Kulicke and Soffa Industries (KLIC) Is Up 7.5% After Dividend Hike and Stronger Outlook - What's Changed

- Kulicke and Soffa Industries recently announced that its Board of Directors approved a quarterly dividend of US$0.205 per share, payable on January 6, 2026, to shareholders of record as of December 18, 2025.

- This dividend decision comes shortly after the company delivered fourth-quarter fiscal 2025 results that exceeded analyst expectations, accompanied by stronger forward guidance and affirmed analyst confidence in its market position.

- We’ll now examine how the stronger forward guidance and recent 7-day share price gain shape Kulicke and Soffa’s investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is Kulicke and Soffa Industries' Investment Narrative?

To own Kulicke and Soffa, you really have to believe in the durability of its position in semiconductor assembly equipment and in a recovery path from a lumpy earnings history and low recent returns. The latest quarterly beat, stronger forward guidance and a 7-day share price pop suggest near term sentiment has improved, but they do not fundamentally change the core catalysts: execution on revenue acceleration and restoring profitability after prior one off losses. The Board’s decision to maintain the US$0.205 quarterly dividend reinforces a disciplined capital return story, yet dividend coverage remains thin, so it does not remove earnings risk. Insider selling by the General Counsel looks too small to be a clear signal, but it may sharpen attention on already modest return on equity and valuation concerns.

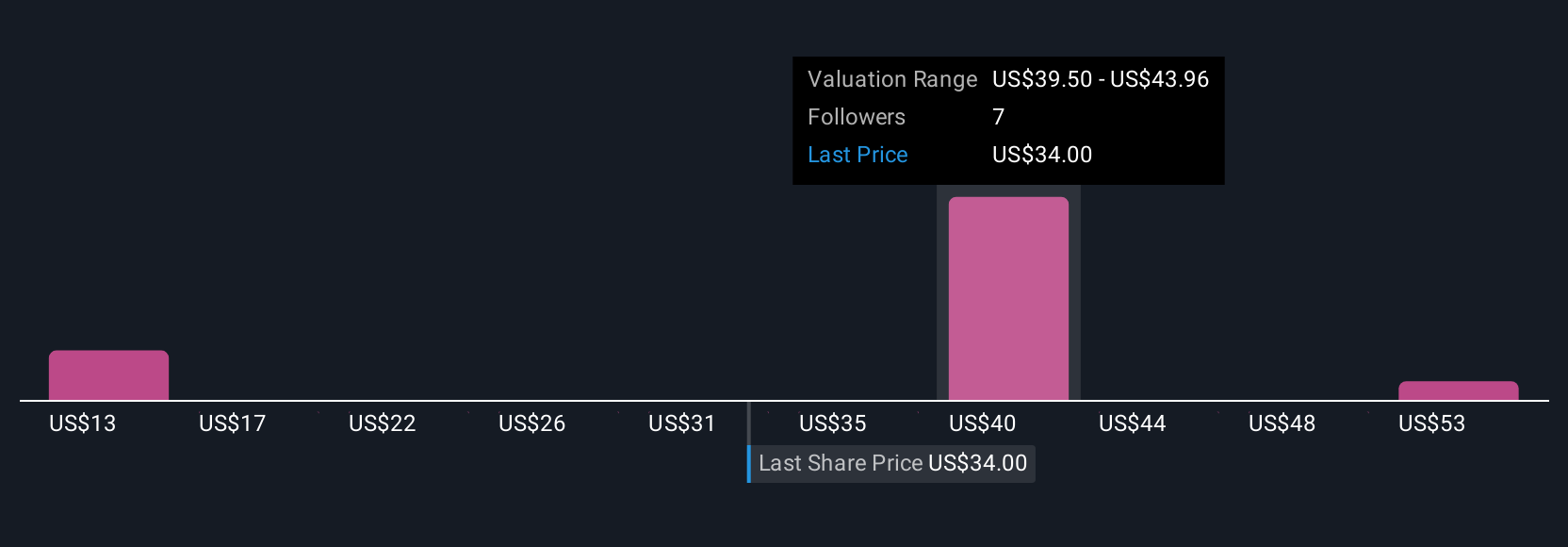

However, one key profitability risk remains that investors should be aware of. Kulicke and Soffa Industries' shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 3 other fair value estimates on Kulicke and Soffa Industries - why the stock might be worth less than half the current price!

Build Your Own Kulicke and Soffa Industries Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kulicke and Soffa Industries research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Kulicke and Soffa Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kulicke and Soffa Industries' overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal