ fair value between US$65 and US$200, reflecting very different expectations. When you weigh those views against the integration and execution risks around large acquisitions, it becomes even more important to compare multiple scenarios for the company’s future performance.

Explore 12 other fair value estimates on Global Payments - why the stock might be worth over 2x more than the current price!

Build Your Own Global Payments Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Global Payments research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Global Payments research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Global Payments' overall financial health at a glance.

No Opportunity In Global Payments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal