Here's Why We Think Union Tool (TSE:6278) Might Deserve Your Attention Today

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like Union Tool (TSE:6278), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Union Tool with the means to add long-term value to shareholders.

Union Tool's Earnings Per Share Are Growing

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That makes EPS growth an attractive quality for any company. We can see that in the last three years Union Tool grew its EPS by 7.7% per year. While that sort of growth rate isn't anything to write home about, it does show the business is growing.

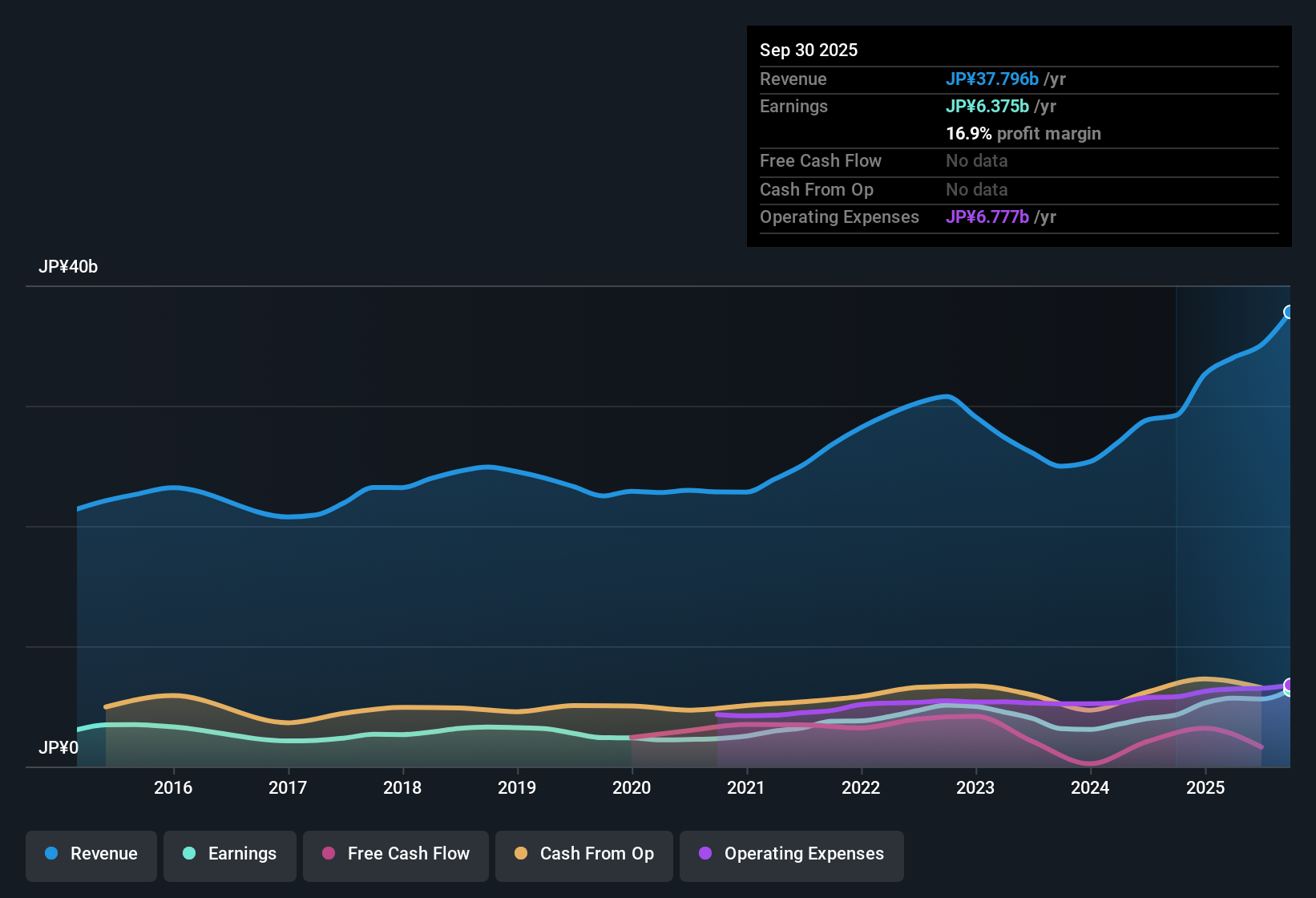

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Union Tool shareholders can take confidence from the fact that EBIT margins are up from 17% to 24%, and revenue is growing. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

View our latest analysis for Union Tool

Fortunately, we've got access to analyst forecasts of Union Tool's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Union Tool Insiders Aligned With All Shareholders?

Theory would suggest that it's an encouraging sign to see high insider ownership of a company, since it ties company performance directly to the financial success of its management. So we're pleased to report that Union Tool insiders own a meaningful share of the business. Actually, with 39% of the company to their names, insiders are profoundly invested in the business. Shareholders and speculators should be reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. This insider holding amounts to This is an incredible endorsement from them.

Is Union Tool Worth Keeping An Eye On?

One important encouraging feature of Union Tool is that it is growing profits. To add an extra spark to the fire, significant insider ownership in the company is another highlight. That combination is very appealing. So yes, we do think the stock is worth keeping an eye on. However, before you get too excited we've discovered 1 warning sign for Union Tool that you should be aware of.

Although Union Tool certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of Japanese companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal