West China Cement (SEHK:2233): Valuation Check After Completing 2026 Notes Tender Offer Settlement

West China Cement (SEHK:2233) has wrapped up the settlement of its tender offer for the 2026 notes, leaving US$200 million outstanding. This provides a clear signal of how management wants its debt profile to look.

See our latest analysis for West China Cement.

People in the market seem to like that clarity, with the share price now at HK$3.18 and a strong year to date share price return of around 100 percent. In addition, multi year total shareholder returns above 250 percent suggest momentum is still firmly building.

If this kind of rerating story has your attention, it could be a good moment to look beyond cement and discover fast growing stocks with high insider ownership.

With debt visibility improving and earnings still growing at a healthy clip, the key question now is whether West China Cement’s sharp rerating still leaves room for upside, or if the market is already pricing in that future growth.

Price to earnings of 16x: Is it justified?

West China Cement last closed at HK$3.18, and the stock is trading on a price to earnings multiple of 16 times, which screens as modestly rich in its sector.

The price to earnings multiple compares the current share price with the company’s earnings per share, so it is a direct gauge of how much investors are paying for each unit of profit. For a cyclical, capital intensive basic materials name like West China Cement, this measure is a useful shorthand for how the market is weighing near term earnings momentum against longer term volatility.

In West China Cement’s case, the 16 times multiple sits below the average for close peers, where valuations cluster nearer 20 times, suggesting investors are still not paying the sort of premium reserved for the most highly rated operators. At the same time, the stock now trades at a somewhat higher multiple than the broader Asian basic materials industry average of 14.8 times, which implies the market is already assigning it a quality and growth edge versus many regional rivals. This remains within reach of what our models indicate as a fair price to earnings level of around 17 times that the shares could converge toward over time.

Explore the SWS fair ratio for West China Cement

Result: Price-to-earnings of 16x (ABOUT RIGHT)

However, risks remain, including potential demand swings in China’s construction cycle and execution challenges as West China Cement expands across multiple African markets.

Find out about the key risks to this West China Cement narrative.

Another view on value

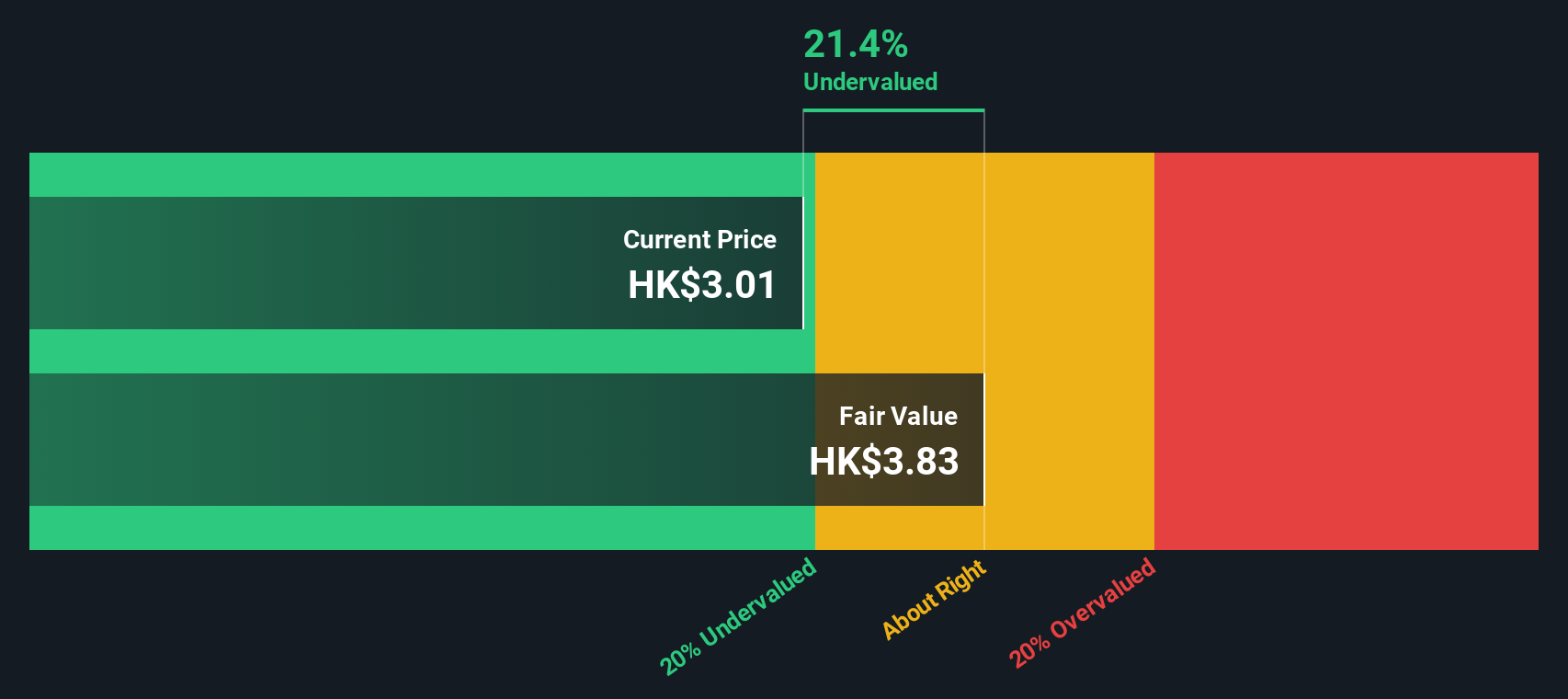

On a more detailed SWS DCF model, West China Cement screens as undervalued, with our fair value estimate of HK$3.89 sitting comfortably above the current HK$3.18 price. If earnings keep compounding as forecast, this raises the question of whether the market is underestimating how long this upswing can last.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out West China Cement for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own West China Cement Narrative

If you would rather test the numbers and assumptions for yourself, you can assemble a custom view of West China Cement in just a few minutes: Do it your way.

A great starting point for your West China Cement research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investing angles?

West China Cement may not be the only opportunity on your radar right now, so use the Simply Wall St Screener to uncover more targeted ideas fast.

- Capture potential mispricings by hunting through these 908 undervalued stocks based on cash flows that the market may be overlooking despite strong cash flow support.

- Ride powerful technology tailwinds by filtering for these 26 AI penny stocks positioned at the heart of machine learning and automation breakthroughs.

- Strengthen your income stream by focusing on these 15 dividend stocks with yields > 3% that can potentially boost long term total returns with reliable payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal