Is BioNTech (NasdaqGS:BNTX) Undervalued After Recent Share Price Weakness? A Fresh Look at Its Valuation

BioNTech (NasdaqGS:BNTX) has been drifting lower over the past month, and that slide is starting to draw value-oriented investors back to the name, especially with revenue stabilizing and net income ticking higher.

See our latest analysis for BioNTech.

Zooming out, BioNTech’s share price has been under steady pressure this year, with a year to date share price return of minus 16.5 percent and a one year total shareholder return of minus 20.9 percent. This suggests momentum is still fading despite hopes that the pipeline and cost discipline can eventually re rate the stock.

If this softer sentiment has you looking beyond BioNTech, it could be a good moment to explore other healthcare names using our screener for healthcare stocks, and see how they stack up on growth and resilience.

Yet with shares trading at a steep discount to analyst targets while revenue plateaus and net income improves, investors are asking whether BioNTech is quietly becoming undervalued or whether the market is already pricing in its next growth chapter.

Most Popular Narrative Narrative: 28.6% Undervalued

With BioNTech last closing at $96.25 against a narrative fair value near $135, the current gap hinges on ambitious profit and multiple assumptions.

Deep investment and advances in mRNA platform technologies, supported by the planned CureVac acquisition and expanding R&D infrastructure, enhance BioNTech's ability to penetrate the rapidly growing market for personalized medicine, targeting expanding patient populations and supporting long-term margin expansion.

Curious how flat revenue and ongoing losses still support such a rich future profit multiple? That narrative leans on a bold margin reset and surprisingly elevated valuation assumptions. Want to unpack the exact earnings path behind that upside gap?

Result: Fair Value of $134.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside case could unravel if oncology pivots disappoint in late stage trials or if COVID-19 revenues erode faster than new products ramp.

Find out about the key risks to this BioNTech narrative.

Another Angle on Valuation

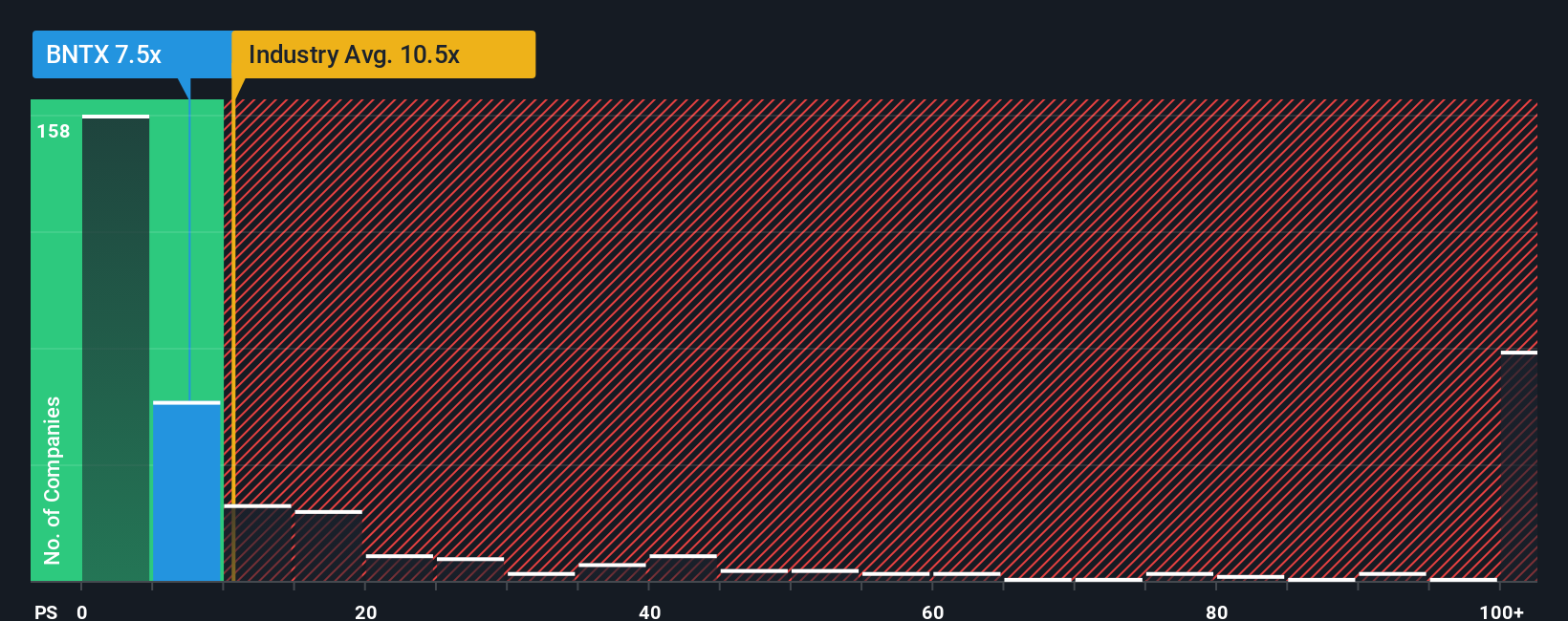

Analysts see upside, but BioNTech’s own price to sales tells a cooler story. At 6.3 times sales, shares are cheaper than the US biotech average of 12 times. They are still above a 5.8 times fair ratio, which hints the market could still mark expectations down.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BioNTech Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in just minutes: Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding BioNTech.

Looking for more investment ideas?

Before you move on, sharpen your watchlist with targeted stock ideas from the Simply Wall St screener so you are not left chasing yesterday’s winners.

- Capture potential mispricings by reviewing these 908 undervalued stocks based on cash flows, where strong cash flow analysis suggests the market has not fully appreciated them yet.

- Tap into cutting edge innovation by scanning these 26 AI penny stocks, which could benefit most from accelerating adoption of artificial intelligence across industries.

- Strengthen your income stream by weighing these 15 dividend stocks with yields > 3%, which offer appealing yields while still meeting your quality and risk standards.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal