Viking Holdings (VIK): Evaluating Valuation After Q3 Earnings Beat, Record EBITDA and Strong 2025–2026 Bookings

Viking Holdings (VIK) just delivered a big third quarter earnings beat, with record Adjusted EBITDA and stronger than expected bookings into 2025 and 2026, and Wall Street is taking notice.

See our latest analysis for Viking Holdings.

The upbeat Q3 surprise fits neatly into a strong run, with a roughly 53% year to date share price return and 44% one year total shareholder return suggesting momentum is still building around Viking’s growth story.

If Viking’s surge has you thinking more broadly about travel and leisure, this could be a good moment to explore fast growing stocks with high insider ownership for other high potential ideas.

Yet with the stock already up sharply this year and trading just below analyst targets, the key question now is simple: Is Viking still a bargain, or is the market already pricing in smooth sailing ahead?

Most Popular Narrative Narrative: 1.8% Undervalued

With Viking Holdings last closing at $67.08 against a narrative fair value of $68.32, the story leans slightly in favor of further upside.

Advanced bookings for core products remain exceptionally strong, with 96% of 2025 capacity and 55% of 2026 capacity already sold at higher rates, indicating durable repeat demand and allowing for mid single digit pricing growth that directly benefits company earnings and net margins.

Curious how robust bookings today translate into tomorrow's profits? The narrative leans on aggressive revenue expansion, powerful margin gains, and a future earnings multiple that assumes Viking keeps compounding at a premium pace.

Result: Fair Value of $68.32 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this story could unravel if stricter environmental rules drive up fleet upgrade costs or if Europe-focused river operations face climate-related disruptions.

Find out about the key risks to this Viking Holdings narrative.

Another View: Rich Versus Reasonable

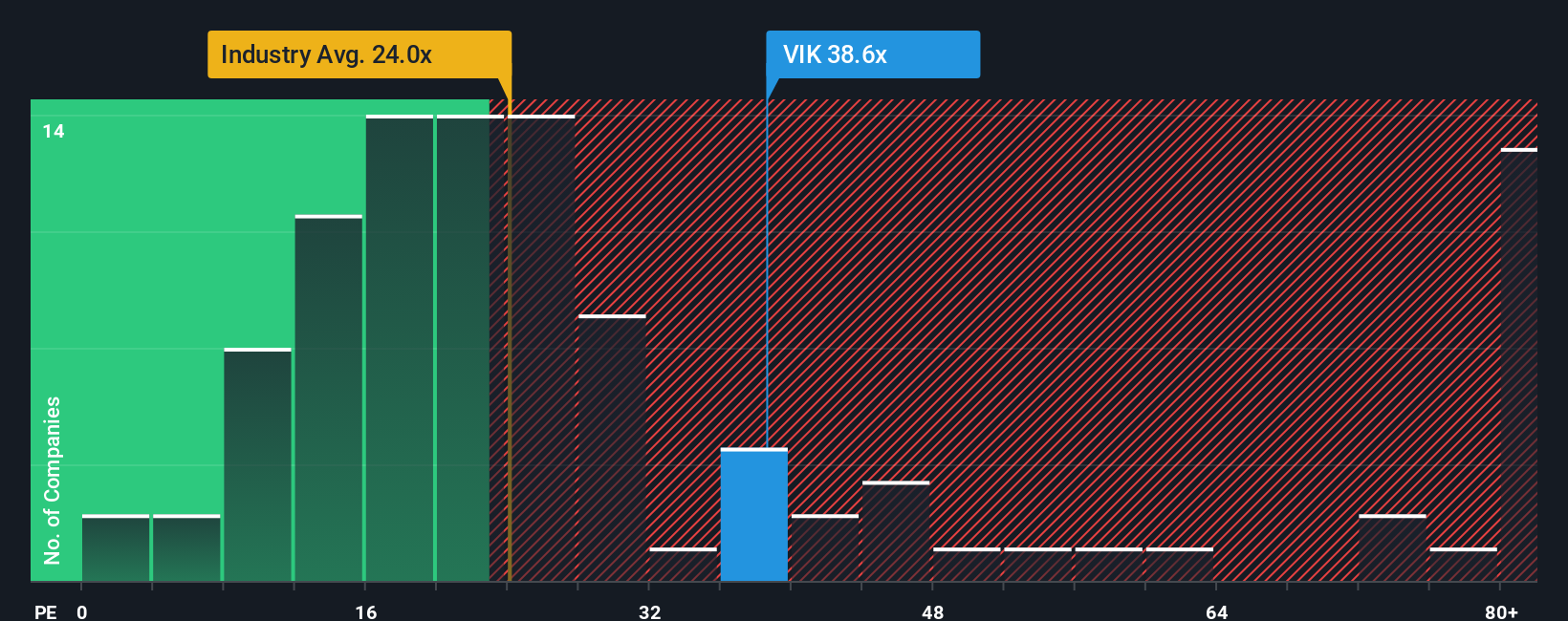

While the narrative fair value suggests a modest 1.8% upside, a simple earnings lens looks harsher. Viking trades on a P/E of 31.7 times, well above the US Hospitality average of 21.2 times and a peer average of 18.3 times. It still sits below a fair ratio of 37.1 times that the market could drift toward.

In practice, that means investors are already paying a premium for Viking’s growth story, leaving less room for error even if long term prospects stay strong. The real question is whether you see this as justified confidence or stretched optimism.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Viking Holdings Narrative

If this perspective does not fully align with your own, you can dive into the numbers, shape your own view, and Do it your way in just a few minutes.

A great starting point for your Viking Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more high conviction ideas?

Before momentum moves on without you, put Simply Wall Street’s screener to work and line up your next set of strong, research backed opportunities today.

- Capture mispriced potential by targeting companies trading below fair value using these 908 undervalued stocks based on cash flows that spotlight compelling cash flow driven opportunities.

- Ride structural growth trends by zeroing in on innovators at the intersection of medicine and algorithms through these 30 healthcare AI stocks that focus on real world adoption.

- Lock in reliable income streams by filtering for dependable payers via these 15 dividend stocks with yields > 3% that emphasise yield strength and balance sheet resilience.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal