European Value Stock Picks Including Partners Group Holding And 2 More Estimated To Be Trading Below Fair Value

As European markets experience mixed returns, with the STOXX Europe 600 Index inching higher amid hopes for interest rate cuts, investors are increasingly focused on identifying value opportunities in this uncertain economic environment. In such conditions, stocks trading below their fair value can present attractive prospects for those seeking to capitalize on potential market inefficiencies and long-term growth potential.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Truecaller (OM:TRUE B) | SEK23.06 | SEK45.76 | 49.6% |

| Streamwide (ENXTPA:ALSTW) | €71.60 | €141.65 | 49.5% |

| Roche Bobois (ENXTPA:RBO) | €35.00 | €69.48 | 49.6% |

| Nokian Panimo Oyj (HLSE:BEER) | €2.475 | €4.88 | 49.2% |

| KB Components (OM:KBC) | SEK42.55 | SEK83.47 | 49% |

| Jæren Sparebank (OB:JAREN) | NOK380.00 | NOK753.30 | 49.6% |

| Exel Composites Oyj (HLSE:EXL1V) | €0.392 | €0.78 | 49.5% |

| Esautomotion (BIT:ESAU) | €3.10 | €6.14 | 49.5% |

| B&S Group (ENXTAM:BSGR) | €5.95 | €11.84 | 49.8% |

| Atea (OB:ATEA) | NOK153.00 | NOK300.63 | 49.1% |

Let's explore several standout options from the results in the screener.

Partners Group Holding (SWX:PGHN)

Overview: Partners Group Holding AG is a private equity firm that specializes in direct, secondary, and primary investments across private equity, real estate, infrastructure, and debt with a market cap of CHF24.82 billion.

Operations: The company's revenue is derived from various segments, including CHF1.43 billion from Private Equity, CHF471.40 million from Infrastructure, CHF215.80 million from Real Estate, and CHF207.40 million from Private Credit.

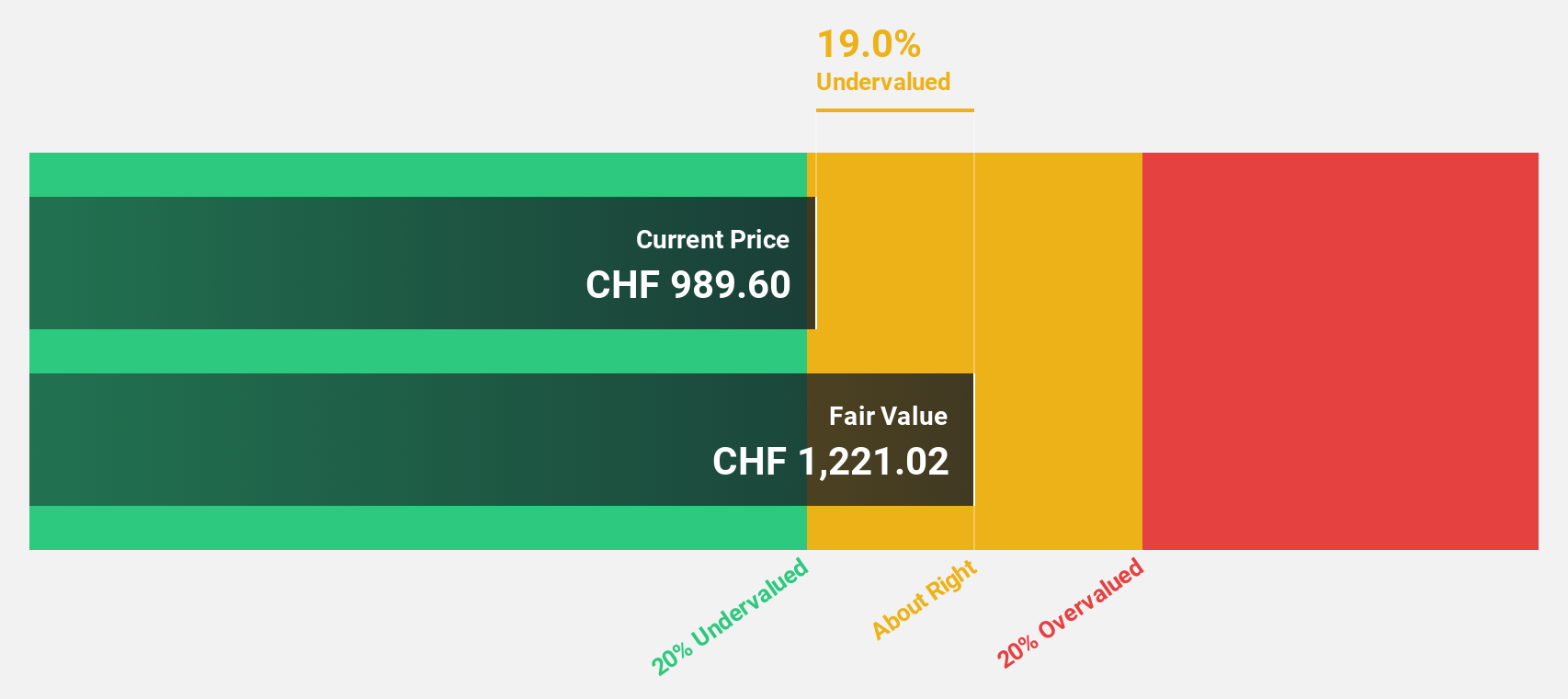

Estimated Discount To Fair Value: 23.8%

Partners Group Holding is trading at CHF956.8, significantly below its estimated fair value of CHF1255.02, indicating potential undervaluation based on cash flows. Despite a high debt level, the firm's earnings are expected to grow faster than the Swiss market at 10.6% annually. Recent strategic expansions in North America and leadership changes in its Private Equity Technology Vertical enhance its growth prospects and operational capabilities amidst ongoing M&A activities and new fund launches.

- Insights from our recent growth report point to a promising forecast for Partners Group Holding's business outlook.

- Dive into the specifics of Partners Group Holding here with our thorough financial health report.

AUTO1 Group (XTRA:AG1)

Overview: AUTO1 Group SE is a technology company that operates a digital platform for buying and selling used cars online across several countries, including Germany, France, and Italy, with a market cap of €5.26 billion.

Operations: The company's revenue is derived from two main segments: Retail, contributing €1.62 billion, and Merchant, accounting for €6.12 billion.

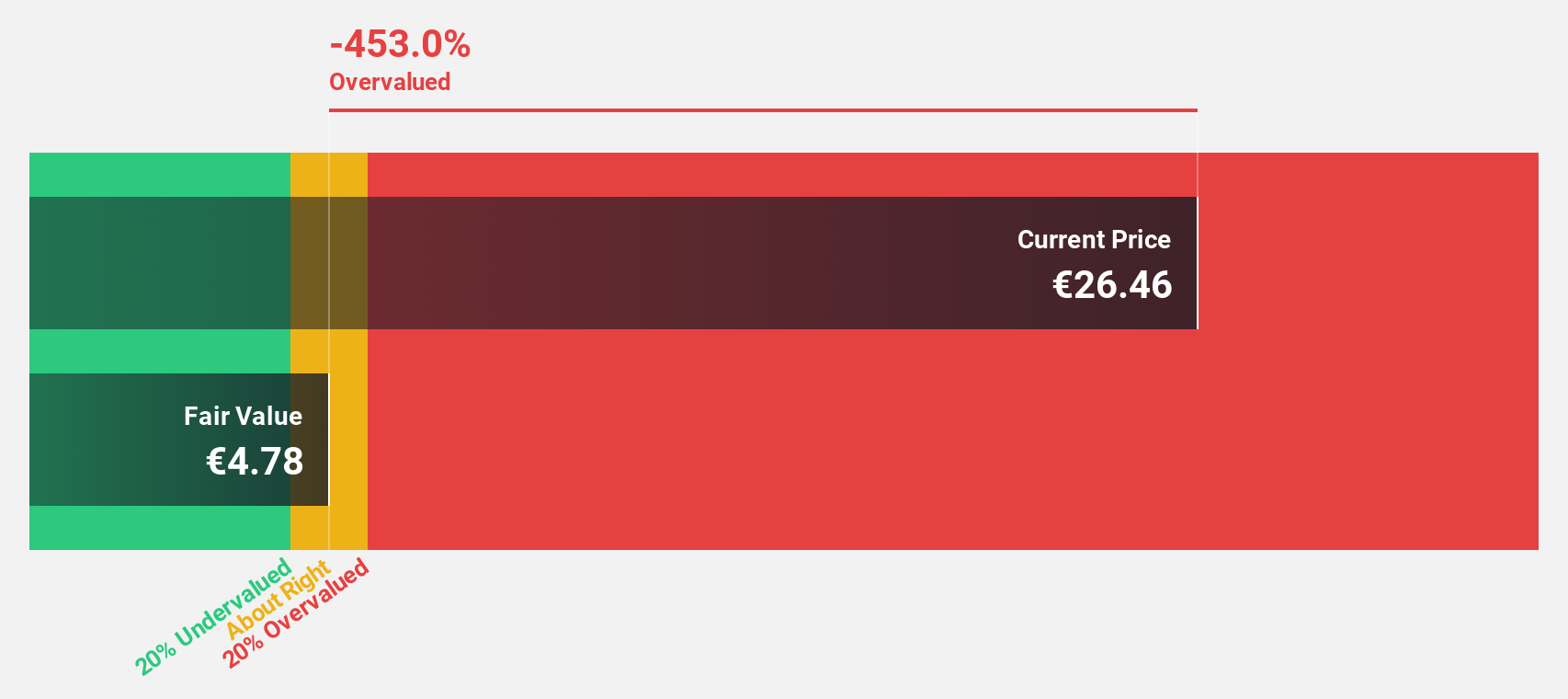

Estimated Discount To Fair Value: 35.9%

AUTO1 Group is trading at €23.88, significantly below its estimated fair value of €37.26, highlighting potential undervaluation based on cash flows. The company reported strong financial performance with a notable increase in net income and sales for the third quarter of 2025. However, its debt coverage by operating cash flow remains a concern. Recent business expansions across Europe aim to enhance production capacity and control over quality processes, potentially supporting future revenue growth above the German market rate.

- Our expertly prepared growth report on AUTO1 Group implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in AUTO1 Group's balance sheet health report.

Nordex (XTRA:NDX1)

Overview: Nordex SE, with a market cap of €6.13 billion, develops, manufactures, and distributes multi-megawatt onshore wind turbines globally through its subsidiaries.

Operations: The company generates revenue from the development, manufacturing, and distribution of multi-megawatt onshore wind turbines across global markets.

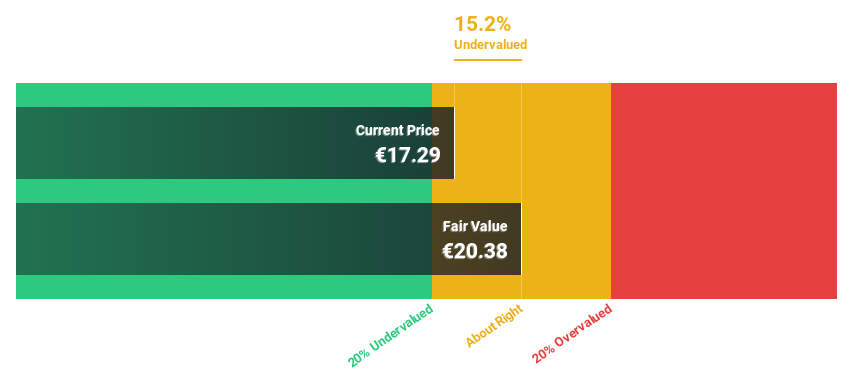

Estimated Discount To Fair Value: 33%

Nordex SE is trading at €25.92, considerably below its estimated fair value of €38.67, suggesting it may be undervalued based on cash flows. The company's earnings have shown remarkable growth over the past year and are expected to continue growing significantly faster than the German market. Recent orders across Europe bolster its revenue outlook, although share price volatility remains a concern for investors seeking stability in their portfolios.

- Our earnings growth report unveils the potential for significant increases in Nordex's future results.

- Get an in-depth perspective on Nordex's balance sheet by reading our health report here.

Key Takeaways

- Access the full spectrum of 196 Undervalued European Stocks Based On Cash Flows by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal