Sasol (JSE:SOL) sheds R6.5b, company earnings and investor returns have been trending downwards for past three years

If you love investing in stocks you're bound to buy some losers. But long term Sasol Limited (JSE:SOL) shareholders have had a particularly rough ride in the last three year. Sadly for them, the share price is down 62% in that time. Furthermore, it's down 17% in about a quarter. That's not much fun for holders.

With the stock having lost 9.0% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During five years of share price growth, Sasol moved from a loss to profitability. We would usually expect to see the share price rise as a result. So it's worth looking at other metrics to try to understand the share price move.

Arguably the revenue decline of 4.7% per year has people thinking Sasol is shrinking. After all, if revenue keeps shrinking, it may be difficult to find earnings growth in the future.

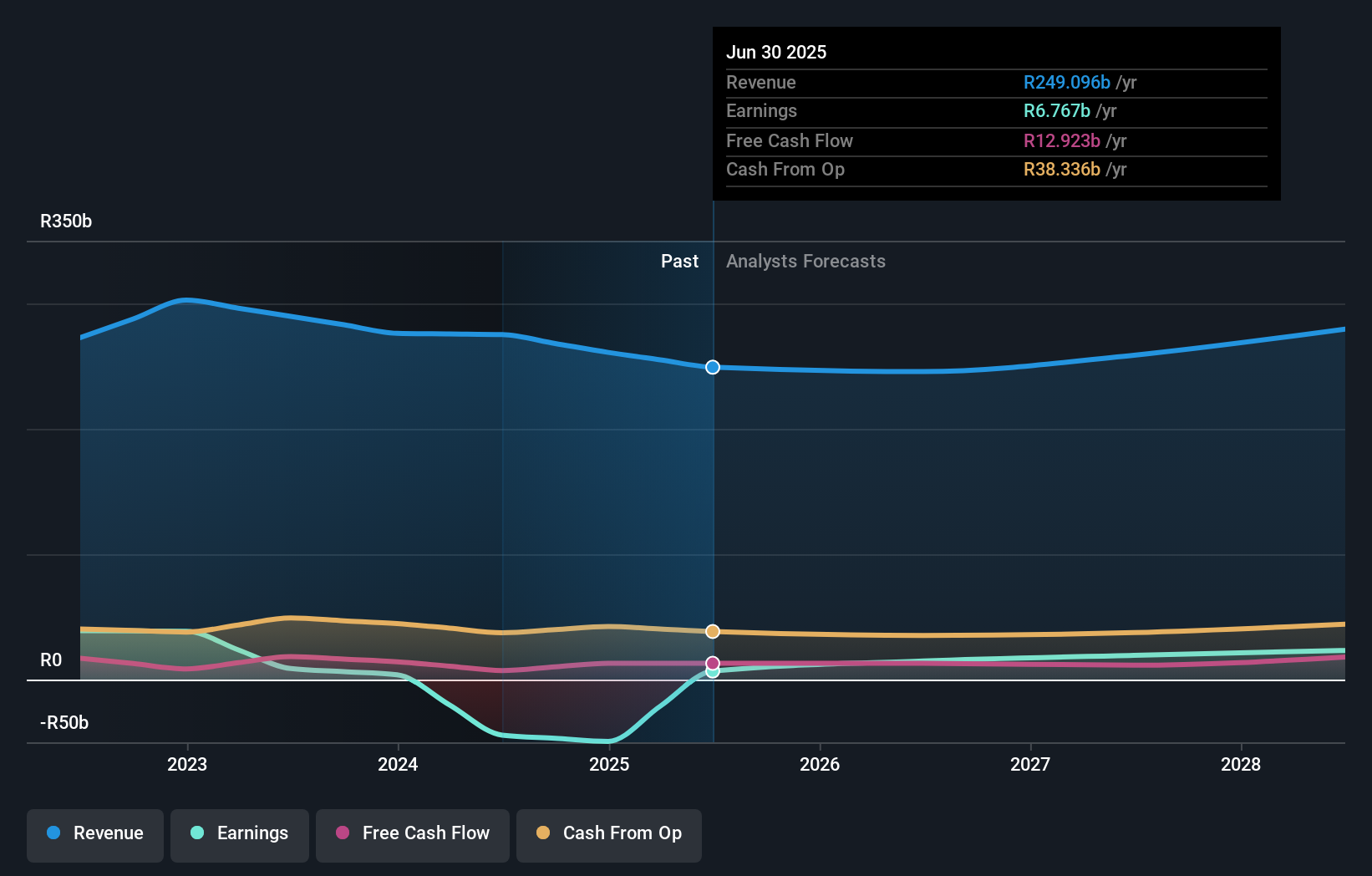

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We know that Sasol has improved its bottom line lately, but what does the future have in store? This free report showing analyst forecasts should help you form a view on Sasol

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Sasol's total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Sasol's TSR of was a loss of 59% for the 3 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

Sasol shareholders are up 8.9% for the year. Unfortunately this falls short of the market return. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 3% endured over half a decade. So this might be a sign the business has turned its fortunes around. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 1 warning sign for Sasol you should be aware of.

We will like Sasol better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South African exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal