How Investors May Respond To Fairfax (TSX:FFH) Reshaping Capital And Cutting Its Orla Mining Stake

- Fairfax Financial Holdings has recently moved to redeem its Series I and J preferred shares for CA$25.00 each, continued paying quarterly dividends on its preferred series, and sold 25,000,000 Orla Mining shares for about CA$441.10 million as part of a portfolio rebalancing by its insurance subsidiaries.

- This combination of preferred share redemptions, ongoing dividends, and a large equity sale highlights how Fairfax is actively reshaping its capital structure and investment exposure while retaining a meaningful stake in Orla Mining.

- We’ll now examine how Fairfax’s sizable Orla Mining stake reduction, executed as part of portfolio rebalancing, may influence its broader investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Fairfax Financial Holdings Investment Narrative Recap

To own Fairfax, you need to be comfortable with an insurance group that leans heavily on investment income and a value-oriented equity portfolio, accepting earnings volatility in return for long term compounding. The Orla Mining sale, preferred share redemptions, and ongoing preferred dividends do not appear to alter the main near term swing factor, which remains the sensitivity of Fairfax’s investment income and equity portfolio results to changes in interest rates and market conditions, or its key risk around earnings volatility.

Among the recent announcements, Fairfax’s plan to redeem all Series I and J preferred shares for CA$25.00 per share, alongside paying the final quarterly dividends on those series, stands out. Together with the continued Series K preferred dividend, this capital move sits alongside portfolio rebalancing such as the Orla Mining sale and feeds directly into how investors think about Fairfax’s balance between capital returns, investment flexibility, and exposure to the very investment income that underpins the current bull case.

Yet investors should be aware that if interest rates fall or market gains reverse, Fairfax’s elevated investment income and mark to market gains could...

Read the full narrative on Fairfax Financial Holdings (it's free!)

Fairfax Financial Holdings' narrative projects $41.8 billion revenue and $2.9 billion earnings by 2028. This requires 3.4% yearly revenue growth and a $1.7 billion earnings decrease from $4.6 billion.

Uncover how Fairfax Financial Holdings' forecasts yield a CA$2708 fair value, a 17% upside to its current price.

Exploring Other Perspectives

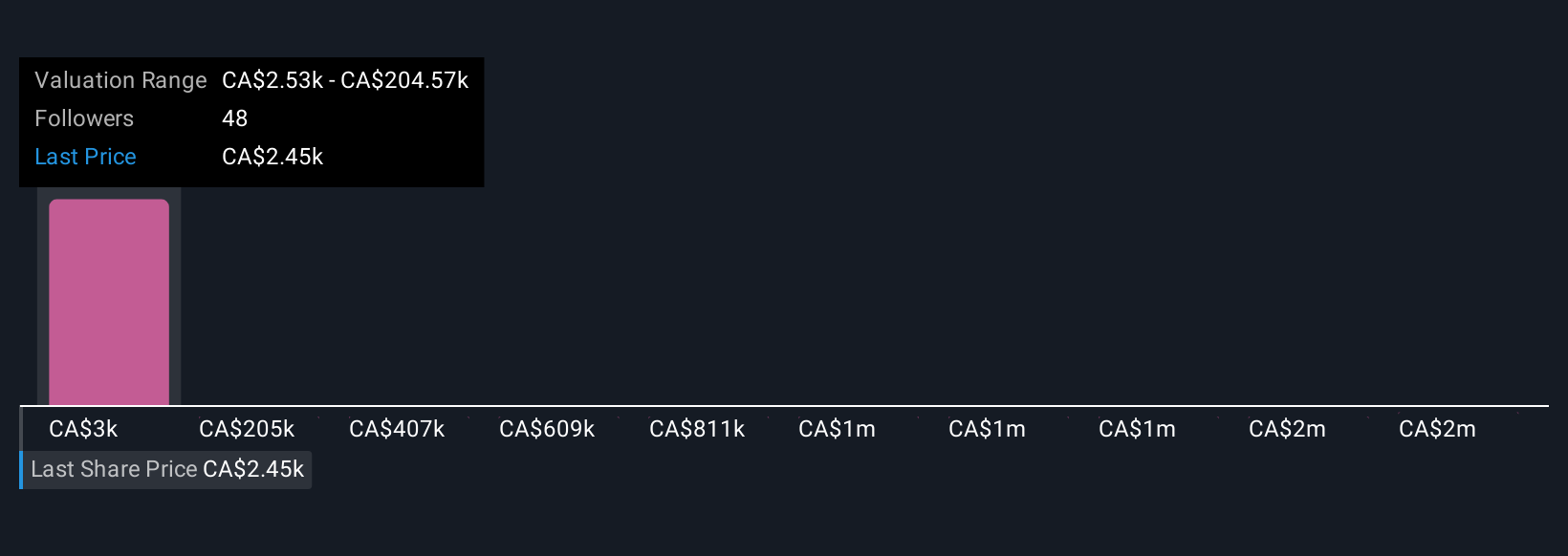

Five fair value estimates from the Simply Wall St Community sit between about CA$2,707.92 and an extreme CA$2,022,944.81, underscoring just how far apart views can be. As you weigh those opinions against Fairfax’s heavy reliance on currently high investment income, it is worth considering how quickly sentiment could shift if interest rates or market returns move the other way.

Explore 5 other fair value estimates on Fairfax Financial Holdings - why the stock might be a potential multi-bagger!

Build Your Own Fairfax Financial Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fairfax Financial Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Fairfax Financial Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fairfax Financial Holdings' overall financial health at a glance.

No Opportunity In Fairfax Financial Holdings?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal