Taiyo Yuden (TSE:6976): Valuation Check After New Automotive-Grade Hybrid Capacitor Rollout

Taiyo Yuden (TSE:6976) just kicked off mass production of its revamped HVX and HTX hybrid capacitors for automotive power circuits, a timely bet on growing ADAS and EV electrification demand.

See our latest analysis for Taiyo Yuden.

The market seems to be warming to that narrative, with a 7 day share price return of 18.47 percent and a powerful year to date share price return of 72.6 percent. However, the 3 year total shareholder return is still slightly negative and suggests the long term recovery story is only just rebuilding momentum.

If Taiyo Yuden’s move into higher spec automotive components has caught your eye, it could be worth seeing what else is gaining traction in tech and electrification via high growth tech and AI stocks.

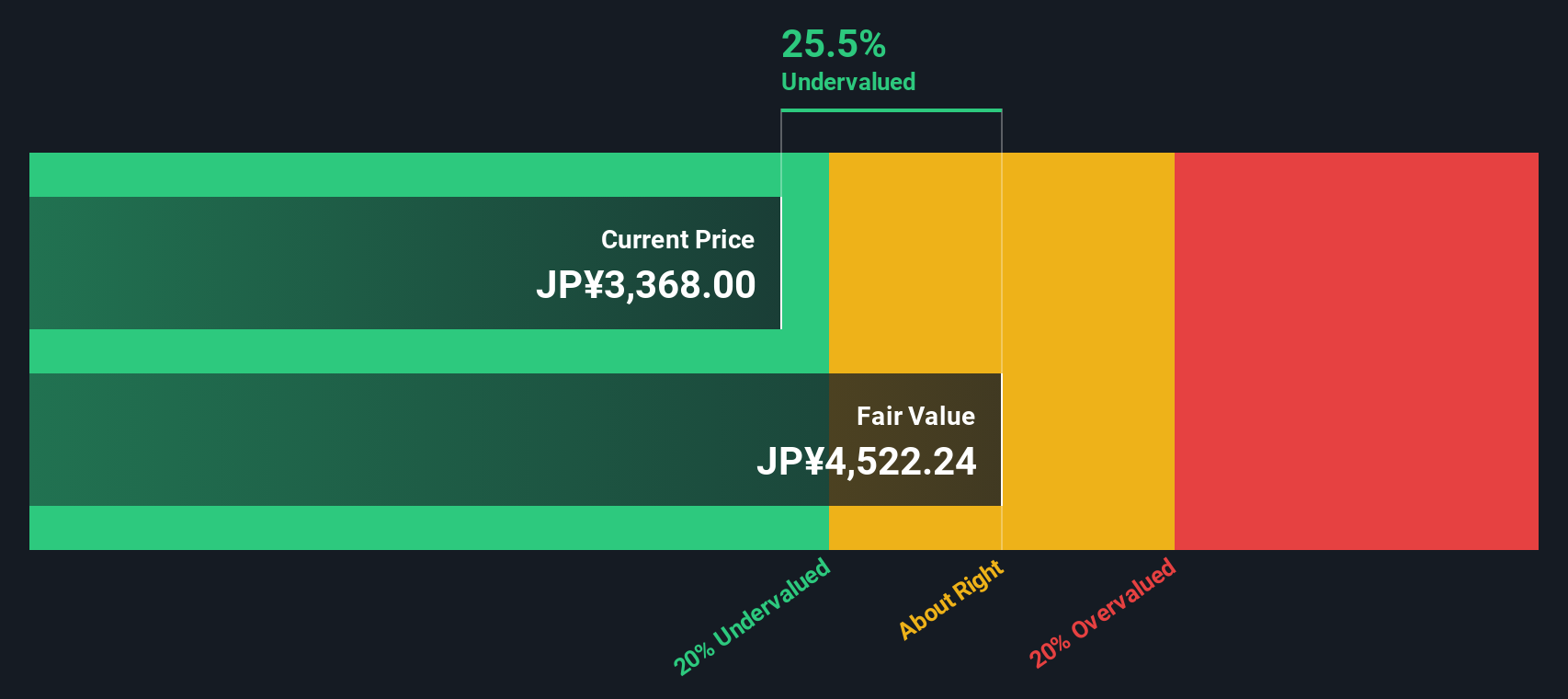

Yet with earnings rebounding, an intrinsic value estimate suggesting upside, and the share price already racing ahead of analyst targets, investors now face a tougher question: is Taiyo Yuden still undervalued or is future growth already priced in?

Price-to-Earnings of 112.3x: Is it justified?

Taiyo Yuden last closed at ¥3,861, but that price embeds a very rich price to earnings multiple of 112.3 times, far above most electronics peers.

The price to earnings ratio compares what investors pay today for each unit of current earnings, a key yardstick for mature, cash generative component makers.

In this case, the market is paying a multiple that is not only far higher than the Japanese Electronic industry average of 14.6 times but also well above the 33.2 times level suggested by the SWS fair ratio model, implying expectations that stretch well beyond the sector norm.

Such a gap signals aggressive optimism, and if sentiment cools, the multiple could compress sharply towards that lower fair ratio benchmark.

Explore the SWS fair ratio for Taiyo Yuden

Result: Price-to-Earnings of 112.3x (OVERVALUED)

However, its stretched valuation and a share price already above analyst targets leave little room for earnings disappointments or a slowdown in EV and ADAS demand.

Find out about the key risks to this Taiyo Yuden narrative.

Another View: Our DCF Points to Upside

While the 112.3 times earnings multiple looks stretched, our DCF model paints a softer picture and suggests fair value around ¥4,630.92, roughly 16.6 percent above today’s ¥3,861 share price. If cash flows are right, is the market being too harsh, or is the multiple still a warning sign?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Taiyo Yuden for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Taiyo Yuden Narrative

If you see the numbers differently or want to dive deeper into your own research, you can craft a tailored thesis in just minutes: Do it your way.

A great starting point for your Taiyo Yuden research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop at a single opportunity when you can scan markets worldwide in minutes and quickly spot fresh ideas that match your strategy and risk profile.

- Explore potential market mispricing by targeting companies trading below intrinsic value through these 908 undervalued stocks based on cash flows before broader attention increases.

- Focus on the next wave of innovation by reviewing early stage AI names using these 26 AI penny stocks while many remain less widely followed.

- Strengthen your income stream by filtering for established payers via these 15 dividend stocks with yields > 3% and help identify quality yields above 3 percent.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal