How Airbnb’s AI Concierge and Super App Ambitions Will Impact Airbnb (ABNB) Investors

- In recent months, Airbnb has pushed further into technology-led innovation, acquiring AI startup GamePlanner and working with Siri’s founder to build an AI-powered concierge that personalizes travel planning within its app.

- At the same time, the company is branching into areas like co-hosting, hotels, and Experiences, aiming to evolve into a broad travel super app even as it manages regulatory pressures and slower growth in mature markets.

- We’ll now examine how Airbnb’s AI concierge push and broader platform expansion may influence its longer-term investment narrative and risk profile.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Airbnb Investment Narrative Recap

To own Airbnb, you need to believe its global brand, profitable platform, and expanding travel ecosystem can offset slowing growth in mature markets and rising regulatory scrutiny. The AI concierge effort and broader “super app” push may not change the key near term catalyst, which remains how well Airbnb manages regulatory pressure in major cities, but they could heighten the main risk if expansion draws more political attention.

The most relevant development here is Airbnb’s acquisition of AI startup GamePlanner to build an in app concierge with Siri’s founder. This speaks directly to the bullish view that advanced AI and personalization could improve conversion and efficiency, potentially reinforcing Airbnb’s already high margins while it invests in newer areas like co hosting, hotels, and Experiences that are not yet meaningful revenue drivers.

Yet behind the promise of AI powered growth, investors should be aware of the mounting regulatory and political pushback that could...

Read the full narrative on Airbnb (it's free!)

Airbnb’s narrative projects $15.4 billion revenue and $3.7 billion earnings by 2028. This requires 10.0% yearly revenue growth and about a $1.1 billion earnings increase from $2.6 billion today.

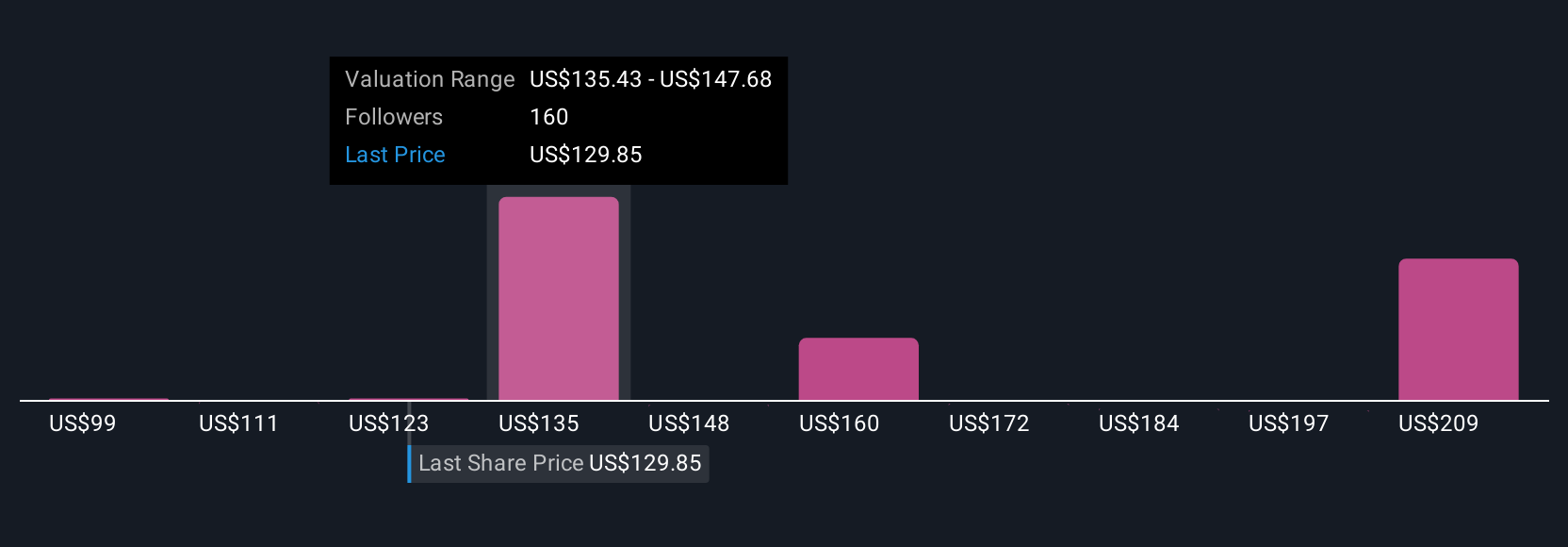

Uncover how Airbnb's forecasts yield a $138.12 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Some of the most optimistic analysts were already modeling Airbnb to reach about US$16.5 billion of revenue and US$4.3 billion of earnings by 2028, and this new AI concierge push could either reinforce that upbeat view of faster international and Experiences growth or, if it provokes more scrutiny, bring the more cautious risk narrative about regulation and costs closer to reality.

Explore 24 other fair value estimates on Airbnb - why the stock might be worth 16% less than the current price!

Build Your Own Airbnb Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Airbnb research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Airbnb research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Airbnb's overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal